REIT share prices, like the broader stock market, have been sensitive to changes in the outlook for interest rates, including both the short-term rates set by the Federal Reserve and the long-term rates that are governed more by market forces. In the current inflationary environment, the Federal Reserve has signaled it will be increasing short-term rates throughout 2022 to address concerns about inflation.

Historically, REITs have performed well during periods of rising long-term interest rates with average four-quarter return in periods with rising rates of 16.55% compared to 10.68% in non-rising rate periods from the first quarter of 1992 to the fourth quarter of 2021. Additionally, REITs outperformed the S&P 500 in half of the periods when Treasury yields were rising. The positive association that has historically been observed between periods of rising rates and REIT returns is consistent with an improvement in the underlying fundamentals.

Market interest rates typically increase during periods when macroeconomic conditions are strengthening, the same strengthening that often drives positive REIT investment performance. Strengthening macroeconomic conditions typically lead to higher occupancy rates, stronger rent growth, increased funds from operations (FFO) and net operating income (NOI), rising property values and higher dividend payments to investors. While a Fed tightening cycle due to inflation creates additional uncertainty about whether the correlation between REIT returns and long-interest rates will remain positive, it is noteworthy that REITs have historically outperformed during periods of above average inflation.

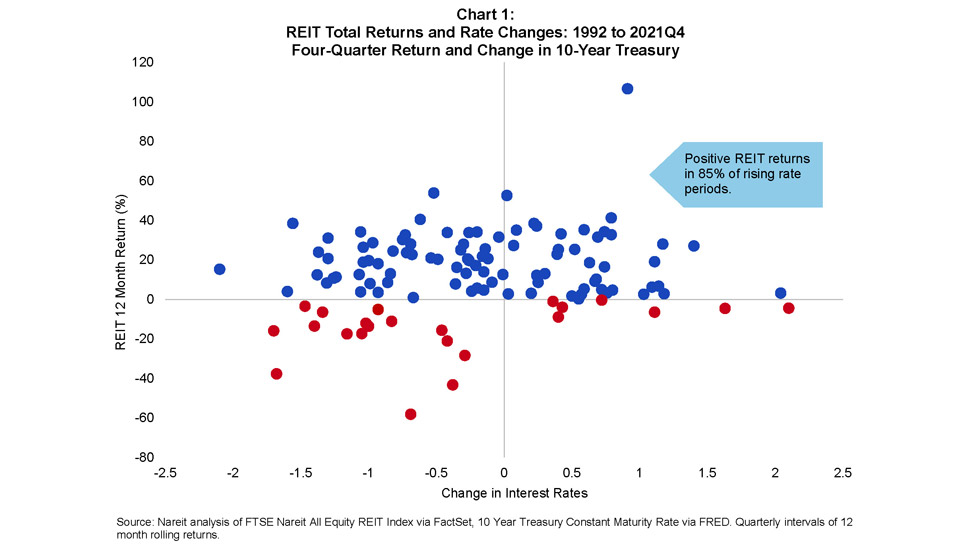

Chart 1 illustrates the relationship between the four-quarter change in the 10-year Treasury yield and the four-quarter total return on the FTSE Nareit All Equity REIT Index. REITs posted positive total returns in 85% of periods with rising Treasury yields from the first quarter of 1992 to the fourth quarter of 2021. The average four-quarter return in periods with rising rates for REITs is 16.55% compared to 10.68% in non-rising rate periods.

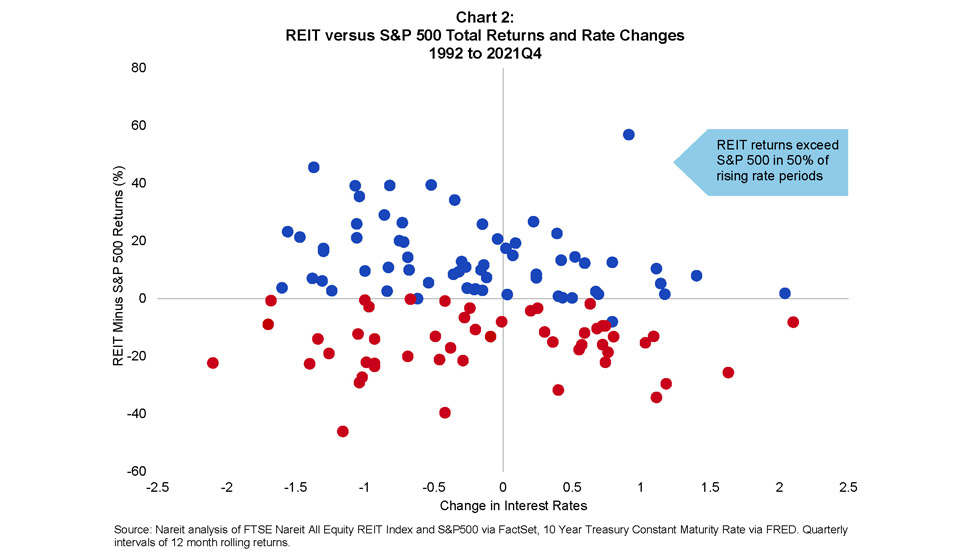

REITs have also outperformed broad equity indexes during many of these periods of rising interest rates. The relationship between the four-quarter change in the 10-year Treasury yield and the difference between four-quarter total returns on REITs and the S&P 500 is shown in Chart 2. REITs outperformed the S&P 500 in half of the periods when Treasury yields were rising from the first quarter of 1992 to the fourth quarter of 2021.

REITs appear to be well prepared for higher interest rates in the months ahead, according to the Nareit T-Tracker® , a summary of operating performance and financial position of the listed REIT sector. REITs have strengthened their balance sheets and reduced exposures to interest rates.

As of the fourth quarter of 2021:

- Equity issuance has been strong: REITs have raised significant amounts of equity capital over the past five years, both to strengthen their balance sheets and also to fund the acquisition of new properties.

- Leverage has declined: The debt-to-book assets ratio of REITs has declined to 48.1%, down from a peak of 58.3% before the Great Financial Crisis. Book leverage of the REIT industry is at its lowest point since at least 2000, the earliest date in the T-Tracker report.

- Interest expense has declined: Interest expense as a share of net operating income (NOI) is at 17.3%, a record low since 2000 and well below the peak of 40.0% in 2009.

- Debt maturities have lengthened: REITs have locked in low interest rates for several years into the future. The weighted average maturity of outstanding debt has lengthened to more than 89 months (more than seven years) from 60 months or shorter in 2009.

- Interest coverage ratios are high: Strong earnings growth, low leverage and low interest rates have raised interest coverage ratios to 6.5 times interest charges. Aggregate coverage ratios are at their highest levels since 2000.

See also:

- REIT Exposures to Interest Rates at an All-Time Low

- How Rising Interest Rates Have Affected REIT Performance

- Solid Balance Sheets Prepare REITs for Rising Interest Rates

- REITs & Inflation Outlook 2022: What to Know

- How Does Inflation Affect REIT and Stock Performance?

- New Morningstar Analysis Shows the Optimal Allocation to REITs