REIT transaction activity is expected to keep accelerating in the second half of 2021.

Following a year of challenges and uncertainty, M&A deals, privatizations, and even IPOs could start to gain further traction in the second half of this year as the economy stabilizes and investors gain more clarity on what lies ahead for the post-pandemic commercial real estate market.

Bolstered by the anticipated pickup in transaction activity, REITs look set to remain a dynamic segment of the broader investment market—one that is likely to see continued expansion given the growing investor appetite for non-traditional asset classes, experts say.

Daniel LeBey, partner at Vinson & Elkins LLP, says the real estate capital markets have heated up so far in 2021. Some of that increased activity can be attributed to pent-up demand, and some of it reflects more certainty coming out of COVID and the prospect of things starting to get back to normal, he says. “That is giving people more confidence in making investments in companies and in specific asset classes. So, I do think that 2021 is going to be a pretty active year.”

The REIT sector has already seen some major announcements in the first quarter of 2021, including Brookfield Asset Management’s go private bid for Brookfield Property Partners (Nasdaq: BPY) and Brookfield Property REIT (Nasdaq: BPYU). Kimco Realty Corp.’s (NYSE: KIM) planned merger with Weingarten Realty Investors (NYSE: WRI), Realty Income Corp.’s (NYSE: O) agreement to acquire VEREIT, Inc. (NYSE: VER), and Equity Commonwealth’s (NYSE: EQC) agreement to buy Monmouth Real Estate Investment Corp. (NYSE:MNR).

Gil Menna, partner and co-chair of the REITs and real estate M&A practice at Goodwin, notes that M&A activity is starting to pick up for the first time since the start of the pandemic, with non-disclosure agreements and confidentiality agreements now being signed.

“There hasn’t been a whole lot of activity in the public REIT sector, but we are starting to see some momentum there; there’s no doubt about that,” Menna says. He notes that there might be some need for rationalization and M&A in some sectors that were adversely impacted by the pandemic. Private equity could also be attracted to those areas to bring a different leverage profile to those assets, he adds.

“We do expect entity level activity to pick up in the latter half of 2021 as the roll out of the vaccine brings more certainty to the timing of when the risks associated with COVID-19 subside,” agrees Tim Bodner, PwC’s U.S. real estate deals leader.

Uncertainty Clearing

Not surprisingly, 2020 was a relatively quiet year for entity deals. Across listed and non-listed REITs, there were 11 M&A transactions, of which the largest was the transaction between Simon Property Group, Inc. (NYSE: SPG) and Taubman Centers, Inc., according to PwC.

“We were expecting more activity in the listed part of the market, but COVID-19 created a dynamic where valuations were too far apart between willing buyers and sellers, which also impacted transaction activity generally,” Bodner says. That being said, REITs are now staging an earnings recovery and the yield curve has begun to steepen, given inflation and growth outlooks in the U.S. “Both of these may impact how much deal activity we see,” he adds.

Furthermore, market participants are questioning whether the level of distress will be as significant as originally thought for a variety of reasons, including federal government stimulus and relaxation of bank regulation, Bodner adds. That could curb some opportunistic M&A deals. “This is not to say there won’t be distress, but I think many are questioning just how much is seen,” he says.

Meanwhile, Dirk Aulabaugh, executive vice president and global head of advisory services at Green Street, says there is still some opaqueness ahead in some sectors, such as office, but the uncertainty does seem to be improving for much of the real estate industry. “I don’t think we are quite through all of the challenges, but what we have seen from a real estate perspective is people paying their bills and paying their rent.”

Given how REIT stocks are trading, investors seem to have a better understanding of values and the outlook ahead. “Because some of that cloud is lifted on the pandemic and because there are a number of parties out there with available capital, I think that is going to provide for more transaction activity in 2021,” Aulabaugh says.

The performance and outlook for individual sectors provides some clues as to which sectors might be more active for entity level deals in the coming year. Those sectors with companies trading above their net asset value (NAV) are seen as more conducive to new IPO entrants, while companies and sectors experiencing stress or distress could create some acquisition targets in the coming year.

“Opportunistic and distressed buying will be prevalent themes in 2021, and we are already seeing that,” Aulabaugh says. The opportunistic buying is absolutely going to lean on those sectors where that distressed buying is available, such as lodging, malls and office, he adds.

IPOs Remain Subdued

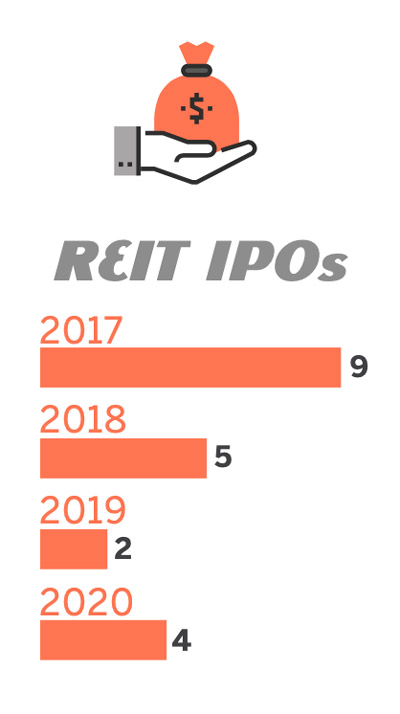

REIT IPO activity, meanwhile, had been trending lower well before the pandemic, with nine IPOs in 2017, five in 2018, two in 2019, and three in 2020.

“I don’t think we would have seen a vigorous year of IPO activity last year, even if we didn’t have a pandemic,” says Greg Steele, managing director and head of REIT investment banking at Capital One Securities Inc.

One reason for fewer companies coming public in the REIT sector is that investors hold the bar high on new entrants. They look for good management teams with public company experience, platform scalability, favorable valuations, and the ability to deliver a unique asset class, or a compelling value proposition, he says. “It takes some doing for all of those circumstances to come together,” Steele adds.

The IPO activity this year is likely to be more focused on the second half. Some companies are waiting for a more benign economic environment and more certainty that the pandemic is nearing an end, Steele notes. “I think by 2022 we will see more IPO activity, but I don’t think we are going to see the activity that we saw several years ago where IPOs were in the double digits,” he says.

The last time the number of REIT IPOs hit double digits was in 2013, with 19 offerings that year. Achieving scale before going public is one big stumbling block. U.S. equity REITs have experienced dramatic growth over the past two decades, increasing in size roughly seven fold from an average size of less than $1 billion in 2000 to about $7 billion in 2020, notes Keven Lindemann, a senior director of global real estate at S&P Global Market Intelligence.

Growth in average market cap is a sign of industry consolidation, as well as simple share price appreciation and a larger capital base in the form of more shares outstanding. “While there are certainly challenges with being larger—it takes bigger deals, bigger revenue to move the needle—there are real advantages in terms of access to capital,” Lindemann says.

Hunger for New Options

Despite the lower pace of IPOs, the REIT sector has been steadily expanding—a trend that is contrary to that seen in the broader public market.

The Wilshire 5000 Total Market Index, widely accepted as the definitive benchmark for the U.S. equity market, had membership of more than 7,500 in 1998 compared with approximately 3,500 today.

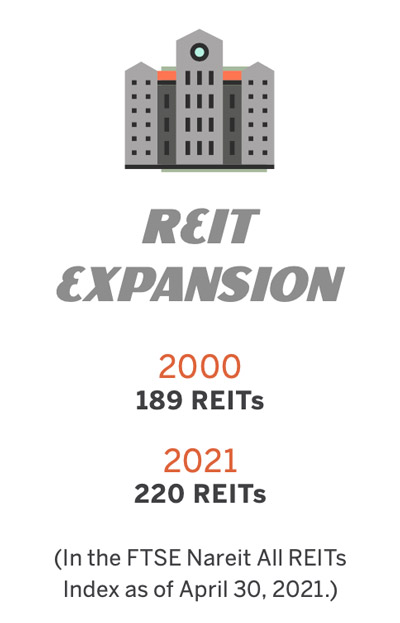

Meanwhile, there are currently 221 companies in the FTSE Nareit All REIT Index compared to 189 in 2000. “We’ve seen consolidation, we’ve seen M&A activity, we’ve seen go-private transactions, but we have still seen the number of public REITs generally increase,” Lindemann says.

The main driver behind that growth is expansion into non-traditional property types. Twenty years ago, the main groups making up the bulk of the REIT industry were office, industrial, retail, multifamily, and hotels. Now there are more than a dozen diverse sectors and sub-sectors, such as health care, cell towers, cold storage, data centers, timberland, farmland, single-family rentals, ground leases, and self-storage.

Many expect new alternatives to continue to drive expansion of the REIT industry. “If you can offer the market something they haven’t seen before, whether that is investing in a particular property type, geography, or a unique strategy that you can’t get with the current menu, then the market is open to that,” Aulabaugh says. “The REIT space is open to more new ideas than there ever have been, because they see some of these niche property sectors out-perform.”

On the institutional investor side, there is a growing focus on consolidating real estate under one real assets umbrella. Potentially, that expansion of a real assets category could bring even more infrastructure companies into the REIT fold, experts say.

“There is appetite for new and innovative asset classes in REITs, and I think that appetite exists both with public market investors and private capital investors,” agrees C. Spencer Johnson III, partner at King & Spalding LLP .

“A lot of that has to do with the sheer depth of capital that is looking for a home in a real asset, whether that is real estate or infrastructure, or something comparable,” Johnson says. The question is what the IRS will permit as real property for tax purposes and what can generate qualifying rents from real property, he adds.

For example, two years ago there was an IRS ruling that said certain types of midstream energy assets, including pipelines, could be put into a REIT if certain conditions were met. “So, I think we will continue to see people push to get assets that are out of the traditional core property types into REIT structures because of the demand from both the public and private capital side,” Johnson says.

Abundant Capital

Certainly, there are plenty of headwinds and tailwinds still ahead for entity level transactions in the coming year, and there are different dynamics influencing opportunities for IPOs, privatizations, and M&A deals.

“With a lot of the mid-cap and long-tenured REITs that we think might be candidates for go privates, I think it is going to be a very measured environment,” Steele says.

Some management teams might be enticed to go private at some point, but they’re likely not going to be motivated by the values that they’re getting today. Although many REITs have seen a tremendous recovery in values in recent months, there will be more ahead in tandem with the economic recovery. So, it may not be the right time to look at privatization, because management may not be optimizing their price, Steele notes.

Because REITs have access to capital, they can continue operating their businesses and wait for values to rise. “Apart from some of these large deals, it is more likely that we will see go private activity occur in 2022 and 2023 rather than later this year,” Steele says.

There remains a significant amount of dry powder within the private equity sector that is targeting real estate, with more that is being raised. Availability of historically inexpensive debt continues to be both a headwind and a tailwind for larger deals. “If you’re looking at a privatization, current interest rates are likely going to allow a buyer to increase the total consideration they are coming to the table with. The flip side is that the public REIT has access to debt at a similar cost of capital,” Johnson says.

Ultimately, privatization deals face challenges in terms of finding the right price, finding the premium, getting the capital stack right, and then convincing everyone that it is the right path forward at this time, he notes.

Public M&A transactions are not typically common in the U.S. equity REIT space. There can be structural impediments that make an unwelcome overture difficult, and often the target does not want to be acquired. Go private transactions have been slightly more commonplace than M&A deals, in part because they are easier to execute, Lindemann says.

Retail, especially malls, hotels, and office are all experiencing significant disruption and that’s reflected in share prices, Lindemann says. “There are certainly big private equity players in the market who have made big contrarian bets in the past and done well,” he says. “So, I think once things stabilize a bit with COVID that we could see a number of go private transactions ahead.”