The Global REIT Evolution: Megatrends and 2025 Performance

Key Takeways

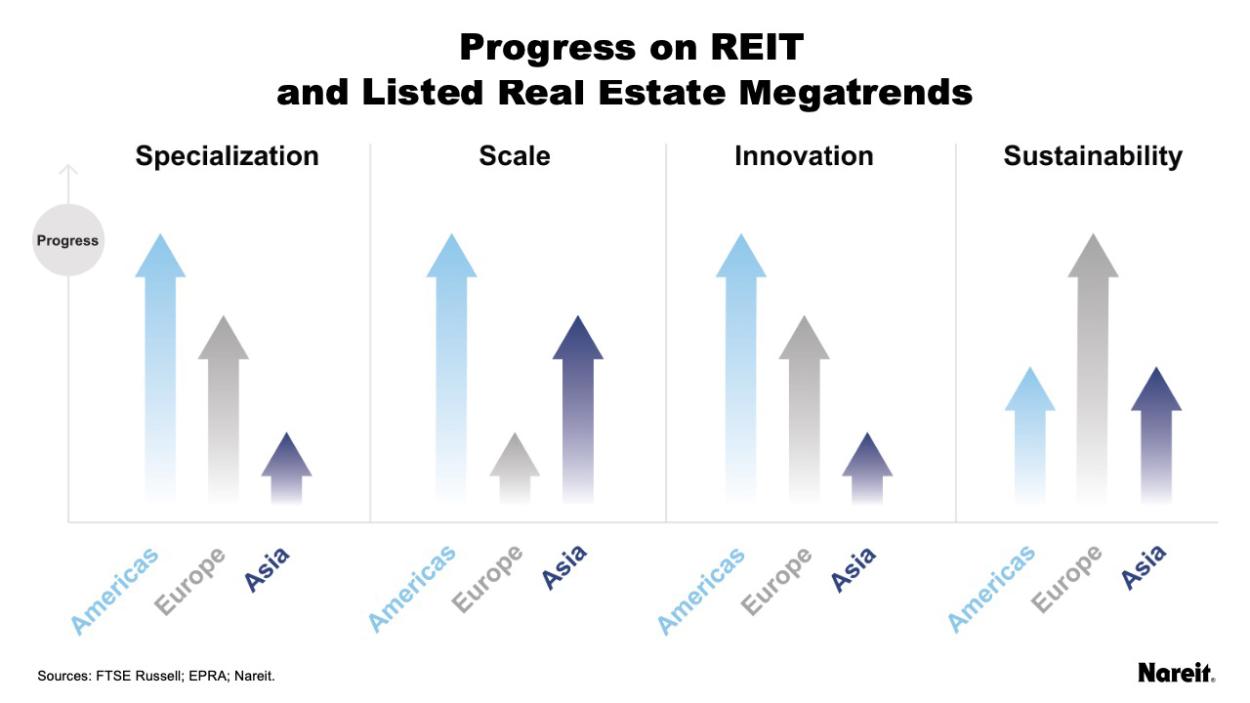

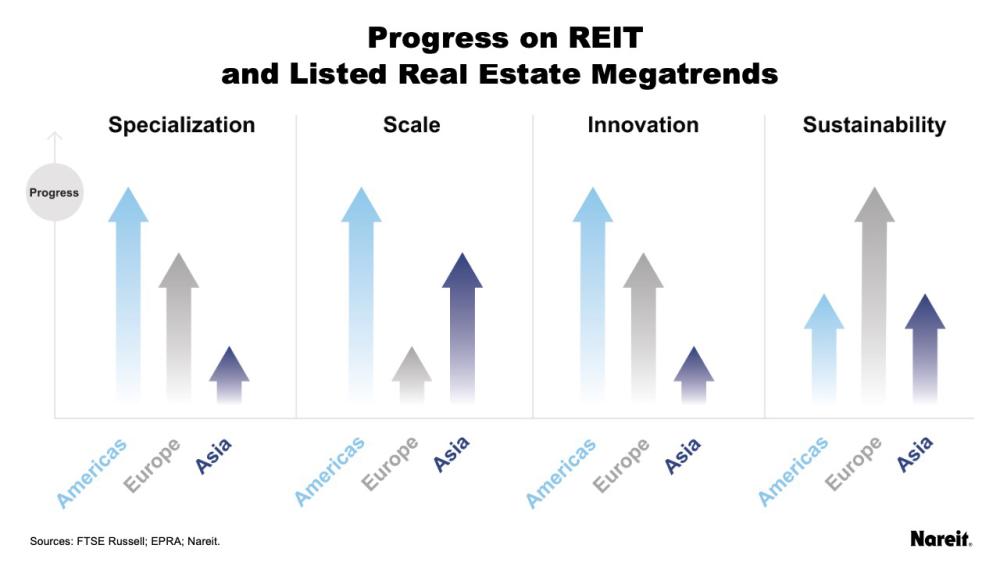

- Four key megatrends will continue to shape the global REIT landscape over the coming decade: specialization, scale, innovation, and sustainability.

- The four megatrends reflect different aspects of REIT and listed real estate’s inherent strengths and advantages.

- In 2025, as monetary policy normalizes, global REIT and listed real estate returns will be more closely tied to underlying operational performance rather than long-term interest rates.

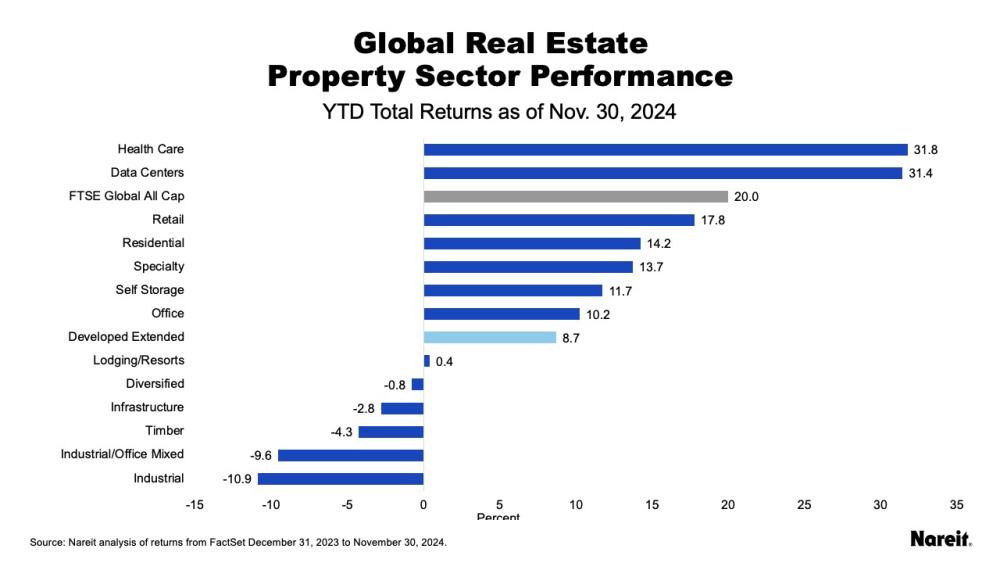

- Health care and data centers were the two best performing global sectors and they outperformed the broader index in 2024, largely because of societal trends and supply and demand dynamics.

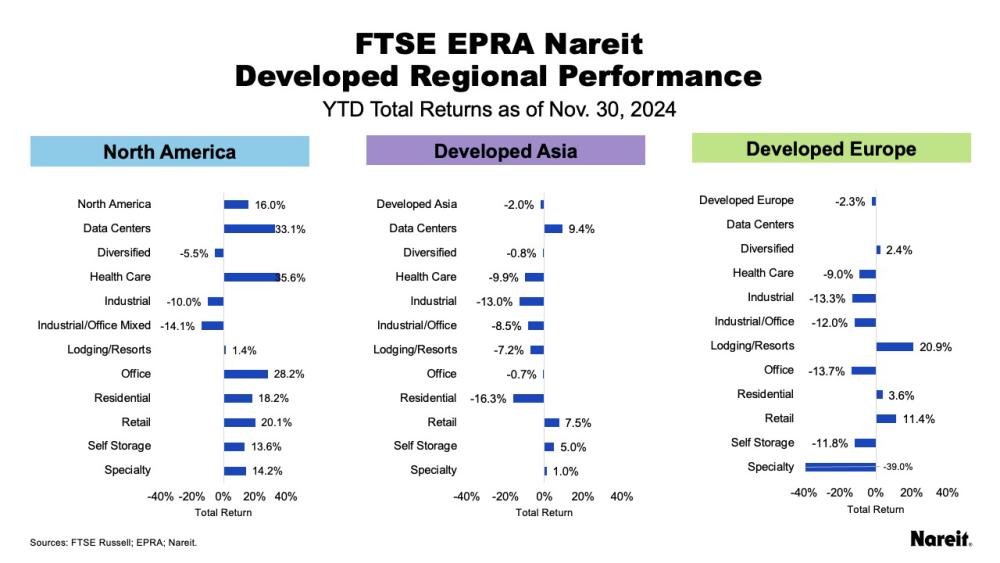

- The Americas region outperformed Europe and Asia in 2024, partly due to the higher share of new and emerging properties in the Americas.

The FTSE EPRA Nareit Global Real Estate Index Series is the largest global public real estate benchmark comprising REITs and publicly listed real estate from around the world. As of Nov. 30, 2024, the index series included 497 constituents in 38 countries with a total equity market capitalization of more than $2.5 trillion.

Four Megatrends Shaping the REIT Landscape in 2025

Looking across the global REIT and listed real estate landscape, four megatrends have emerged and will continue to progress at varying speeds across the regions. Importantly, each of these four megatrends reflect different aspects of REITs’ inherent strengths and advantages. These megatrends include:

- Specialization – Focusing on owning properties within one sector enables REITs to be world-class operators in their spaces.

- Scale – REITs are building large operating platforms that are fostering economies of scale, lowering the cost of capital, and making it easier to deliver solutions to the largest tenants.

- Innovation – REITs are leading the way in developing new property types and offering institutional investors efficient access to them. These property types range from data centers, logistics facilities, and telecommunications towers to health care facilities, hotels, self-storage buildings, and gaming properties.

- Sustainability – REITs continue to be leaders in owning assets with best-in-class sustainability characteristics as reflected in Nareit’s REIT Industry Sustainability Report 2024 and a peer-reviewed academic study sponsored by Nareit.

Across the globe, these megatrends are unfolding at different speeds, but all the regions are moving in the same direction. The figure above illustrates the progress of each megatrend in different areas of the world. The Americas, driven by the United States, leads in specialization, scale, and innovation, while Europe leads in sustainability. Nareit analysis of the REIT sectors in these regions gives further insights into the progress of these megatrends.

Specialization

- The diversified sector in the North America region accounts for just less than 2% of the FTSE EPRA Nareit North America Index, underscoring how much REITs have embraced specialization in the region.

- Europe is rapidly embracing specialization; the share of the diversified sector in the European region has declined from 43% to 30% in the FTSE EPRA Nareit Developed Index (Developed Index) during the past 10 years.

- Asia is moving more slowly toward specialization as diversified strategies represent 66% of regional market capitalization in the Developed Index.

Scale

- There are various measures to consider the scale of companies, but it should be noted that the top 10 REITs in the Americas region of the Developed Index account for nearly 50% of market capitalization, reflecting the growth of the largest REITs.

- Behind the Americas, Asia’s top 10 constituents account for nearly 43% of the Developed Index. In some markets there are dominant REITs, but they tend to focus on diversified strategies.

- Europe trails with the top 10 REITs accounting for about 40% of the Developed Index. The challenges inherent in creating pan-European REITs may be restraining the region’s progress in developing scale.

Innovation

- New and emerging property types account for a little more than half of the market capitalization in the Americas, reflecting the early adoption of sectors including telecommunications, data centers, health care, self-storage, hotels, gaming, and more.

- Europe follows the Americas with 7% of market capitalization in new and emerging sectors, mostly in health care and self-storage.

- Asia is trailing with just 4% of market capitalization in new and emerging sectors, but Nareit expects this to grow given new entrants in data centers and other new and emerging sectors.

Sustainability

- Europe is the clear leader in combined sustainability metrics for REIT and investor demand for sustainable investments.

- Asia and the Americas lag Europe in REIT sustainability performance and investor interest, but Asia is pulling ahead in both categories, particularly in Australia.

These four megatrends—specialization, scale, innovation, and sustainability—highlight REITs’ natural advantages and offer insights into how the REIT industry will evolve. Likewise, taking a deeper look at REITs’ performance during the past year can also offer greater understanding of how the global REIT landscape may change.

Global Returns Offer Insights Into REIT Landscape

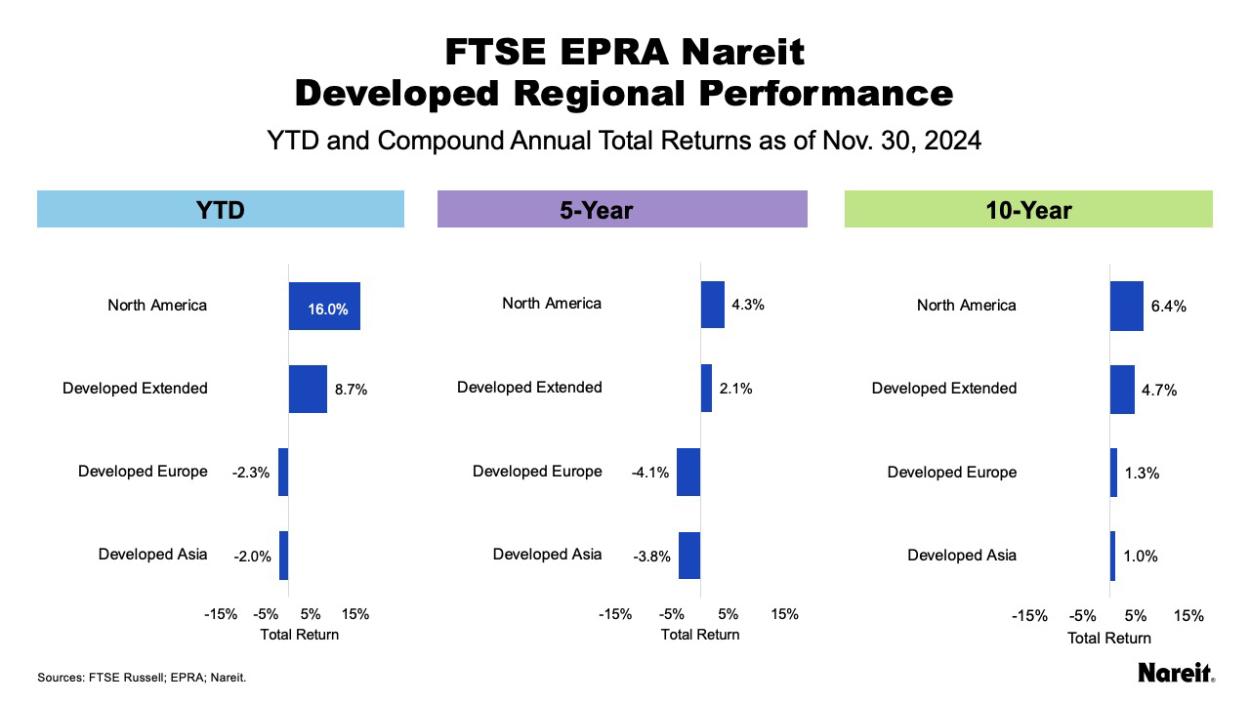

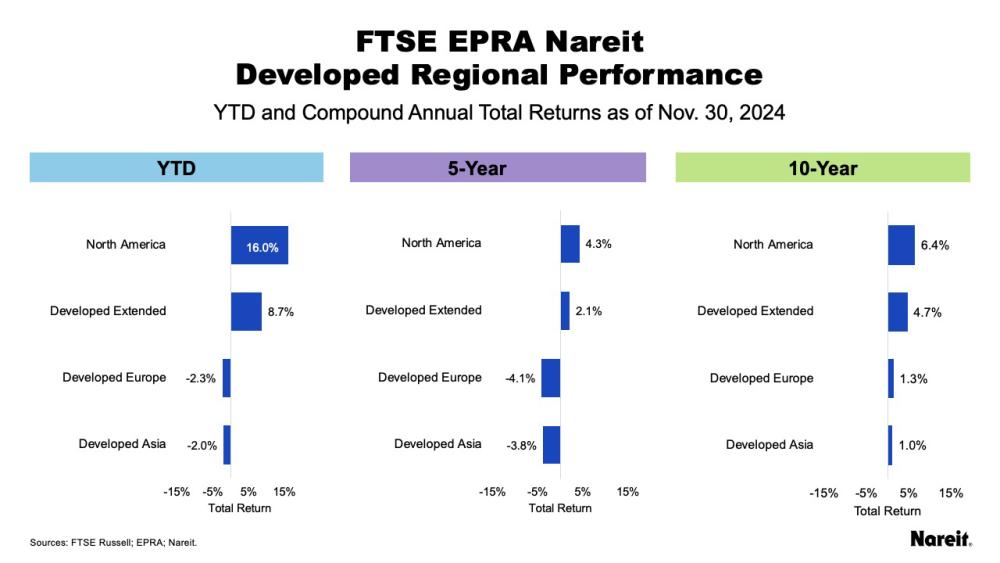

As of Nov. 30, 2024, the FTSE EPRA Nareit Developed Extended Index (Developed Extended Index) is up 8.7% on a year-to-date (YTD) basis. In 2024, the 10-year U.S. Treasury yield peaked in April and since that time the Developed Extended Index has returned 18.2%.

Health Care, Data Centers, and Retail Lead in 2024

As shown in the chart above, health care has been the best-performing global sector in 2024, with a return of 31.8%, followed by data centers at 31.4%, and retail at 17.8%. These returns compare favorably to global equities as the FTSE Global All Cap has posted a total return of 20.0% over this timeframe. Industrial (and industrial/office mixed), timberland, and telecommunications have lagged, posting respective returns of -10.9%, -4.3%, and -2.8%.

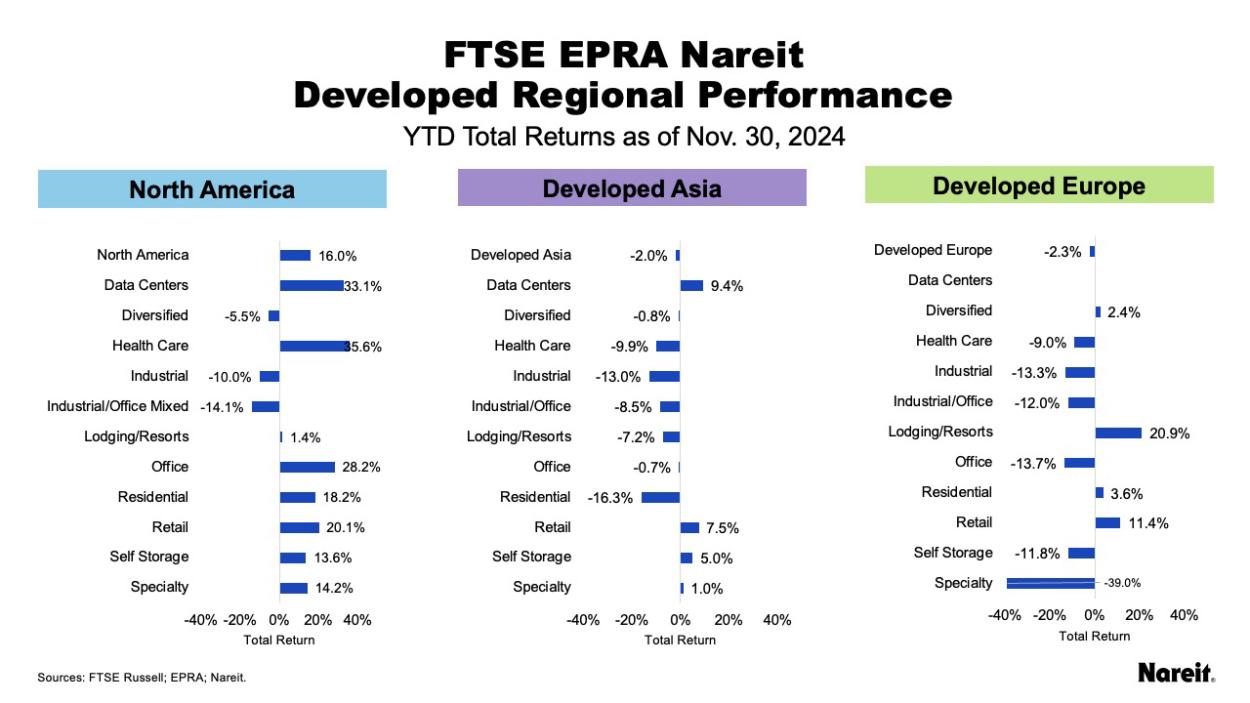

Real Estate Property Sectors Perform Differently Across Regions

It is important to note the regional differences in sector performance, specifically in terms of YTD total returns performance.

- Health care has been the strongest performing sector globally, but this is in large part due to the performance of the sector in North America (35.6%), compared to Developed Asia (-9.0%) and Developed Europe (-9.9%).

- Data centers have performed well in North America (33.1%) and Asia (9.4%); there are no pure-play data center constituents in Europe.

- Retail has performed well across all regions, including North America (20.1%), Europe (11.4%), and Asia (7.5%).

- Office is the third strongest performer in North America (28.2%), while it is flat in Asia (-0.7%) and has declined in Europe (-13.7%).

North America Leads Returns on a Regional Basis

As shown in the graphic above, North America has posted the strongest regional returns YTD as well as the past five and 10 years, returning 16.0%, 4.3%, and 6.4% during these respective periods. Europe follows with a year-to-date total return of -2.3%, a five-year total return of -4.1%, and a 10-year total return of 1.3%. Asia declined 2.0% in 2024, posted a five-year total return of -3.8%, and a 10-year total return of 1.0%.

Looking Ahead: Global REITs in 2025

As the REIT model of real estate investment continues to make global in-roads, the current megatrends—specialization, scale, innovation, and sustainability—will keep influencing the direction of global real estate. Looking to 2025, as monetary policy normalizes, REIT and global real estate return performance will be more closely tied to underlying operational performance rather than long-term interest rates.