The Growing Role of REITs in Institutional Investor Portfolios

Key Takeaways

- Institutional investors will continue to use REITs as integral components of their real estate portfolios.

- Institutional real estate investors will keep using REITs to achieve geographic and sector diversification as part of their portfolio completion strategies.

- REITs will continue to offer investors tactical investment opportunities because of REITs’ liquidity, short-term valuation swings, and potential for relative outperformance as valuations stabilize across the market.

Institutional Investors Use of REITs Will Grow

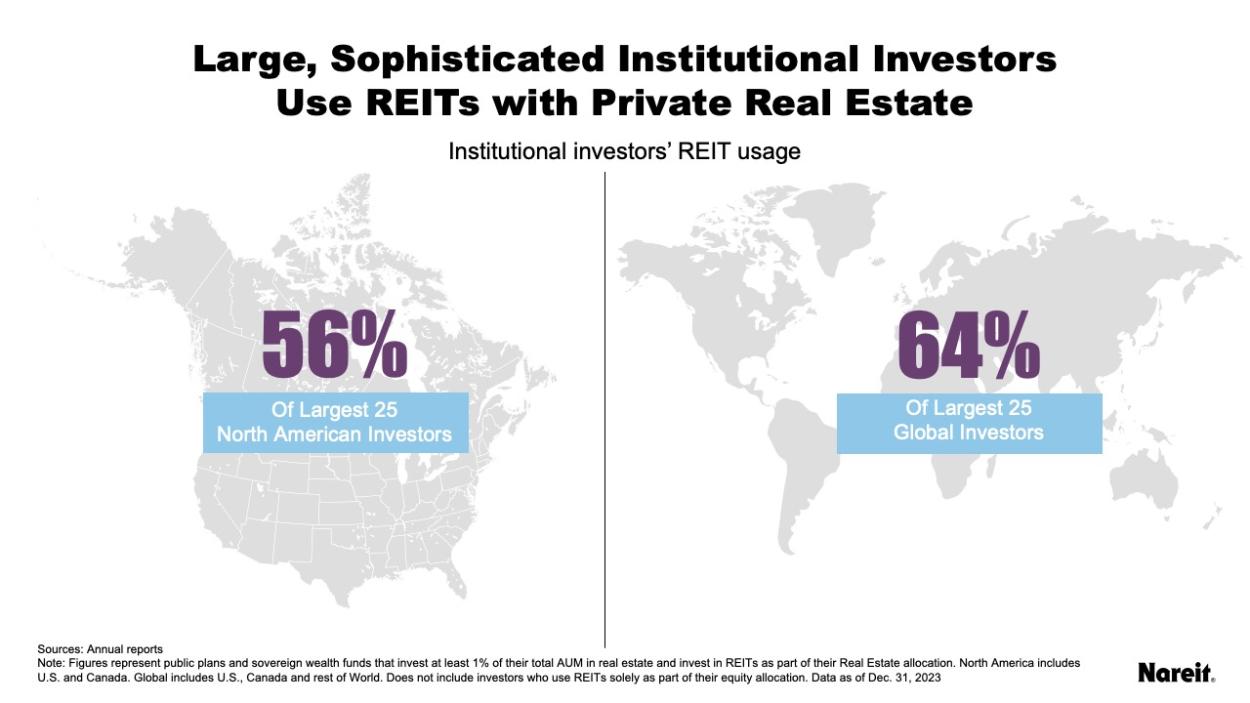

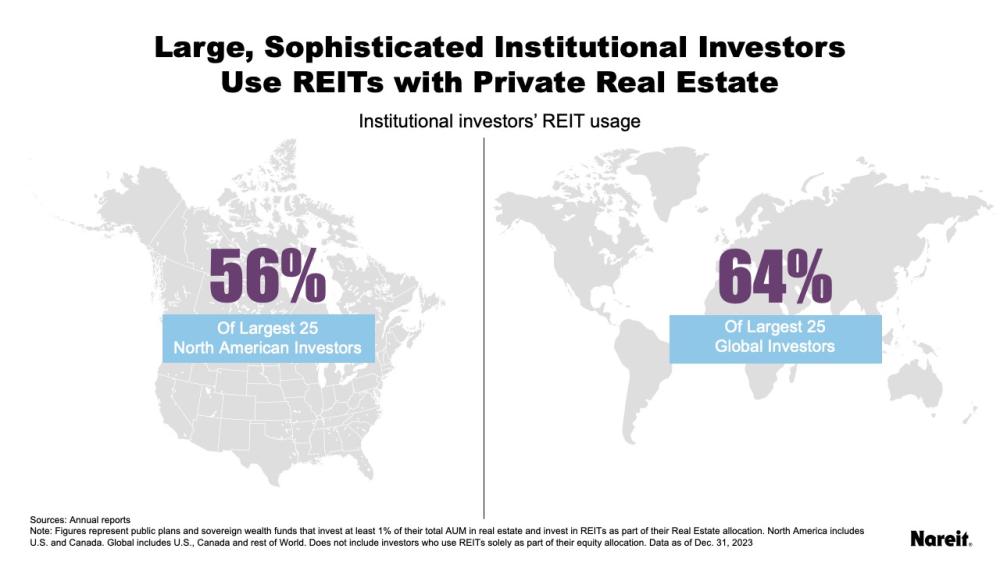

Today, the majority of institutional investors look at REITs as a critical real estate investment and are increasingly using REITs in innovative ways. A recent institutional investor REIT usage study by Nareit and the market research firm Coalition Greenwich underscore this fact; 88% of investors said they view investing in REITs as investing in real estate. In addition, the Coalition Greenwich research also indicates that 89% of institutional investors plan to maintain or increase their REIT allocations over the next three years with 20% planning to increase their exposure. Finally, Nareit analysis demonstrates that the majority of the largest investors use REITs as a key component of their real estate strategy.

As shown in the chart above, 56% of the largest 25 North American investors are using REITs in their real estate strategy and 64% of the largest global investors are doing the same. New research by Hodes Weill, an institutional real estate advisory firm, and Cornell University highlights this point, showing that 65% of U.S. institutions with more than $50 billion in assets under management (AUM) invest in REITs as part of their real estate allocations.

REITs Provide Access to Broad Array of Property Sectors

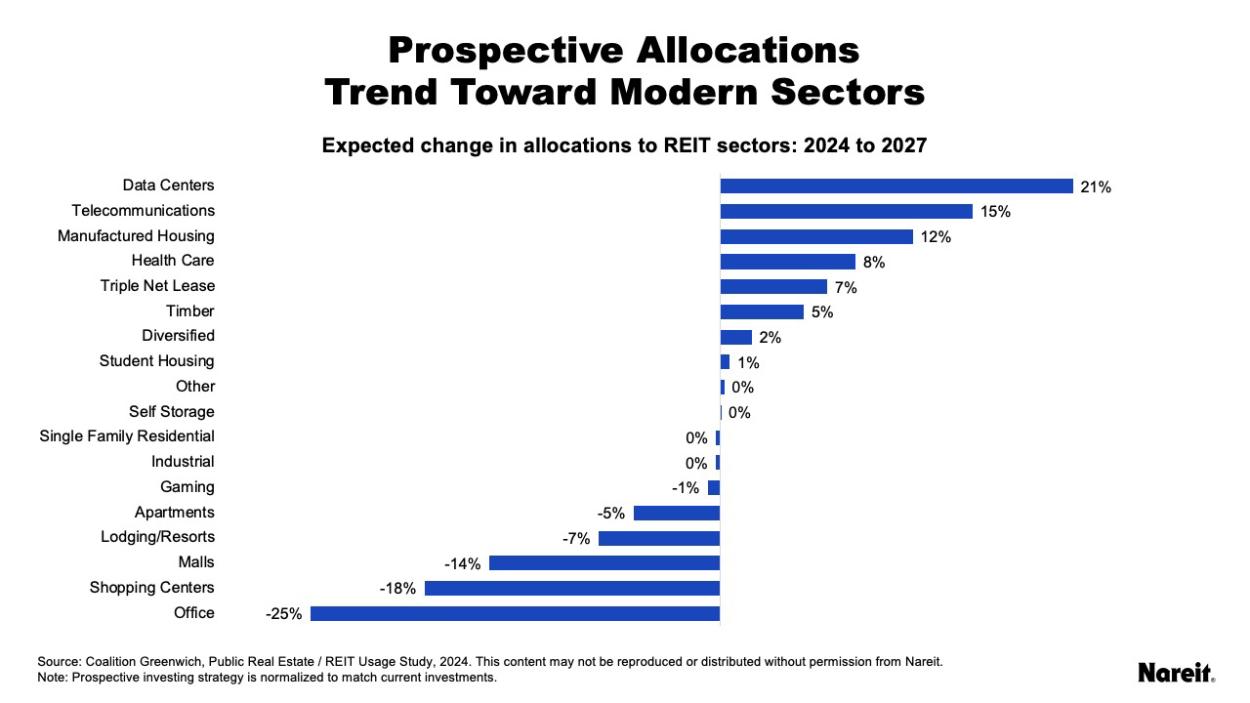

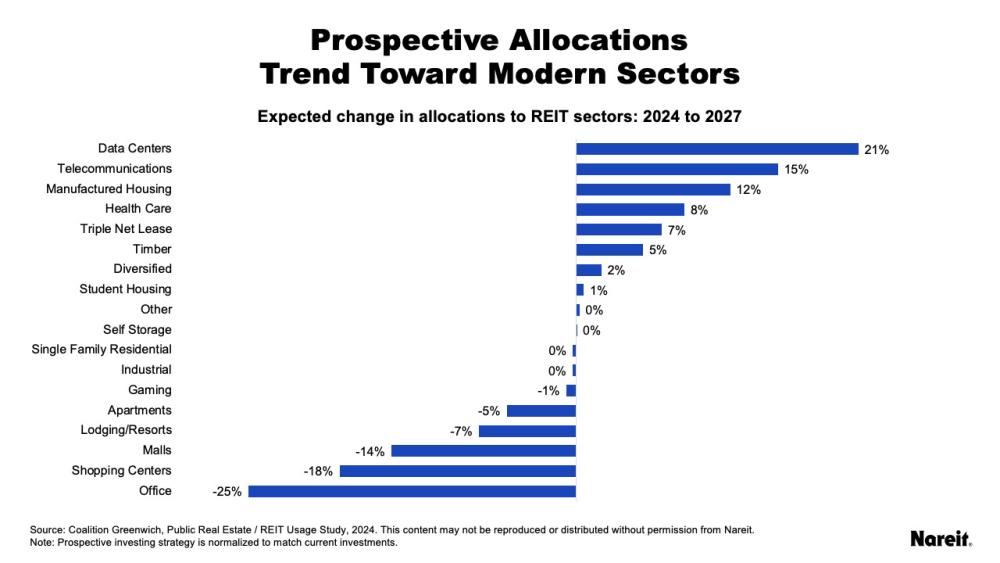

Institutional investors are increasingly interested in accessing new and emerging real estate sectors and are recognizing that REITs offer access to modern economy sectors, such as data centers, telecommunications, and health care.

The chart above demonstrates that property sector exposures are evolving. Comparing investors’ current allocations and expectations of future allocations, the Coalition Greenwich data show how institutional investors’ allocations are expected to shift by 2027. The clear trend is that as institutional investors make new investments, those investments will lean toward modern economy sectors.

Based on the Hodes Weill/Cornell study, the Coalition Greenwich research, and Nareit’s institutional investor case studies, Nareit expects to see more institutional investors using REITs in 2025 as part of portfolio completion strategies to optimize, or complete, an element of their real estate portfolios.

Case Studies Show Innovative Approaches to Using REITs

During 2024, Nareit released a series of case studies illustrating how institutional investors are strategically incorporating REITs to achieve their real estate portfolio objectives, including enhancing sector diversification and driving returns. These examples offer valuable real-world insights for other institutional investors that are considering integrating REITs into their 2025 strategies.

Case Study 1: Norges Bank Investment Management (NBIM)

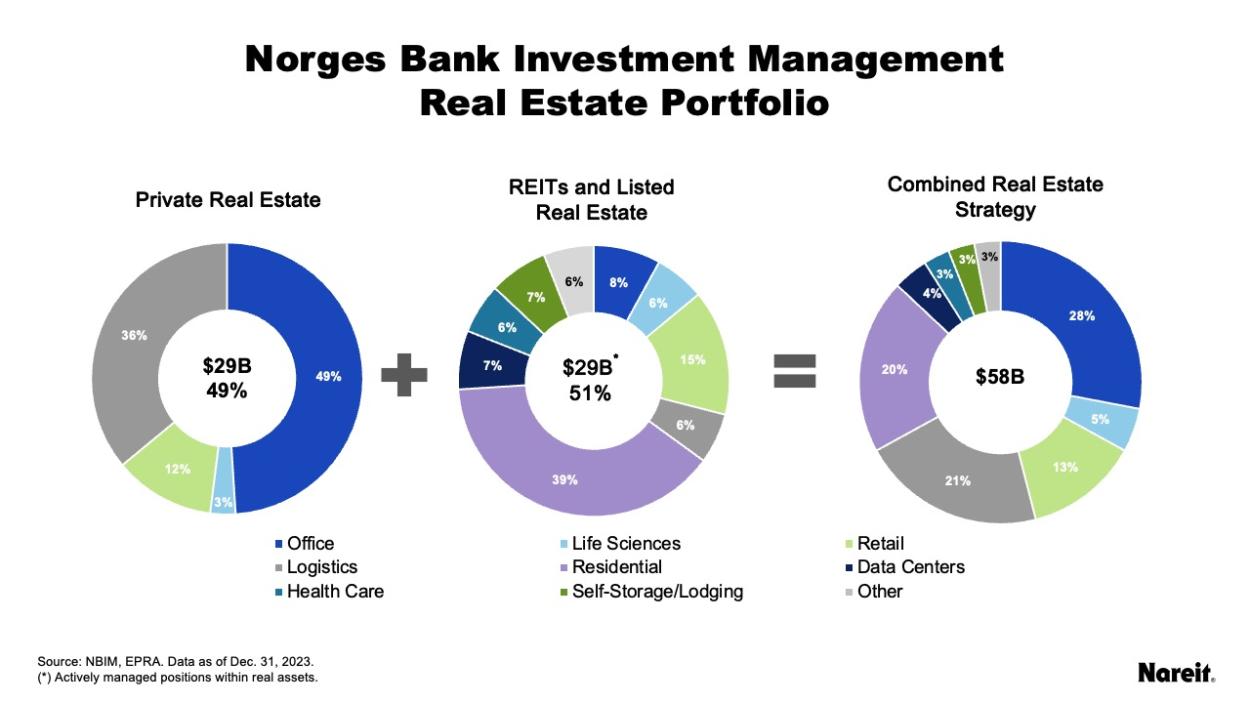

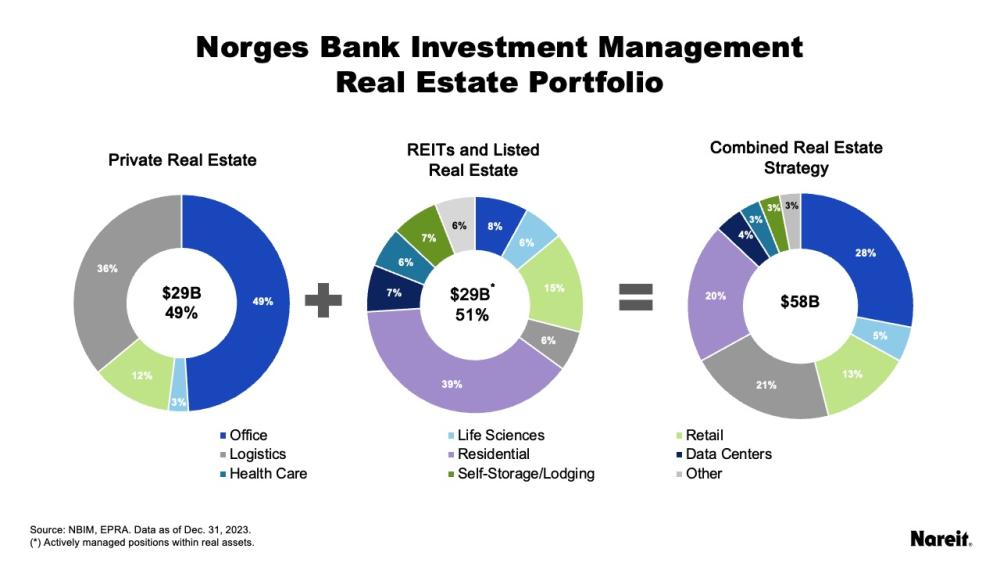

NBIM manages Norway’s Sovereign Wealth Fund and oversees $1.7 trillion in AUM, including approximately $58 billion in real estate. It invests 51% in REITs and 49% in private real estate to enhance diversification, access new and emerging property sectors, and optimize cost management.

The chart above shows how Norges uses public and private real estate in one portfolio. The REIT strategy gives Norges access to sectors like residential, data centers, health care, self-storage, and lodging, which private funds or direct investing may not be able to efficiently access. Office properties make up nearly half of Norges’ private portfolio, but this exposure drops to 28% of the total portfolio when REITs are included. Norges’ strategy shows how REITs play a crucial role in improving sector diversification and the overall risk-return profile of the fund. Read the full case study.

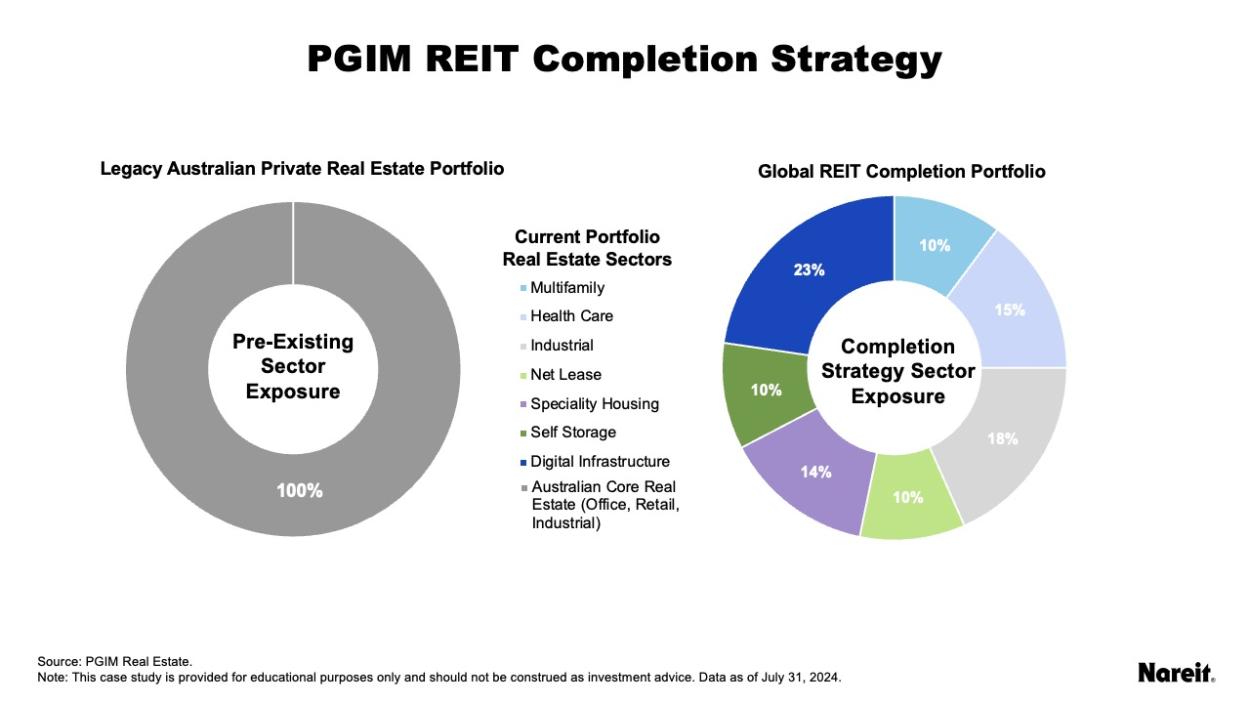

Case Study 2: PGIM and an Australian Superannuation Fund

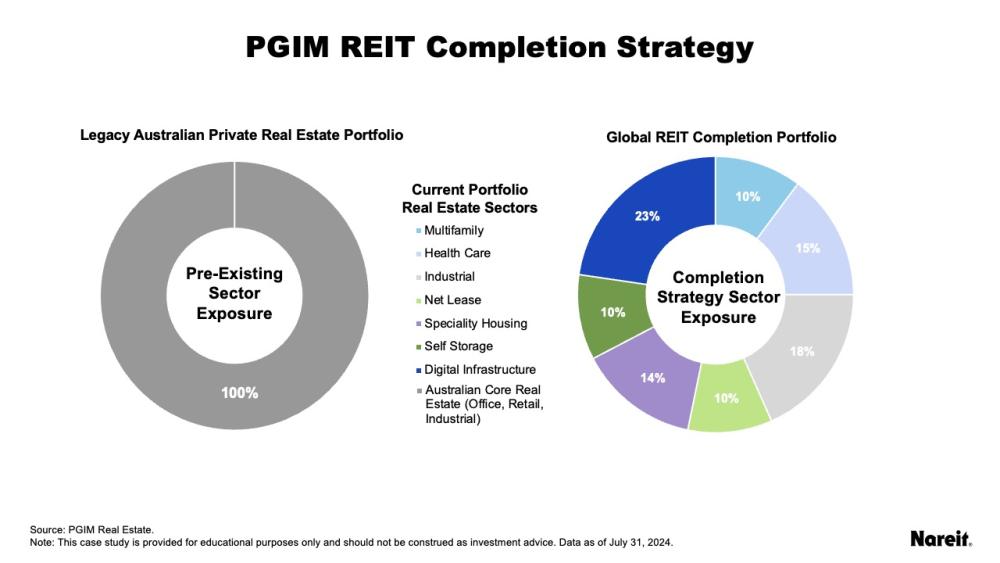

An Australian superannuation fund identified critical gaps in property types and geographies within its commercial real estate portfolio. To address these gaps and improve performance, the fund partnered with PGIM to integrate REIT investments into its real estate portfolio.

The chart above shows how the fund’s original portfolio focused on three traditional property sectors, all within Australia. By using REITs, PGIM expanded the portfolio’s exposure to new property types and regions, including multifamily, heath care, specialty housing, self-storage, and digital infrastructure within the United States, Canada, and Europe. This strategy demonstrates how using private and listed real estate helped achieve the fund’s goals of enhancing geographic and sector diversification. Read the full case study.

Case Study 3: Employee Retirement System (ERS) of Texas

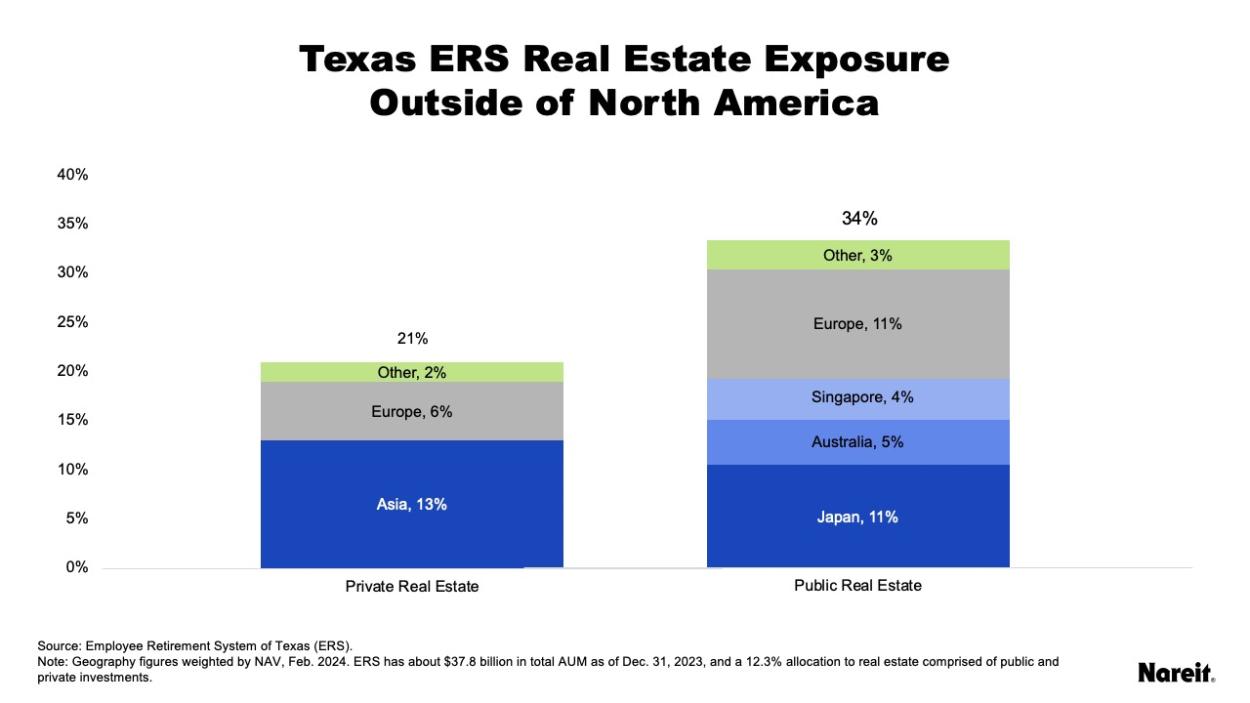

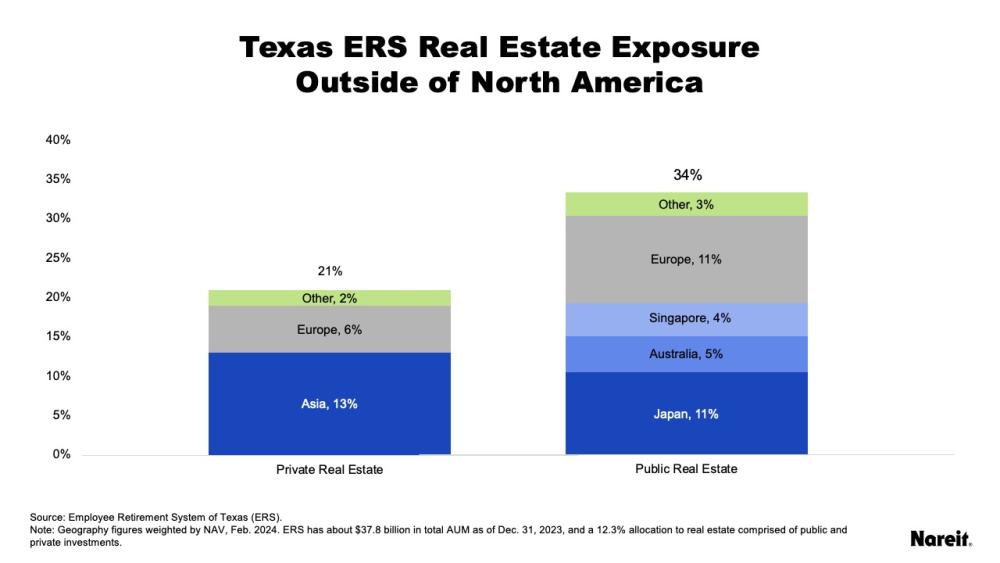

The Texas ERS manages approximately $38.2 billion in AUM and allocates 12% of it to real estate. Within that real estate allocation, ERS has a 25% target for REITs. ERS uses REITs to gain geographic and property sector diversification.

Global listed real estate, especially in Asia, is a key growth area for ERS, offering unique access to high-quality assets in foreign markets. The chart above shows how the public real estate portfolio with REITs has 37% exposure to foreign real estate compared with just 21% in the private real estate portfolio. By using REITs, ERS achieves geographic and property sector diversification otherwise unachievable in a private real estate portfolio. Read the full case study.

Case Study 4: Teacher Retirement System (TRS) of Texas

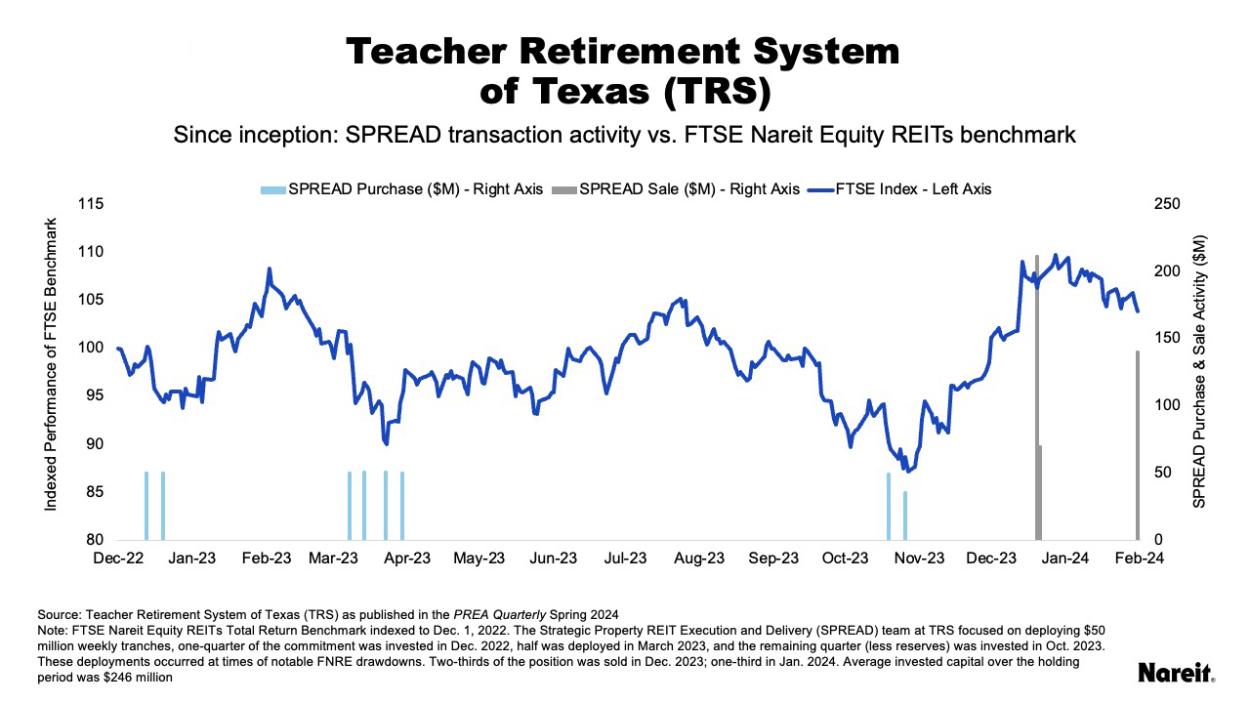

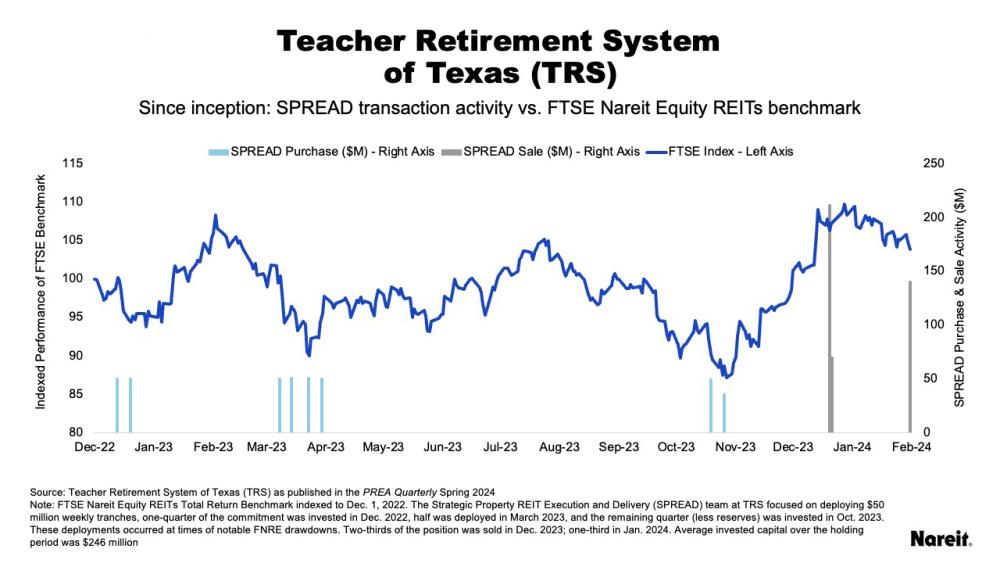

The Texas TRS manages $200 billion, 15% of which is allocated to its real estate portfolio. That portfolio historically invested mainly in private real estate but used REITs from 2022 to 2023 to tactically capitalize on the divergence between public and private real estate valuations. Through its Strategic Public REIT Execution and Delivery (SPREAD) program, TRS invested $400 million into public REITs over the course of 2023. During that time, TRS achieved a 17.1% internal rate of return with $47 million in profit, significantly outperforming TRS’s ODCE private real estate benchmark, which would have otherwise yielded more than a 10% loss.

The chart above presents the amounts and timing of the deployments (light blue) and realizations (gray) of the SPREAD investment capital. It also shows REIT index performance (dark blue) using the FTSE Nareit Equity REITs Index (FNRE) indexed to 100 at the SPREAD approval date of Dec. 1, 2022.

This case study offers a valuable model for institutional investors considering tactical REIT allocations by underscoring the importance of being nimble, flexible with asset class allocation, and sensitive to public market dynamics. Read the full case study in PREA Quarterly or listen to the REIT Report podcast episode , which features TRS members talking about the SPREAD program.

Institutional Investors Will Continue to Use REITs as a Key Component of Real Estate Portfolios

Institutional investors are increasingly recognizing that REITs provide efficient access to new and emerging real estate sectors and geographic diversification. Leading institutional investors believe REITs complement private real estate by filling allocation needs and addressing liquidity objectives.

Going forward, Nareit anticipates that more investors will continue to use REITs in increasingly creative and sophisticated strategies, including to access targeted sectors, different geographic regions, and to leverage REITs’ scale, scope, and operational expertise in traditional real estate sectors.