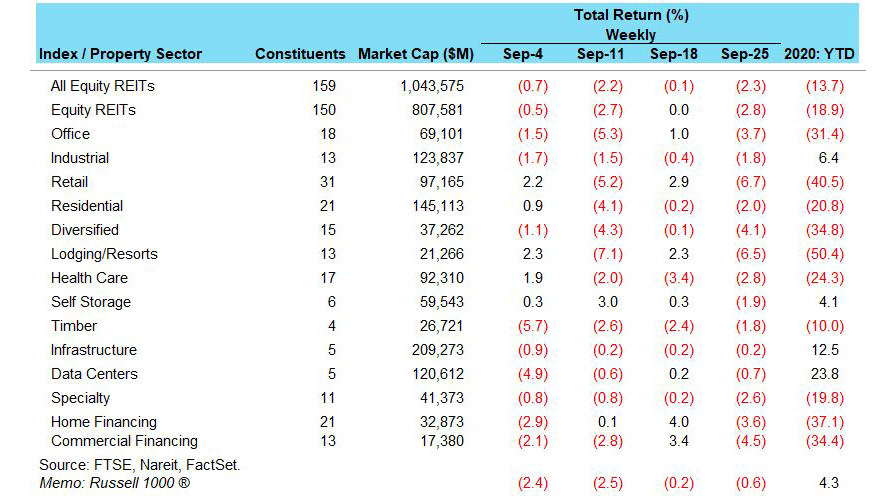

REIT share prices measured by the FTSE Nareit All Equity total return index fell 2.3% last week. During the first three weeks of September, REITs provided a shelter from turmoil in the broader stock market, especially among technology stocks. Last week concerns about economic growth and continued consumer resiliency to COVID-19 led to REIT stocks underperforming the broader equity indexes. Consistent with earlier social distancing related selloffs, the hardest hit equity REIT sectors were Retail (-6.7%), Lodging/Resorts (-6.5%), and Diversified (-4.1%). The two best performing sectors were Infrastructure (-0.2%) and Data Centers (-0.7%).

Both Home financing and Commercial financing mREITs gained, with total returns of 4.0% and 3.4%, respectively.

Despite the tough conditions for REIT stocks last week, for September as a whole, REITs are outperforming both the S&P 500 and Russell 1000 indexes with month-to-date returns of -4.3% for the FTSE Nareit All Equity total return index compared with -5.7% and -5.5% for the S&P 500 and Russell 1000 respectively.