REITs in 2025: Finding Opportunities in a Changing Real Estate Market

On balance, 2024 has been successful for REITs. They have adeptly weathered higher interest rates, while maintaining enviable balance sheets and access to capital markets. REIT operating performance also has been sound. Comparing the first three quarters of 2024 to the same period in 2023, aggregate net operating income and dividends paid are each more than 3% higher.

In addition, REIT share price performance has been impressive. Through Nov. 30, 2024, total returns for the FTSE Nareit All Equity REIT Index were 14%, well above the 25-year average of nearly 10%. While REITs lagged the broader stock market, they significantly outperformed private real estate. Through the third quarter, REITs outperformed private real estate (measured by the NCREIF ODCE index) by more than 17 percentage points, as private real estate valuations continue to slowly price-in higher interest rates.

In 2025, there is a real possibility for an environment with both moderating interest rates and robust economic growth, otherwise known as an economic soft landing. Nevertheless, there are both lingering and emerging risks, including soft property fundamentals in some sectors, higher interest rates reflecting fiscal imbalances, and the possibility that shifting tariff policies could restrain commercial real estate (CRE) performance in 2025.

Overall, in a world that will be marked by increasing and accelerating change, we see opportunities for REITs in 2025. Specifically, we expect REITs to:

- find accretive growth opportunities as CRE transactions increase;

- continue leading globally as they embody the megatrends that will define real estate for the next decade: specialization, scale, innovation, and sustainability; and

- make critical inroads with institutional investors seeking efficient access to CRE with those characteristics.

Commercial Real Estate and REITs

In our broad CRE and REIT Outlook, we consider the three keys to a more dynamic CRE market in 2025: an economic soft landing, public-private real estate valuations returning to equilibrium, and a resulting property transaction market revival.

The rate-hiking cycle has been marked by the wide and persistent valuation divergence between REITs and private real estate, as REIT valuations adjusted to reflect higher interest rates in 2022, while private valuations have moved more slowly. Last year, we predicted that the convergence process would gain speed in 2024 as private real estate repriced and REITs outperformed their private counterparts. That prediction was correct. We show that the cap rate spread between private real estate and REITs fell from 212 basis points (bps) at the end of the fourth quarter in 2023 to just 69 bps at the end of the third quarter in 2024.

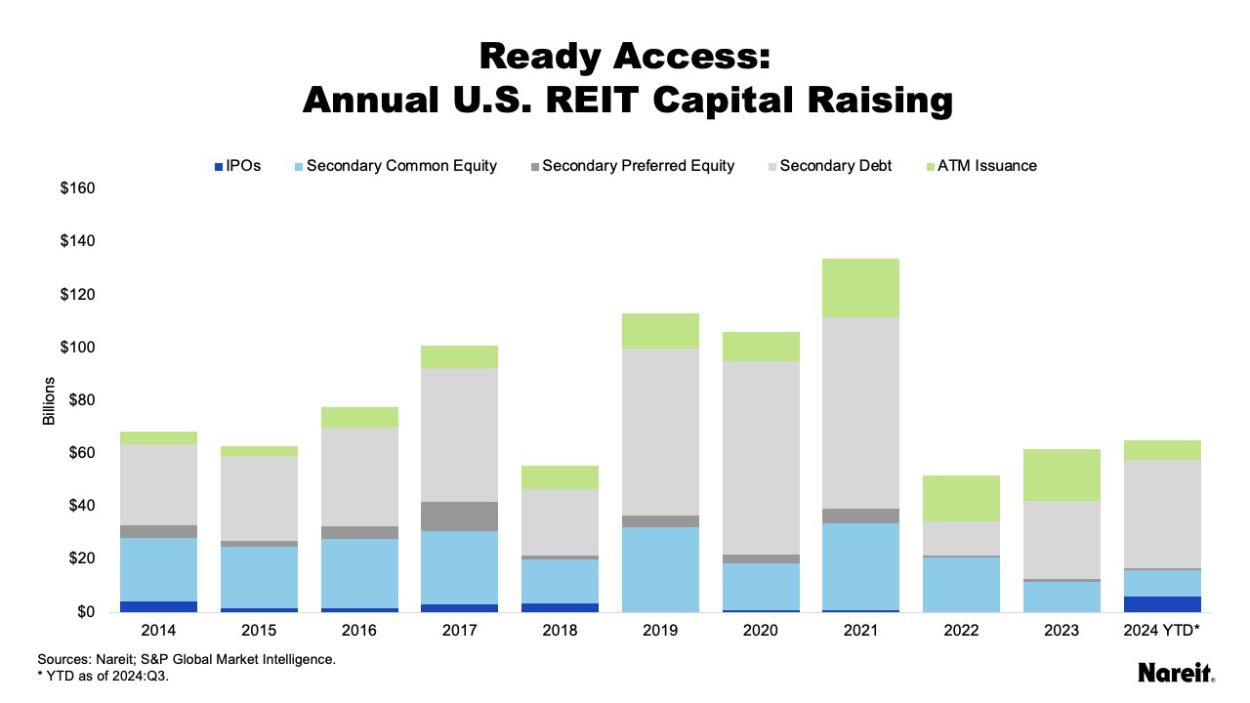

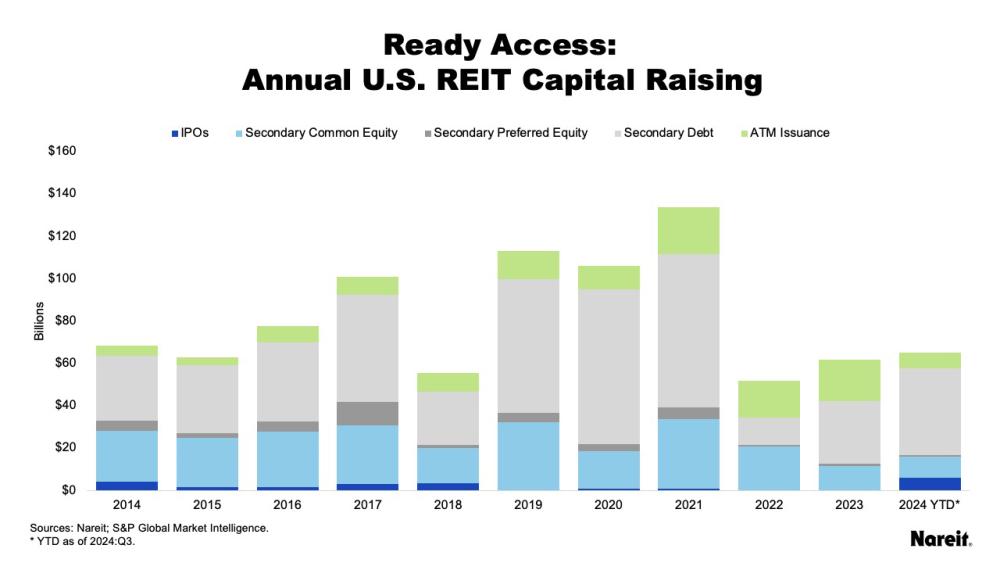

As public and private real estate values become more in sync, there likely will be a revival in the currently stalled CRE transaction market. REITs’ disciplined balance sheets and ready access to capital—through debt, equity and other forms of financing such as joint ventures with large institutional investors—will provide an important distinction in the current market. Though bank financing for real estate is improving, it remains challenging. With private real estate capital raising in the doldrums, REITs are well-positioned to enter a growth cycle, by taking advantage of their disciplined balance sheets and access to cost-advantaged capital to pursue accretive growth opportunities.

Global REITs and Listed Real Estate

As the REIT approach to real estate investment becomes increasingly global, it is important to analyze the U.S. REIT market in the context of the global REIT landscape. The FTSE EPRA Nareit Developed Index was up nearly 10% at the end of November 2024. Throughout 2024, U.S. REITs, particularly the U.S. health care and data center sectors, led the index as returns in Europe and Asia lagged the Americas.

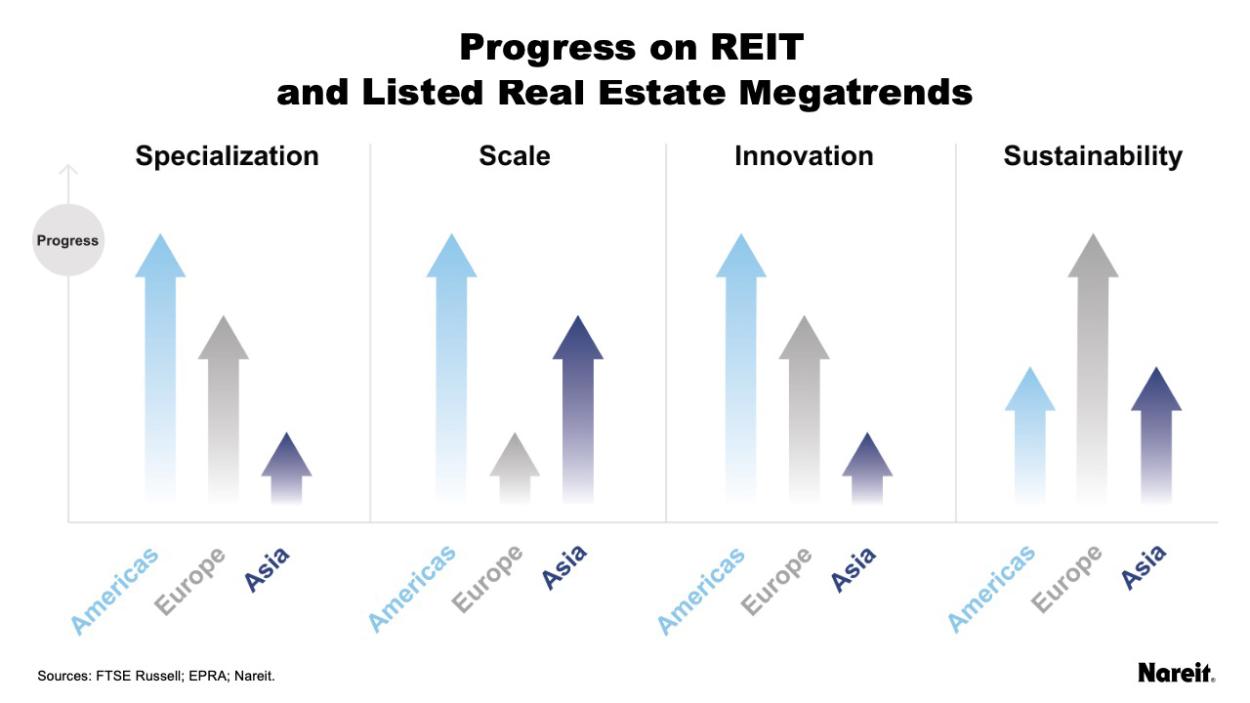

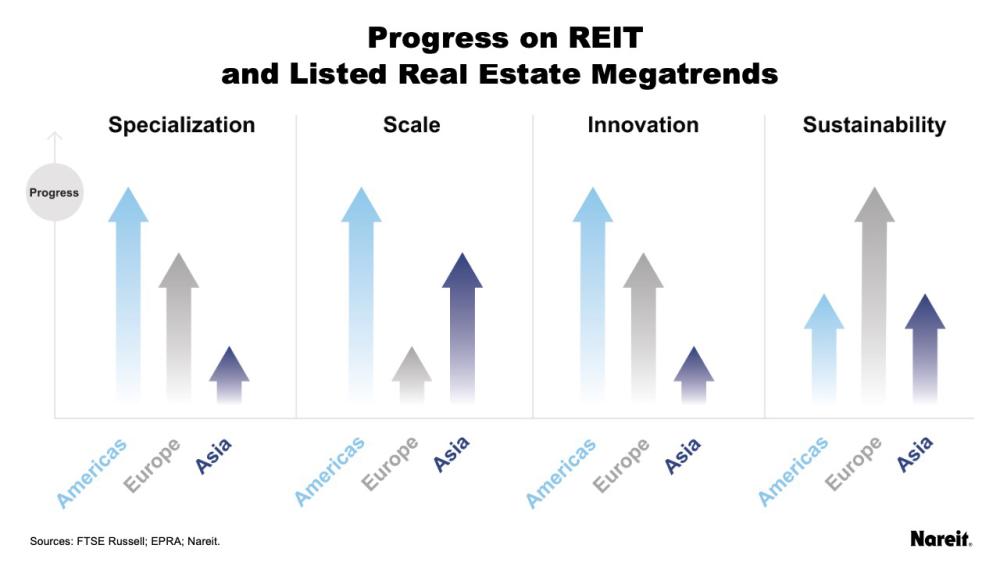

Taking a broader perspective, we identify and discuss four megatrends that have and will shape the global real estate landscape: specialization, scale, innovation, and sustainability.

These megatrends are progressing across the Americas, Europe, and Asia, creating current and future growth opportunities. Importantly, each one reflects different aspects of REIT and listed real estate’s inherent strengths and advantages.

REITs and Institutional Investors

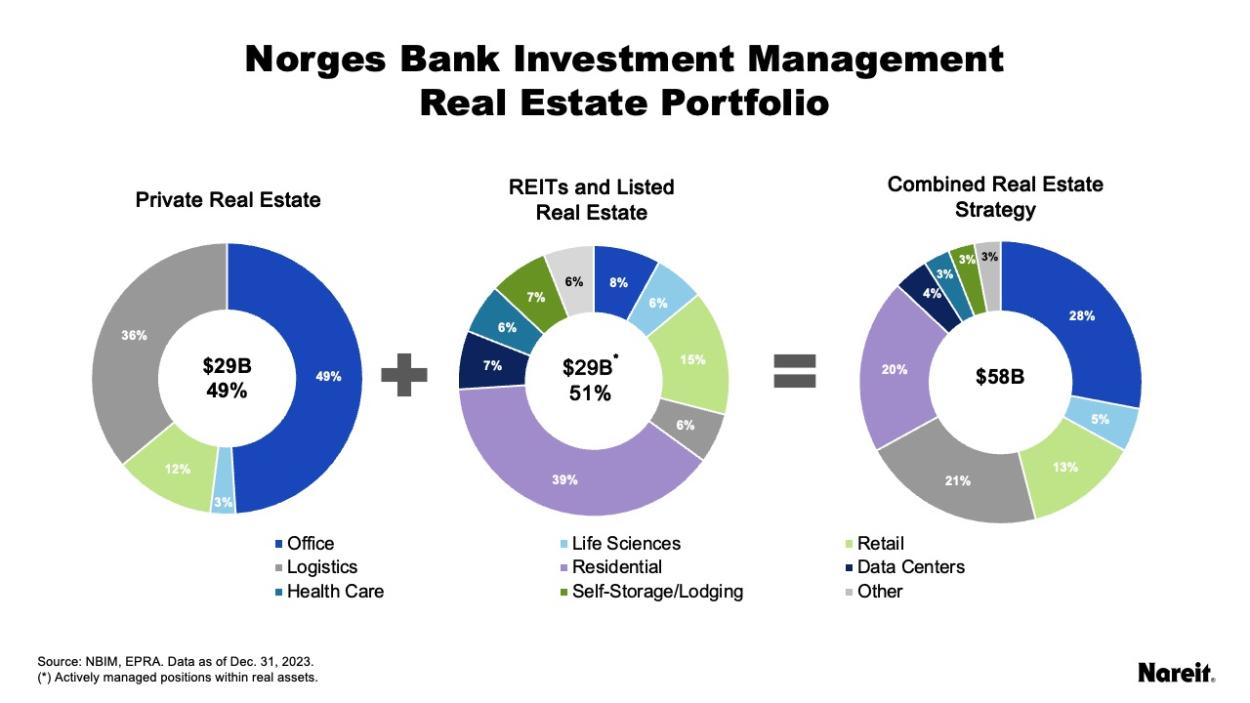

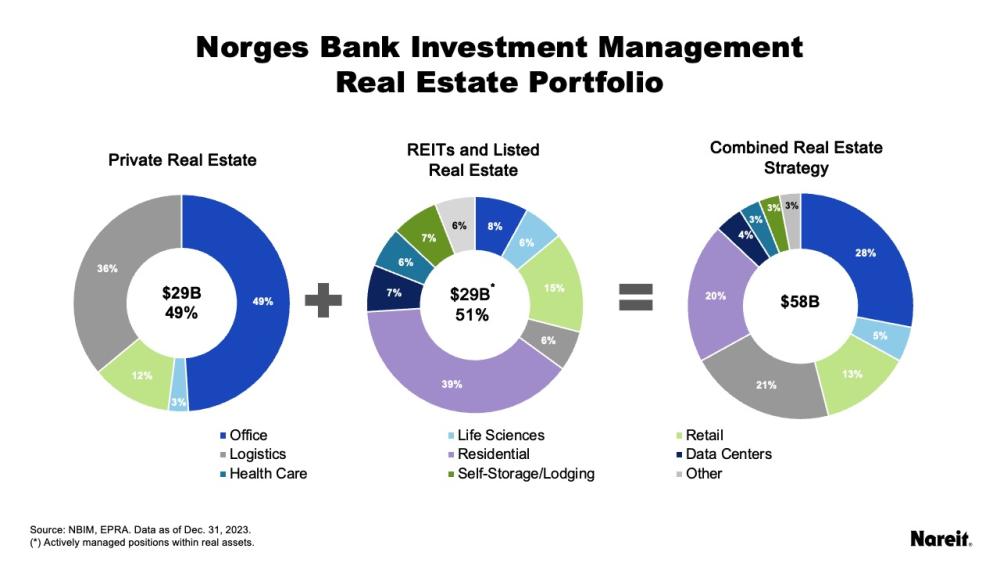

Leading institutional investors, including pensions and sovereign wealth funds, are increasingly understanding the importance of the megatrends discussed above and, critically, that REITs offer easy access to cutting edge real estate. This accelerated in 2024, and we expect it to continue in 2025, as institutional investors increasingly recognize that REITs have historically provided both higher total returns and world class operational performance, impressive scale, strategic access to new and emerging property sectors, efficient access to global real estate, and leading sustainability performance.

In this outlook, we also summarize four case studies showing how institutional investors are tactically and strategically using REITs to meet their real estate portfolio objectives, which include increasing property sector diversification, increasing geographic diversification, and increasing returns through tactical allocations to REITs.

Over the last two years, REITs have proved that they are adept at navigating the higher interest rate environment. In 2025, we are cautiously optimistic that we will see a more robust CRE market with more transaction activity. These transactions will provide REITs with opportunities for accretive growth, particularly given that REITs will continue to have access to various capital sources and well-managed balance sheets. At the same time, we expect REITs to keep making inroads into institutional real estate portfolios, as leading investors increasingly use REITs to access their high-quality properties, world-class operating platforms, and commitment to innovation.

Listen to a podcast about the 2025 REIT Outlook: