Financial markets continue to face the headwinds of tightening monetary policy and inflationary pressures driven by food and energy prices, as economists have raised the prospects for the likelihood of a recession in the U.S. and markets around the world.

Global Real Estate Performance

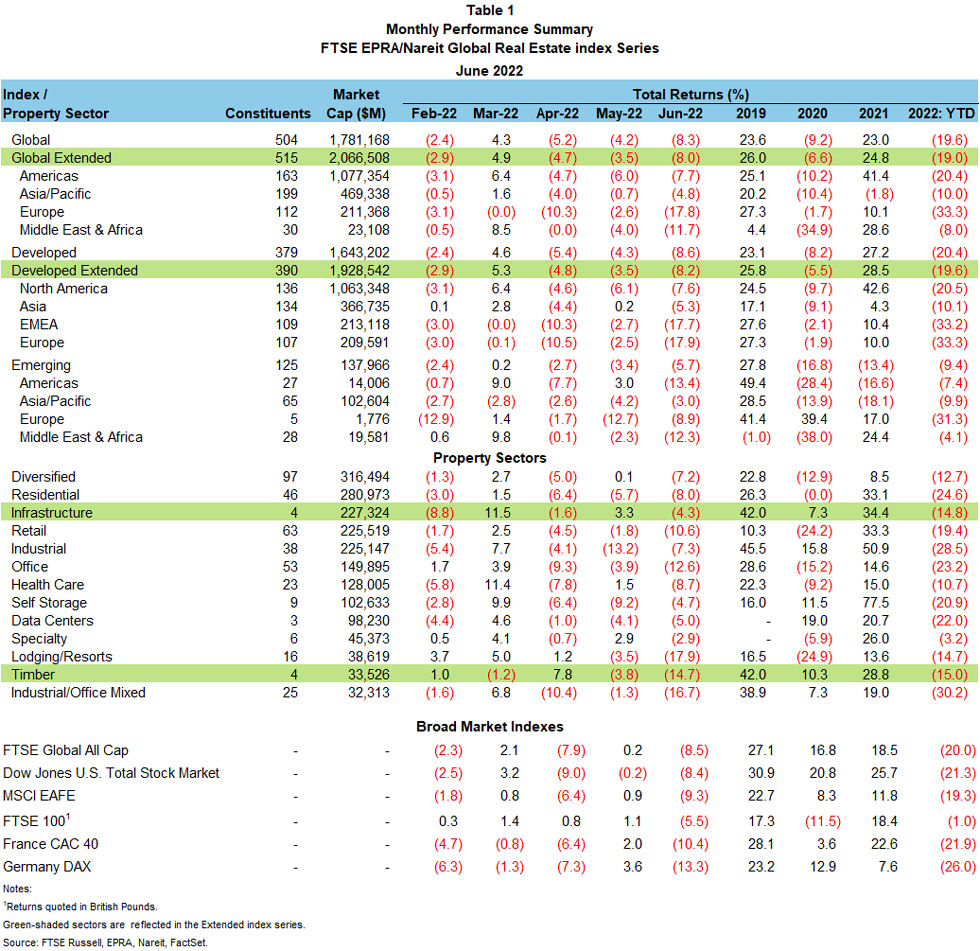

The FTSE EPRA/Nareit Global Real Estate Index Series narrowly outperformed broader markets in June, as the U.S. Federal Reserve and central banks around the world took more aggressive measures to fight inflation. The FTSE EPRA/Nareit Developed Extended Index posted a total return of -8.2% for the month and -19.6% year-to-date, while the Global Extended Index, which includes both Developed and Emerging Markets, returned -8.0% and -19.0%, respectively, over these periods. The FTSE EPRA/Nareit Developed Index returned -8.6% in June and -20.4% year-to-date.

Broader Market Performance

Broader markets posted disappointing returns in June, while also narrowly underperforming real estate, with total returns on the Dow Jones U.S. Total Stock Market, FTSE Global All Cap, and MSCI EAFE of -8.4%, -8.5%, and -9.3%, respectively.

Year-to-date, the MSCI EAFE is down 19.3%, the FTSE Global All Cap is down 20.0%, the Dow Jones U.S. Total Stock Market is down 21.3%. Since Russia invaded Ukraine on Feb. 23, the FTSE Global All Cap is down 12.3%, the Dow Jones U.S. Total Stock Market is down 10.8%, and the MSCI EAFE is down 14.4%. Over this period, the EPRA/Nareit Developed Extended Index is down 9.8% while the EPRA/Nareit Developed Index is down 12.2%.

Property Sector Highlights

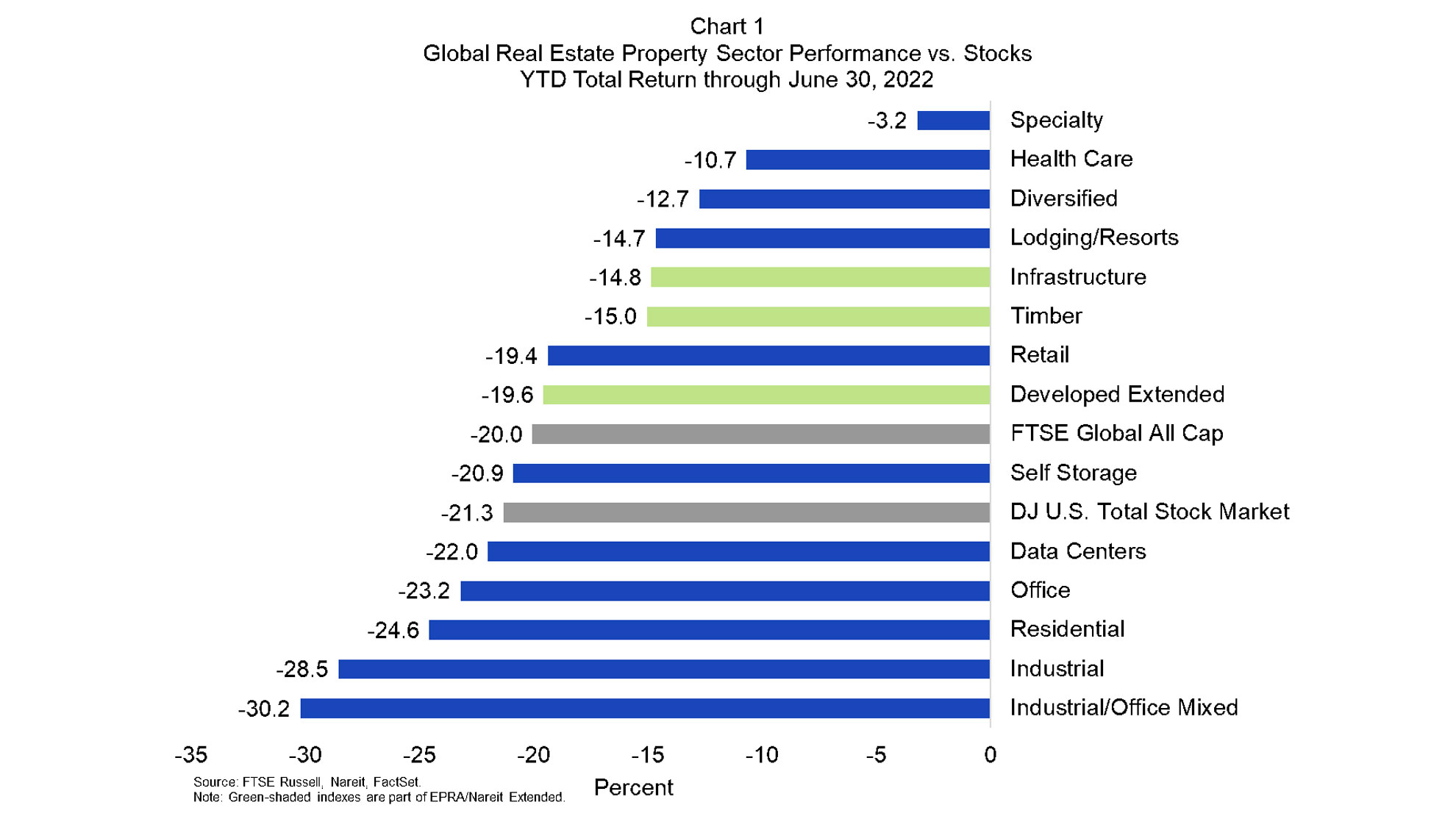

In June, the specialty sector led with a total return of -2.9%, followed by infrastructure at -4.3%, and self-storage at -4.7%. On a year-to-date basis, these sectors have posted total returns of -3.2%, -14.8%, and -20.9%, respectively. Lodging/resorts lagged in June, with a total return of -17.9%, followed by industrial/office mixed at -16.7%, and timber at -14.7%. Year-to-date, these sectors are down 14.7%, 30.2%, and 15.0%, respectively.

Regional Performance

Regionally within the Developed series, Asia continued to outperform in June, with a total return of -5.3%, followed by North America at -7.6%, and EMEA at -17.7%. Year-to-date, these regions posted returns of -10.1%, -20.5%, and -33.2%, respectively.

While also posting negative performance in 2022, emerging markets have outperformed developed markets in the FTSE EPRA/Nareit series. For the month, EPRA/Nareit Emerging was down 5.7%; regionally, Asia/Pacific led, with a total return of -3.0%, followed by Europe at -8.9%, Middle East & Africa at -12.3%, and Americas at -13.4%. Year-to-date, the Emerging Index is down 9.4%, with returns of -4.1% for Middle East & Africa, -7.4% for Americas, -9.9% for Asia/Pacific, and -31.3% for Europe.