The three authors of the study, Tom Arnold, David Ling, and Andy Naranjo spoke with REIT magazine about their research findings and the ramifications for public and private real estate investors.

Listed REITs outperform private equity real estate by a wide margin in ‘horse race’ head-to-head matchups over a 20-year sample period from the first quarter of 2000 to the fourth quarter of 2019, suggesting that investors should reconsider their allocations to public real estate, new research sponsored by Nareit shows.

The study, Private Equity Real Estate Fund Performance: A Comparison to Listed REITs and Open-end Core Funds, was recently published in the Journal of Portfolio Management and compares the returns of individual private funds with REIT indexes over each private fund’s investment horizon.

The three authors of the study, Tom Arnold, David Ling, and Andy Naranjo spoke with REIT magazine about their research findings and the ramifications for public and private real estate investors.

What was one of the main takeaways from your new academic study on the performance of REITs versus private equity real estate funds?

Tom Arnold: Investors are always trying to determine whether the public markets or the private markets will generate superior returns. You can look at returns either naively, or you can look at them on a risk-adjusted basis. Our research was to try to take a look at the comparison of individual funds against the real estate indices, with and without risk adjustments.

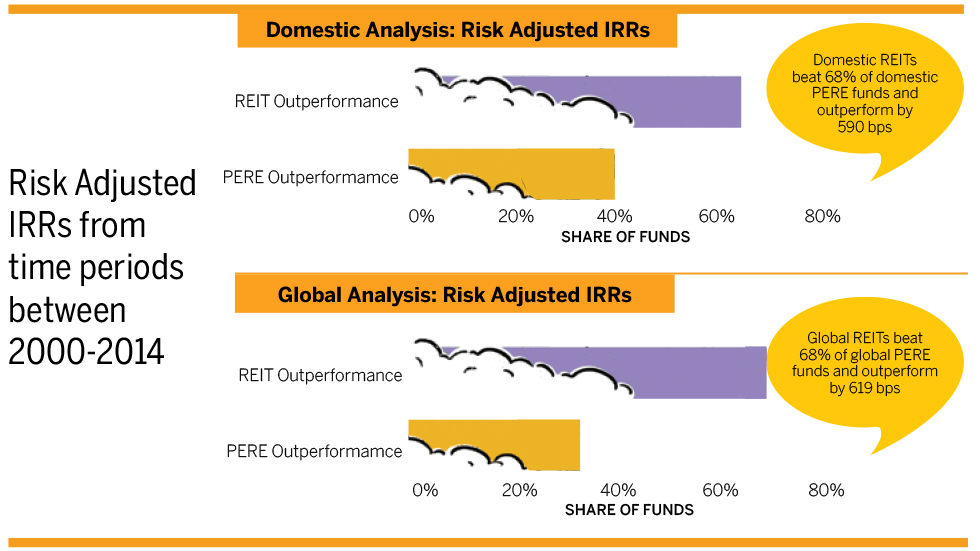

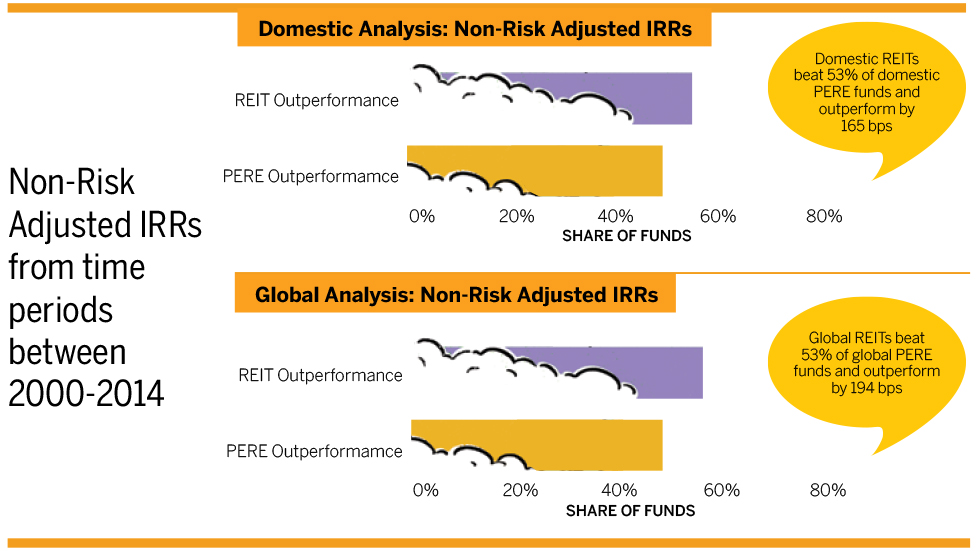

Our observations and conclusions were that even with no risk adjustments, 53% of the time you would have been better off in the REIT index during the period of time that the private equity real estate fund was investing. The mean out-performance was 165 basis points, or 1.65 percentage points, per year. With a conservative investment for relative risk, REITs outperformed nearly 70% of the time, and their outperformance grew from 165 basis points per year to almost 600 basis points per year.

There have been previous studies about REITs versus private real estate. What is it about your research that sets it apart?

Andy Naranjo: We examine fund level data as opposed to an index or an average. We measure fund-by-fund what the performance looks like and what the distribution of that relative performance looks like in terms of outcomes, as opposed to other studies that often lump together a bunch of private equity real estate into a performance measure.

Arnold : A lot of the prior research has a comparison of a private benchmark of some kind to a public benchmark. That’s an awkward comparison as the private benchmarks are neither specified in advance nor investible.

David Ling: One of the things we show in our research is that the performance of private equity funds really varies by vintage year. With our horse race approach, we take each fund and then we match its performance, based on its internal rate of return, over its investment horizon with the return the investor would have earned had they been invested in a REIT index. It’s simple, yet we don’t believe anybody else has done it. I think it makes for significantly better performance comparisons.

How can investors use this information most effectively? Are there things that they should be doing differently?

Naranjo: Our findings indicate that institutional investors might benefit from reevaluating the way they structure their real estate allocations. In particular, instead of using REITs as a tactical way of investing, it would make more sense to allocate a larger portion to REITs from the outset.

Ling: These results, especially when you think about reasonable risk adjustments, suggest that for a typical investor, real estate should be part of their portfolio, in addition to stocks and bonds and maybe other alternative investments. For the piece that’s allocated to real estate, these results suggest that a portion should be allocated to publicly traded REITs.

Arnold: Investors need to think about whether they are being compensated for incremental risk and then determine if they have selected a top portfolio manager, because that’s really what it takes to beat the public markets.

Talk about the mechanics of the research and how you reached some of your key conclusions regarding performance?

Naranjo: We measure the performance on a fund-by-fund matched time horizon to obtain individual private equity real estate relative performance. This approach allows us to pin down the distribution of the performance of outcomes and provides a clear picture of the relative performance of private equity real estate versus public equity markets.

Can you put your research into a broader context of what academic literature has learned about the importance of investing in public real estate?

Ling: There’s a lot of literature, some of it we’ve contributed to in the past, that looks at the performance of public real estate versus private. Separating out the funds and looking at them individually and comparing them to the performance of the REIT index over a comparable time period is, we think and hope, a contribution to the literature that will help people better understand the relative performance of public and private commercial real estate.

Why do pension funds weight their real estate allocations the way they do and what does this new research tell us about how they should be weighting?

Ling: A big explanation has to do with the perceived riskiness of REITs relative to the private vehicles. For example, when COVID hit, REIT prices reacted immediately, as they should have. Private market values were moving just as quickly, it’s just that we can’t observe them as readily in transaction prices. We can’t measure the true volatility of the underlying private market. It’s important to continue to educate the investing public that private investments may be as risky as public investing.

Naranjo: If you have a pension fund that’s been allocated in a certain way for a long period of time, it’s very difficult to disrupt that. Our research basically suggests that institutional investors should consider reversing their approach and begin by allocating to publicly traded real estate first, then do the tactical private equity real estate allocation in terms of geographic or sector concentrations.

Arnold: I think that there’s a perception that they’re getting better returns with private real estate. There’s a perception that with leverage, they can generate cashflow that would be in excess of a dividend yield from the public market and that there would be less diversification benefit from investing in the public markets, relative to private real estate. But our research suggests this is not the case.

What is the next big question that you’d like to tackle in this area?

Ling: Certainly one thing we’d want to do is to look at the performance of the funds that came to market in 2015 to 2019. Our fund sample stops in 2014 because we need to give those funds time to mature. As more time goes by, we can then look at the 2016s, the 2017s, 2018s, etc. That would then allow us to see if this relative under-performance of funds relative to REITs persists.

Global Appeal

Why did you launch a REIT investment program At the Abu Dhabi Investment Authority (ADIA)?

Arnold: When I arrived in 2009, the only public real estate managed by the real estate department had been in private investments that some of the managers then floated, so the only public real estate that we had was private real estate that had then been sold or fractionally sold into the U.S. and European public markets. The public markets were able to provide a liquidity event that was deeper than what the private markets offered.

We ultimately decided to launch a dedicated public real estate investment program and interviewed over 30 prospective managers in the process. I think the biggest surprise was the professionalism, experience and success of these REIT managers, available to both institutional and retail investors.

Beyond the Classroom

What career development advice would you offer students who are trying to find the right place and path post-graduation?

Naranjo: Institutionally, we try to promote students taking internships and co-ops during their academic preparation so that they get to see what it means to be in that particular career and to be able to effectively launch into it. We also want every one of our students to be career ready, so when they finish, they’re ready to run.

But what happens when they’re in the middle of their career? The important part then is they need to see it’s essential that they seek internal and external mentors to gain a learned perspective. Learning on the job is great, but there’s no need to re-learn what somebody else has already learned when they can impart that information to you.

Getting that internal, within the firm, or external mentoring perspective, is both important and valuable. They should also know that they’re going to have many jobs in their career, so the important thing is that they should grow into a career that provides personal growth and satisfaction in the end.

What are students today expecting in their career experience?

Ling: Students, at least in the business school, are much more aware of commercial real estate as a career option than ever before. Gratifyingly, what I’ve seen over the years is an acknowledgement and an awakening as to the vast number of career opportunities available in REITs and the commercial real estate sector that allow economics majors and finance majors to apply their skillset to what I think is a very interesting asset class.