Commercial Real Estate and REITs: Change Is In the Air for 2025

Key Takeaways

- Three keys may unlock the stifled commercial real estate (CRE) market and benefit REITs: an economic soft landing, a convergence of public-private real estate valuations, and an increase in property transactions.

- The public and private real estate valuation gap is closing and could close further in 2025.

- REITs’ disciplined balance sheets and low debt costs likely will continue to give them a competitive edge over their counterparts with higher debt loads and costs.

- As transactions increase, REITs are expected to be better-positioned than some of their competitors to make acquisitions and benefit from accretive growth.

- Lingering and emerging risks, including soft property fundamentals in some sectors, higher interest rates reflecting fiscal uncertainty, and the potential for changes in tariffs affecting growth, may restrain CRE performance in 2025.

Unlocking the Stifled CRE Market

With healthy economic growth, steady unemployment, a moderating pace of inflation, and limited recession fears, U.S. economic conditions are currently solid. While this type of environment typically benefits CRE, the market appears to be stuck in a period of stagnation characterized by supply and demand imbalances, softening fundamentals, a lingering public-private real estate valuation problem, and muted property transaction activity.

Despite these challenges, a brighter CRE outlook may be on the horizon. Three keys that could unlock the property market’s stifled potential are:

- An economic soft landing. Economic conditions support, and the Federal Reserve appears to be poised to successfully engineer, another soft landing for the U.S. economy. This is good news for the broad CRE market.

- A public-private real estate valuation reunion. Monetary policy easing and declining interest rates are expected to play critical roles in closing the public-private cap rate gap. Increasing closure would likely continue to fuel REIT outperformance into 2025.

- A property transaction market revival. As public and private real estate values become more in sync, Nareit expects the broad CRE transaction marketplace to regain its footing and become active once again.

Executing the three keys would reenergize the broad CRE market; it would also benefit REITs. In this environment, REITs are expected to maintain their competitive edge over typical property investors. Best-in-class operator knowledge, discipled balance sheets, and efficient access to cost-advantaged capital can give REITs an edge over their competition.

While the three keys offer optimism for CRE and REITs, there are notable downside risks. For example, debt markets have priced in meaningful fiscal uncertainty, including the possibility of higher inflation and deficits. As of Nov. 29, 2024, the 10-year Treasury yield stood at 39 basis points (bps) above where it was at the end of September, despite continued monetary policy easing. In addition, the potential for high tariffs and the emergent threat of trade conflicts, especially with Canada and Mexico, may slow or derail growth and have negative implications for economic growth. Although there is great potential for a more robust CRE market in 2025, CRE investors should remain mindful of property fundamentals and external shocks, which could potentially disrupt economic outcomes.

Engineering a Soft Landing

Although viewed as the holy grail of monetary policy, economic soft landings lack a formal definition. They are typically described as times when the Federal Reserve’s monetary tightening policy has been successful in reducing inflation, avoiding a surge in unemployment, and circumventing negative economic growth. Often regarded as rare, history shows that the Fed has executed several soft and softish landings. Current U.S. economic conditions seem to support a soft landing.

- Real gross domestic product (GDP) increased at an annual rate of 2.8% in the third quarter of 2024, according to the “second” estimate.

- Total nonfarm employment increased by 227,000 jobs and the unemployment rate was 4.2% in November 2024.

- The Consumer Price Index for All Urban Consumers (CPI) increased 2.7% over the 12 months through November 2024 and core CPI (excluding food and energy) rose 3.3%.

- Through November, the Federal Open Market Committee (FOMC) reduced its target policy rate range twice in 2024; it now stands at 4.50% to 4.75%.

- As of November 2024, the Bloomberg consensus forecast survey placed the probability of a U.S. recession within the next 12 months at 25%; it was 30% in September.

Under these conditions, the Fed is well-positioned to successfully engineer another soft landing for the U.S. economy, which is good news for the broad CRE market. However, the real estate market is facing several challenges relating to property fundamentals, public-private valuations, and transaction volumes.

The Weight of Soft Property Fundamentals

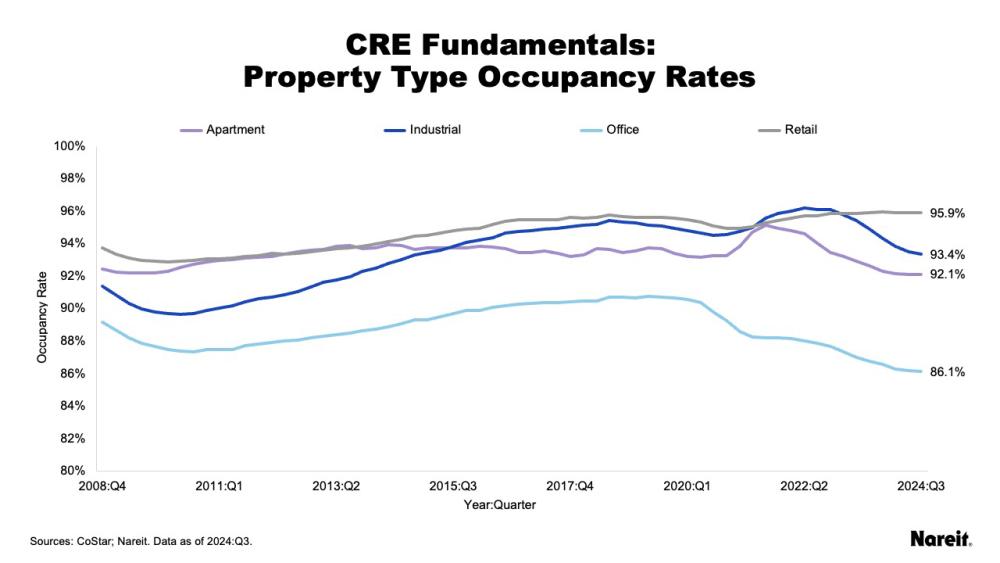

While economic conditions have bolstered enthusiasm for CRE investment, some important sectors of the property market are still generally marked by supply–demand imbalances, declining occupancy rates, and moderating rental growth rates. These conditions will likely place pressure on property operational performance gains in 2025.

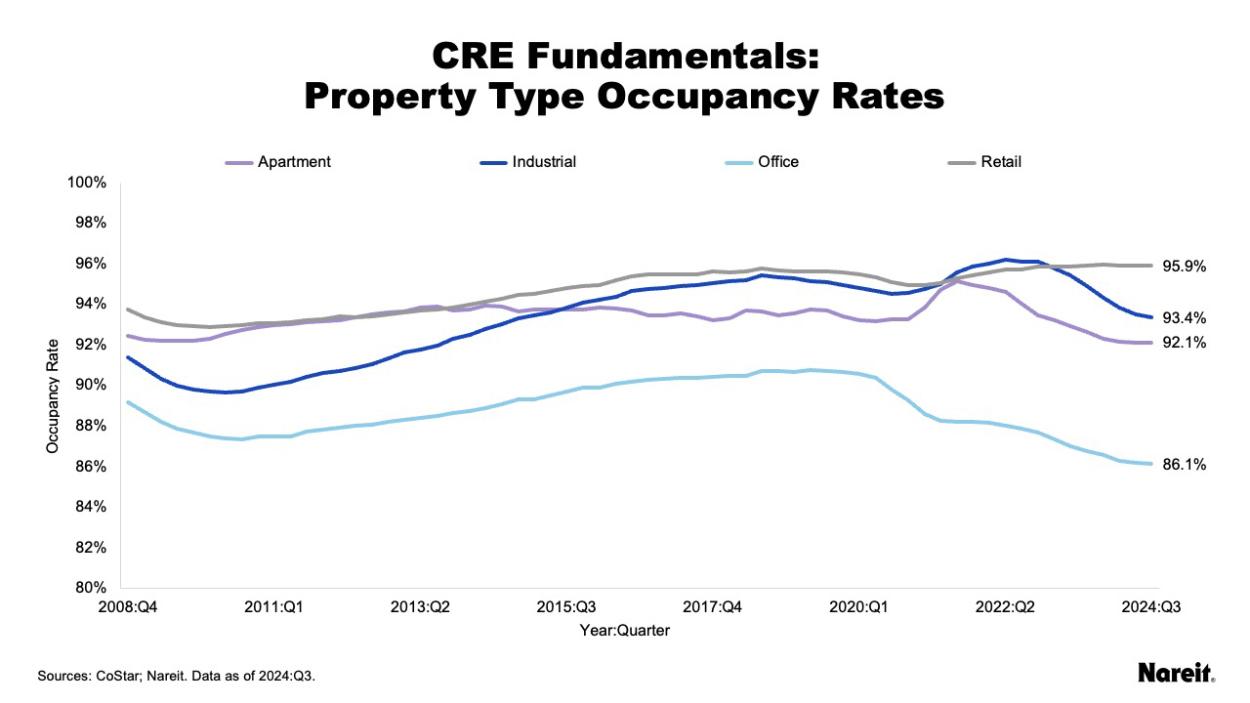

The chart above displays occupancy rates for the four traditional property types from the fourth quarter of 2008 to the third quarter of 2024. In recent years, the retail sector has enjoyed a rising occupancy rate, but it appears to have plateaued. In contrast, occupancy rates for the apartment and industrial sectors have dropped off in the face of record amounts of new supply following record rent growth in the past few years. Office occupancy reflects a shifting and uncertain demand environment with the advent of more widespread remote work. As of the third quarter of 2024, CoStar occupancy rates for the retail, industrial, apartment, and office sectors were 95.9%, 93.4%, 92.1%, and 86.1%, respectively.

Occupancy rate trends will likely weigh on future property operational performance. They also underscore the need for realism in investment underwriting.

REIT Occupancy: A More Positive Picture

While REITs in these sectors have not been immune from supply and demand imbalances, data from Nareit’s quarterly REIT industry tracker, which focuses on U.S. public equity REITs, offers a more positive picture. Occupancy rates across each of the four traditional property types were higher than their CoStar counterparts. In the third quarter of 2024 (the most recent data available), average retail, industrial, apartment, and office REIT occupancy rates were better than their CoStar equivalents by 122, 171, 346, and 11 bps, respectively.

Dedicated REIT managers have increasingly been targeting modern economy sectors in their investment strategies. In the third quarter of 2024, data from Nareit’s actively managed real estate fund tracker showed that modern economy sectors with the largest changes in their active weights included data centers, telecommunications, health care, and self storage. Fundamentals across these sectors appear to be more robust than those of the four traditional property types.

- Data center demand continues to be fueled by developments in artificial intelligence (AI). Demand is expected to exceed supply in both the space and capital markets.

- Telecommunications has been enjoying a resurgence in popularity as investors look to 2025 for a rebound in cell tower demand, setting the stage for the sector’s recovery.

- Health care’s outlook remains positive, especially for senior housing where demand from an aging population and curtailed supply have combined.

- Self storage has started its path to recovery, but demand in the coming year will likely be dependent on the health of the U.S. housing market.

Though overall CRE fundamentals are waning in some sectors, REIT occupancy rates for traditional property types remain higher than their CoStar counterparts, and active fund managers continue to increase their allocations toward REIT modern economic sectors because of their strong fundamentals.

A Valuation Reunion for Public and Private Real Estate

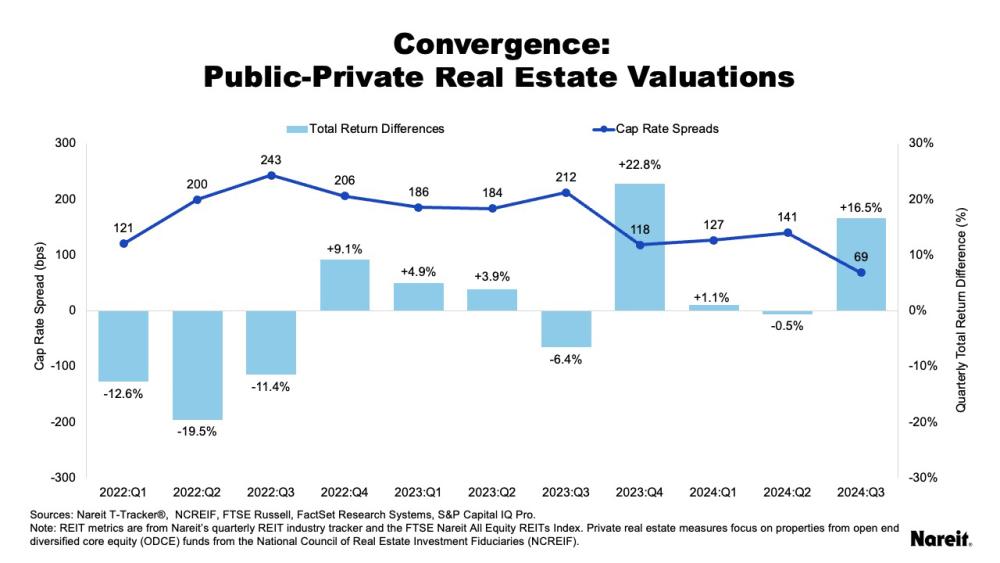

In addition to generally soft or softening fundamentals, the lingering public-private real estate valuation phenomenon has impeded significant property transaction activity. Despite reaching its crest two years ago, the spread between REIT implied and private appraisal cap rates has been stubbornly slow to close. Recent REIT performance, however, has made material progress in closing the gap. The long goodbye to the current valuation divergence may finally be reaching its end.

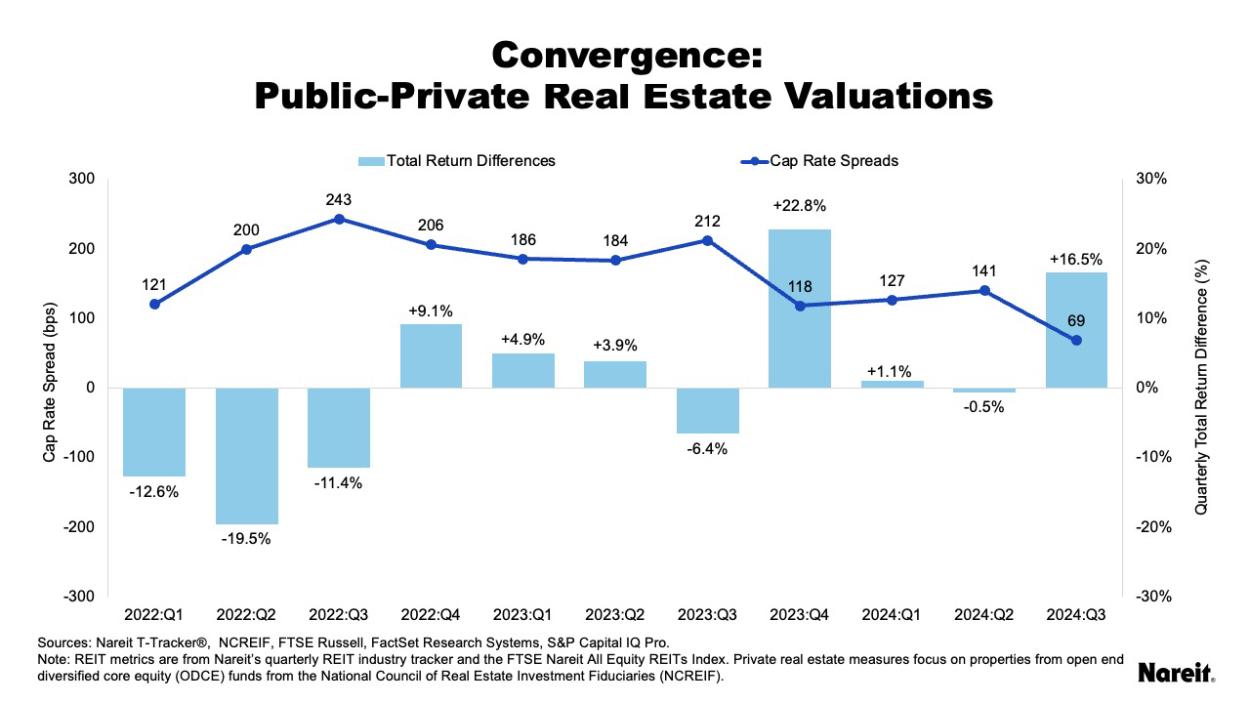

The chart above shows public-private real estate cap rate spreads (REIT implied less private appraisal cap rates) and total return differences since the first quarter of 2022 through the third quarter of 2024. In the chart, quarterly total return differences and cap rate spreads have a negative relationship, for example:

- When REITs had the greatest degree of outperformance (+22.8%) in the fourth quarter of 2023, the cap rate spread plunged by 94 bps.

- When REITs experienced the greatest degree of underperformance (-19.5%) in the second quarter of 2022, the cap rate spread surged by 79 bps.

- When REITs outperformed (+16.5%) in the third quarter of 2024, the cap rate spread dropped to 69 bps, a level less than half its previous quarter’s value.

The good news is that the spread is approaching the average spread across periods since 2000 that did not have a valuation divergence. Thus, values are becoming more aligned.

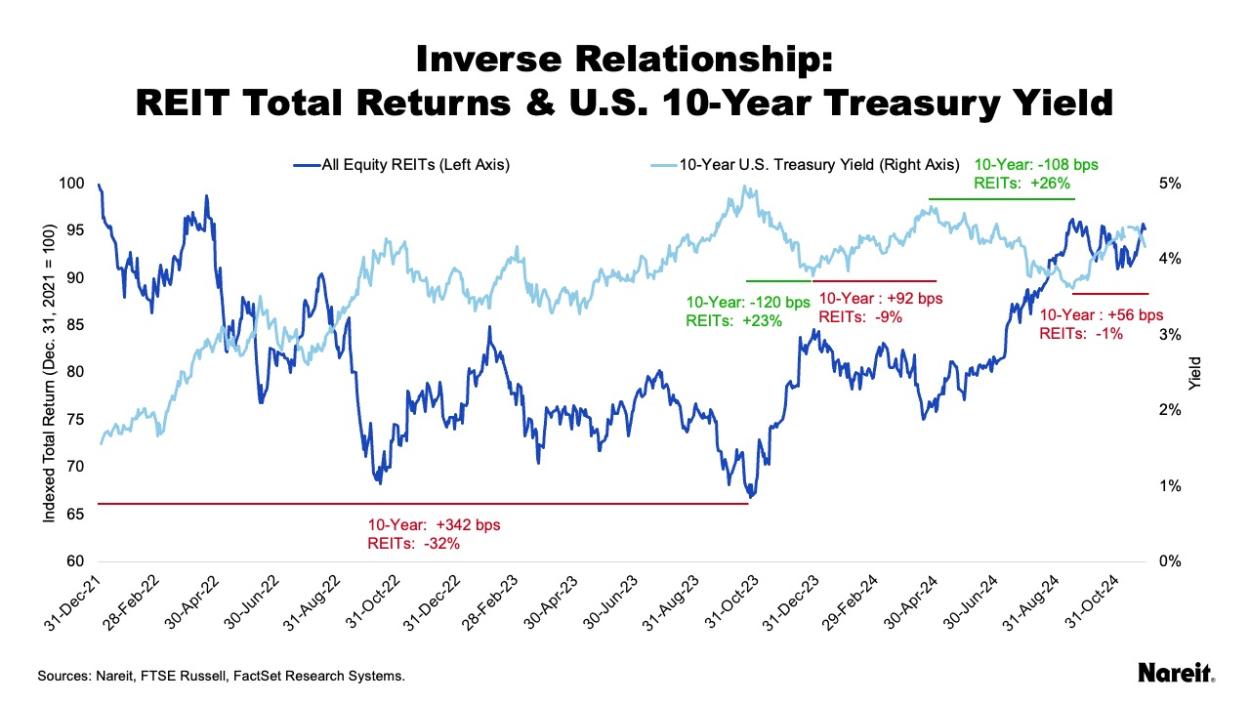

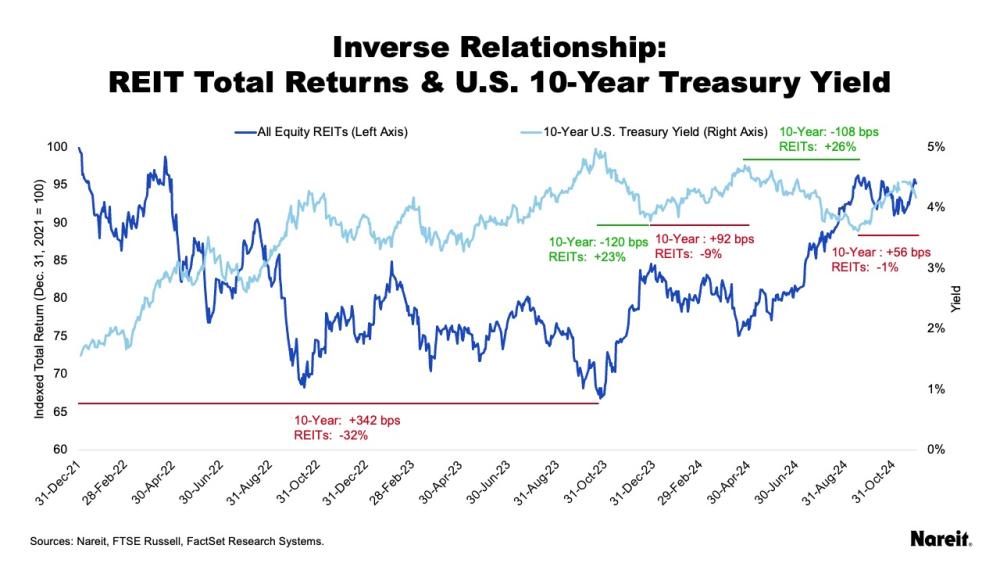

The chart above displays U.S. 10-year Treasury yields and the FTSE Nareit All Equity REITs Total Return Index on a daily basis from Dec. 31, 2021 to Nov. 29, 2024. Since 2022, REIT performance has generally followed an inverse relationship with 10-year Treasury yield movements. In the third quarter of 2024, REITs posted solid total returns as the 10-year Treasury yield dropped, resulting in material declines in the REIT implied cap rate and the corresponding public-private cap rate spread. Since the end of the third quarter, the 10-year Treasury yield has moved materially higher and REIT total returns have retreated. These movements have likely widened the public-private cap rate spread.

If the inverse relationship persists, interest rates will likely play a critical role in the valuation adjustment process. Closing the public-private cap rate gap bodes well for reviving property transactions. It also presents an opportunity for real estate investors, as it will likely continue to fuel REIT outperformance into 2025. If REITs can continue their gains, and private property investors remain steadfast in their measured quarterly appraisal cap rate increases, CRE may finally close the door on its public-private valuation dislocation.

REITs are Poised for Growth

Throughout the ups and downs of real estate cycles, REITs have maintained their unique and valuable characteristics in the CRE marketplace. Best-in-class operator knowledge and efficient access to cost-advantaged capital give REITs an edge over their competition. Disciplined balance sheets also provide REITs with the upper hand when it comes to growth opportunities.

Today, REITs have ready access to various capital sources, including equity, debt, and joint venture (JV) partnerships. In contrast, many of their private real estate market counterparts have been facing significant capital raising challenges with longer fundraising periods and lower proceeds. Preqin data show that aggregate real estate capital raised has been on a consistent downward trajectory since reaching a crest in 2021. Through the third quarter of 2024, aggregate capital raised was roughly half its peak value.

Many property investors are envious of current REIT balance sheets. Data from Nareit’s quarterly REIT industry tracker show that REITs have maintained low leverage ratios, focusing their financing activities on fixed interest rates, longer-term maturities, and unsecured debt. Third quarter 2024 data show that, on average:

- Leverage ratios were low with debt-to-market assets at 30.7%.

- Interest expense to net operating income ratio was also low at 23.2%.

- Weighted average term to maturity of REIT debt was 6.5 years.

- Weighted average interest rate on total debt was 4.1%.

- Fixed rate debt accounted for 91.3% of listed REITs’ total debt.

- Unsecured debt was 79.5% of REITs’ total debt.

REITs’ typical longer-term investment focus has kept them reasonably well-insulated from rising interest rates. REIT access to unsecured debt has been an important differentiator compared to many private real estate investors. In 2024, REIT unsecured debt issuances have been particularly strong, reaching $40.8 billion by the end of September. In the third quarter of 2024, 32 senior debt deals closed with an aggregate value of $15.4 billion. The average yield to maturity for these issuances was 5.2%.

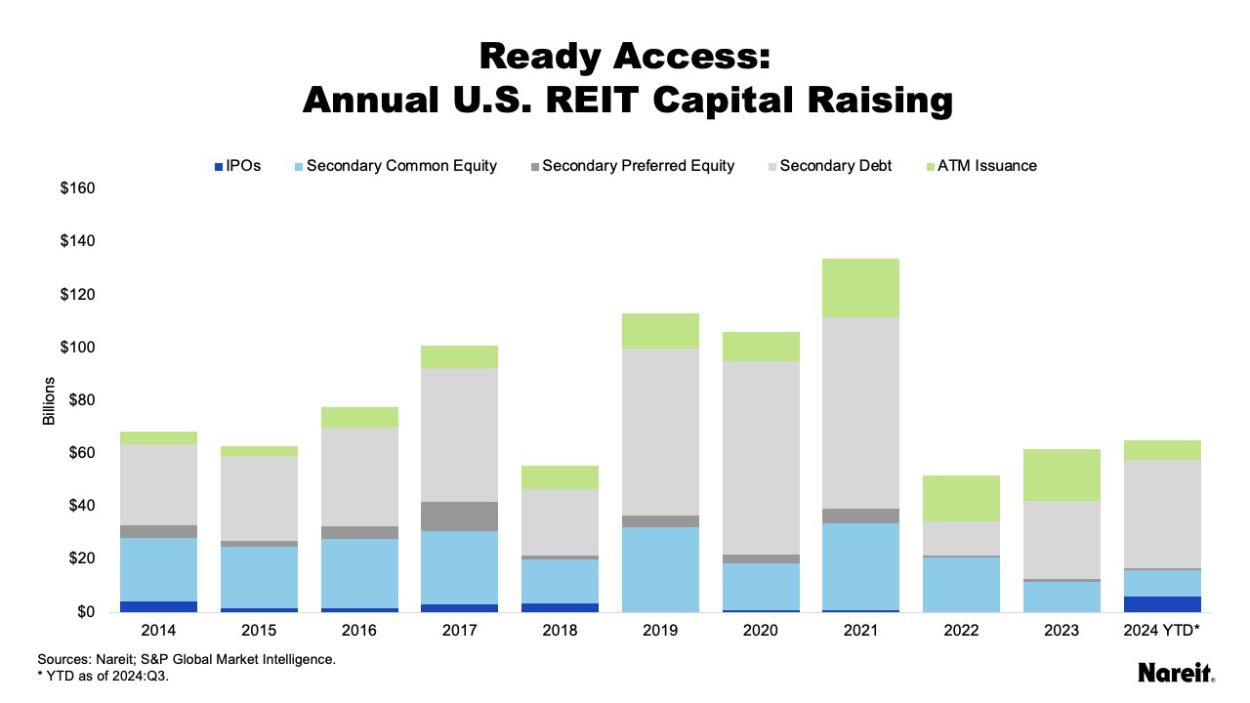

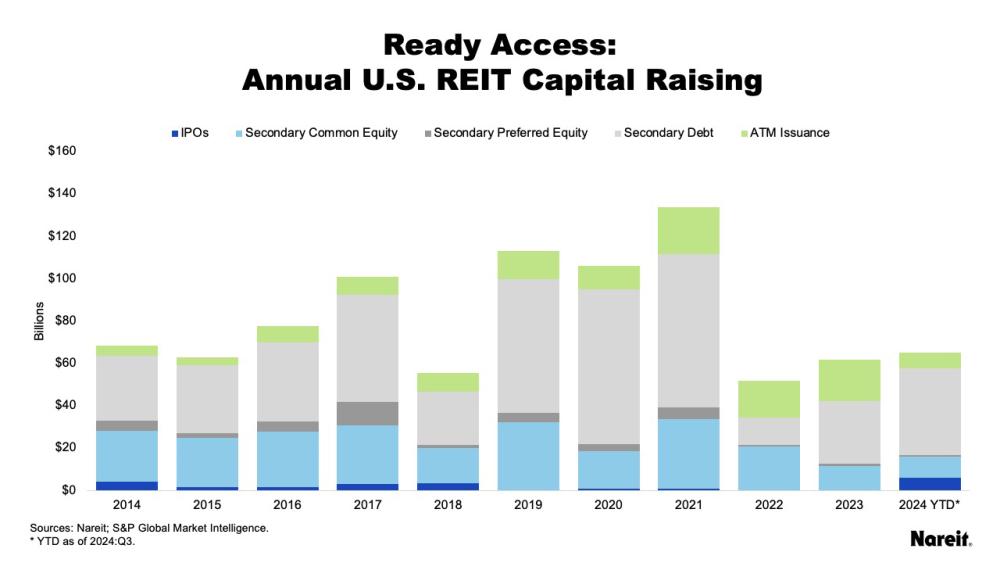

The chart above presents annual U.S. REIT capital raising from 2014 through year-to-date (YTD) 2024. It includes initial public offerings (IPOs), secondary common and preferred equity issuances, at-the-money (ATM) issuances, and secondary debt issuances. Throughout the ups and downs of the CRE cycle, the capital markets “kitchen” has remained open for REITs.

Notable recent U.S. public equity REIT transactions include the Lineage IPO and Equinix / GIC / Canadian Pension Plan Investment Board JV. Lineage, the world’s largest temperature-controlled warehouse REIT, raised $5.1 billion in gross proceeds in July 2024. The Equinix JV, which was signed in October 2024, plans to raise more than $15 billion to expand hyperscale data centers and support AI and cloud innovation.

The issuance data illustrates a valuable REIT characteristic in the CRE marketplace. REITs’ disciplined balance sheets and low debt costs have given them an edge, while enabling them to enjoy greater operational flexibility and face less stress than their counterparts with higher debt loads and costs.

A Property Transaction Market Revival

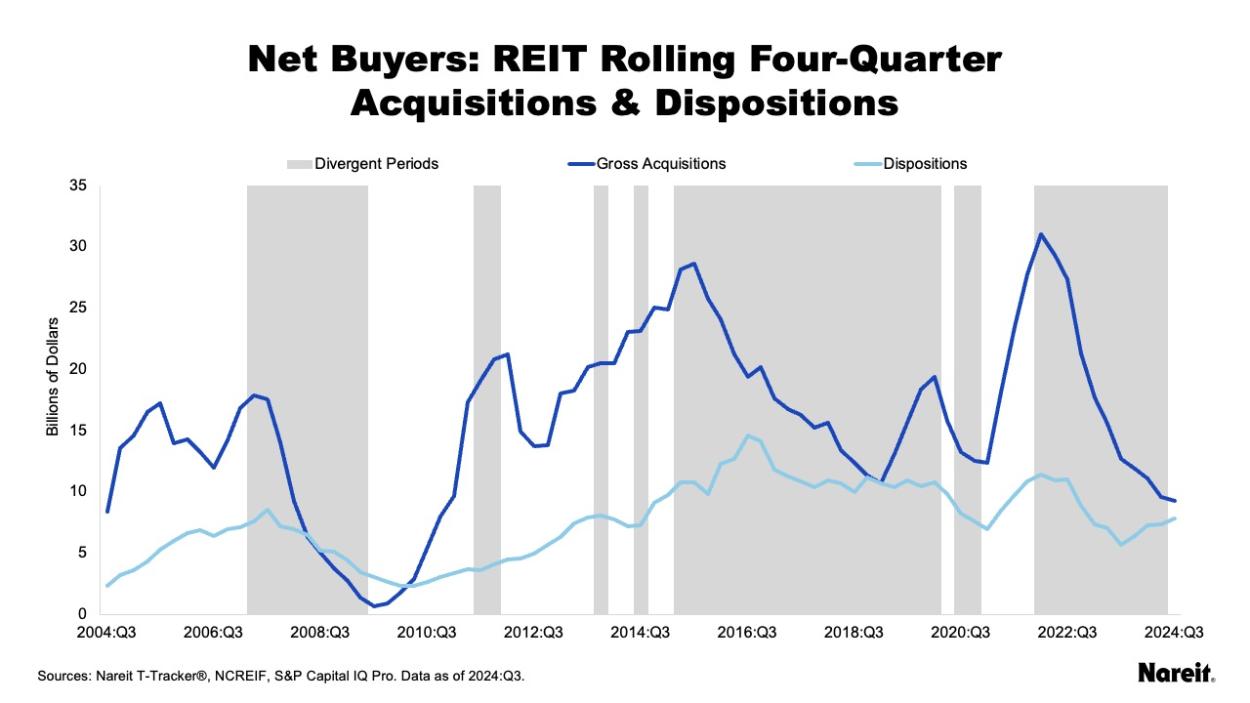

As public and private real estate values become more in sync, there likely will be a revival in the currently stalled CRE transaction market. History shows that REITs have been active buyers and sellers throughout real estate cycles, but they have modified their appetites with changing market conditions. REIT transaction activity declined markedly across consistent periods of divergence and higher capital costs; it accelerated when public-private valuations were aligned and costs were lower.

Using data from Nareit’s quarterly REIT industry tracker, the chart above presents REIT rolling four-quarter gross acquisitions and dispositions for the last 20 years. It also identifies quarters where public and private real estate values diverged, meaning the spread between REIT implied and private appraisal cap rates was greater than or equal to 100 bps. With their focus on growth, REITs have been net buyers of real estate, except for during the Global Financial Crisis (GFC). Highlighting their portfolio management diligence, REITs have consistently pruned their portfolios throughout the cycle. Although muted, current gross acquisitions and dispositions have remained materially higher than their respective GFC levels.

As public and private valuations continue to converge, the transaction market will likely regain its footing and accelerate. When this happens, REITs are expected be well-positioned to enter a growth cycle, given that their disciplined balance sheets and access to cost-advantaged capital offer them the upper hand in pursuing potential acquisition opportunities.

2025: A Brighter Investment Outlook for CRE and REITs

Going into 2025, while risks certainly exist, there are three keys that may help reenergize the current stagnant CRE market: an economic soft landing, a convergence of public-private real estate valuations, and an increase in property transactions. REITs will likely be poised for growth in a more robust CRE market because of their disciplined balance sheets, low debt costs, and greater access to various capital sources. With change in the air, REITs are positioned to take advantage of a potential revival in the CRE market next year and enter a new cycle marked by growth and ongoing innovation.