Study Highlights

- REITs had the second highest average annual return of the 12 asset classes covered.

- REITs outperformed private real estate in defined benefit plans by more than 2%.

- REITs had a relatively low correlation with equities.

- REITs outperformed most styles of private real estate.

About the Study

CEM Benchmarking’s 2024 study (PDF), sponsored by Nareit, provides a comprehensive look at realized investment performance across asset classes over a 25-year period (1998–2022) using a unique dataset covering more than 200 public and private sector pensions with more than $4 trillion in combined assets under management. Unlike index-based research, the CEM dataset provides the actual realized performance of the assets chosen by plan managers and trustees.

Returns

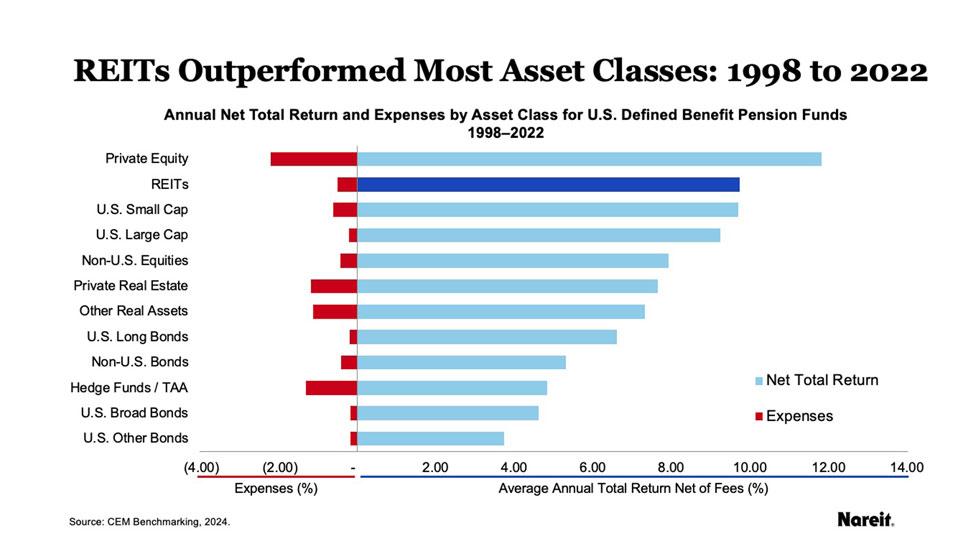

Over the 25-year period covered by the study, there are striking differences in performance across asset classes. The figure below summarizes average annual net returns and expenses for the 12 asset classes.

- Listed equity REITs had the second highest average annual net return over the period, 9.74%.

- Private real estate produced average net returns of 7.66% over the period, more than 200 basis points less than REITs.

- The three worst performing asset classes were hedge funds/tactical asset allocation (TAA) strategies, U.S. broad bonds, and U.S. other fixed income. U.S. other fixed income, however, includes cash.

REIT Performance vs. Private Real Estate in DB Plans

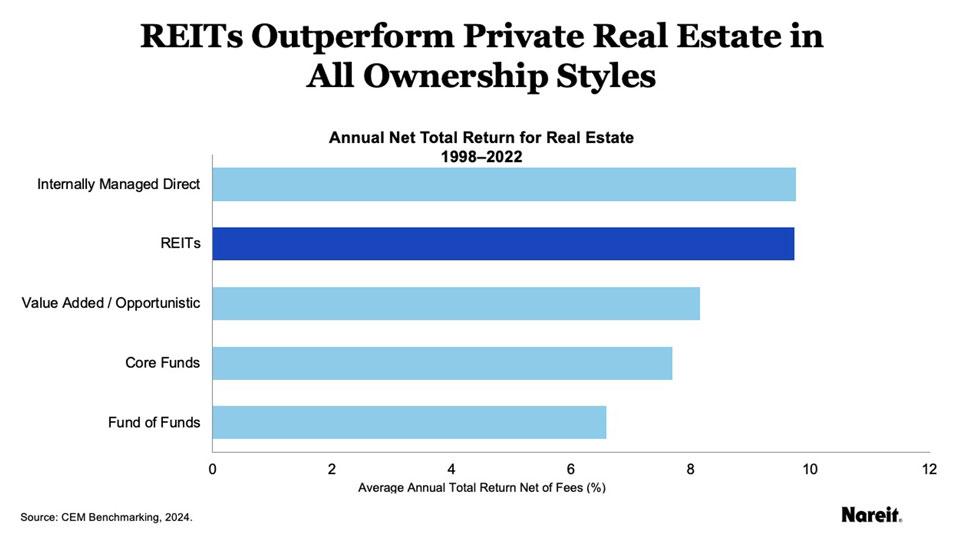

Unlisted or private real estate can be accessed through a number of different ownership styles each with different risk profiles and costs. CEM provides comparisons of returns, correlations, and volatilities for each of the four key private real estate ownership styles:

- Internally managed direct

- Core funds

- Value added / opportunistic funds

- Fund of funds

The figure below shows that REITs outperform private real estate in all ownership styles excluding internally managed direct.

Correlations

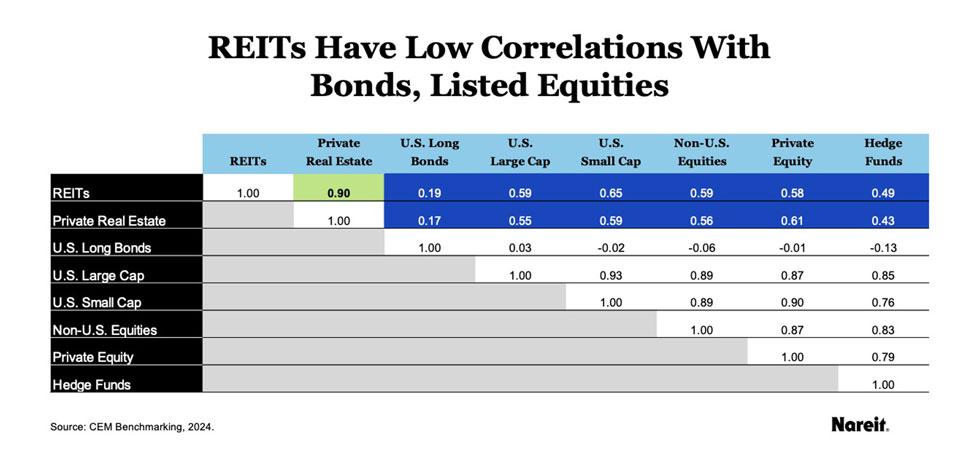

The study computed correlations of annual returns among the 12 asset classes. The correlation table below summarizes some key correlations between broad equities, REITs, and private real estate. As highlighted in green, REIT and unlisted real estate returns were highly correlated when illiquid returns are adjusted for reporting lags. The correlation is measured as 0.90. The high correlation is not surprising given the similarities in underlying assets.

As highlighted in blue, REIT and private real estate returns had relatively low correlations with bonds and listed equity returns. These relatively low correlations reflect the well-known diversification benefits associated with the real estate asset class, whether REITs or private real estate.

Volatilities and Risk Adjusted Returns

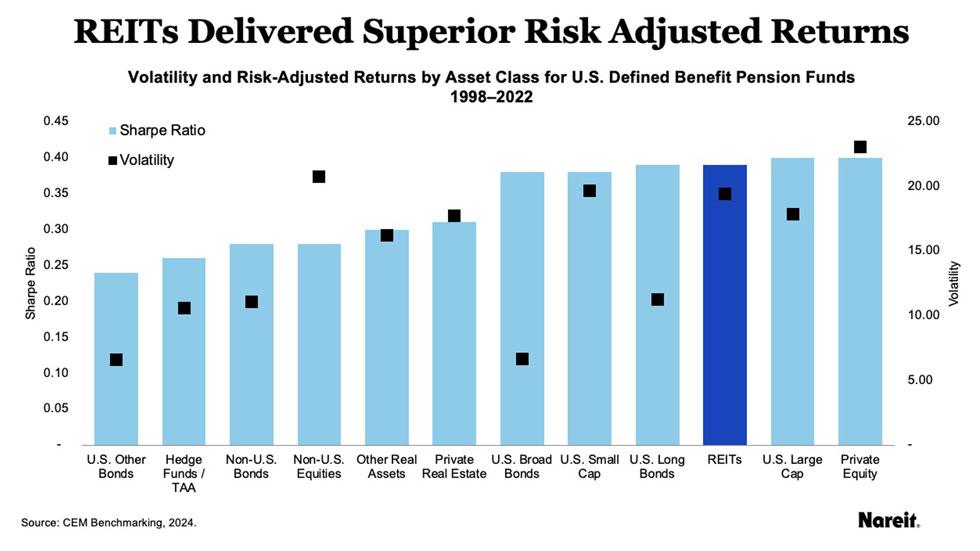

The study also compared volatilities and risk adjusted returns using the Sharpe ratio across asset classes.

The data are summarized below.

- Outside of private equity and U.S. large cap, REITs had the highest Sharpe ratio measuring 0.39, reflecting their high returns and just above average volatility. Private real estate had a lower Sharpe ratio measuring 0.31, reflecting lower returns and just slightly lower volatility compared to REITs.

- After adjusting for valuation lags, the study found that REITs and private real estate had comparable volatilities. REITs and private real estate measured volatilities of 19.4% and 17.7%, respectively. As with correlations, the similarity in volatilities is not surprising given that REITs and private real estate have the same underlying assets.

- After adjusting for valuation lags, private equity was by far the most volatile asset class.

Conclusion

The CEM analysis concluded that over the 25-year period of study covering the years 1998 through 2022, REITs had the second highest average annual net return and relatively low correlations with other asset classes, implying good diversification benefits and strong risk-adjusted returns. The study also found that REITs outperform private real estate in all ownership style excluding internally managed direct.

Methodology

The study compares gross and net average annual total returns as well as correlations and volatilities for 12 asset classes with appropriate adjustments for reporting lags associated with illiquid asset classes (private real estate and private equity). The 2024 study also compares the performance of different styles of private real estate including internally managed, core, value added/opportunistic, and fund of funds.

Resources

- Download the 2024 study (PDF)

- Download the 2024 executive summary (PDF)

- Download the 2016 study containing the full methodology (PDF)

- Read CEM Benchmarking’s study on REIT active management, showing how it adds net value to CRE portfolios