A recent Nareit commentary examined occupancy rate momentum across the four traditional property types and found that property fundamentals have generally been soft or softening across these sectors. Rent growth rates also highlight property market fundamentals. A review of these metrics and their respective momentum measures reveals similar outcomes to the occupancy rate analysis: year-over-year rent growth rates have broadly been modest or moderating across the four traditional property types. While these conditions, along with occupancy rate trends, may place further pressures on property operational performance gains into 2025, it is important to note that rent growth rates across each of the four traditional property types have generally remained positive.

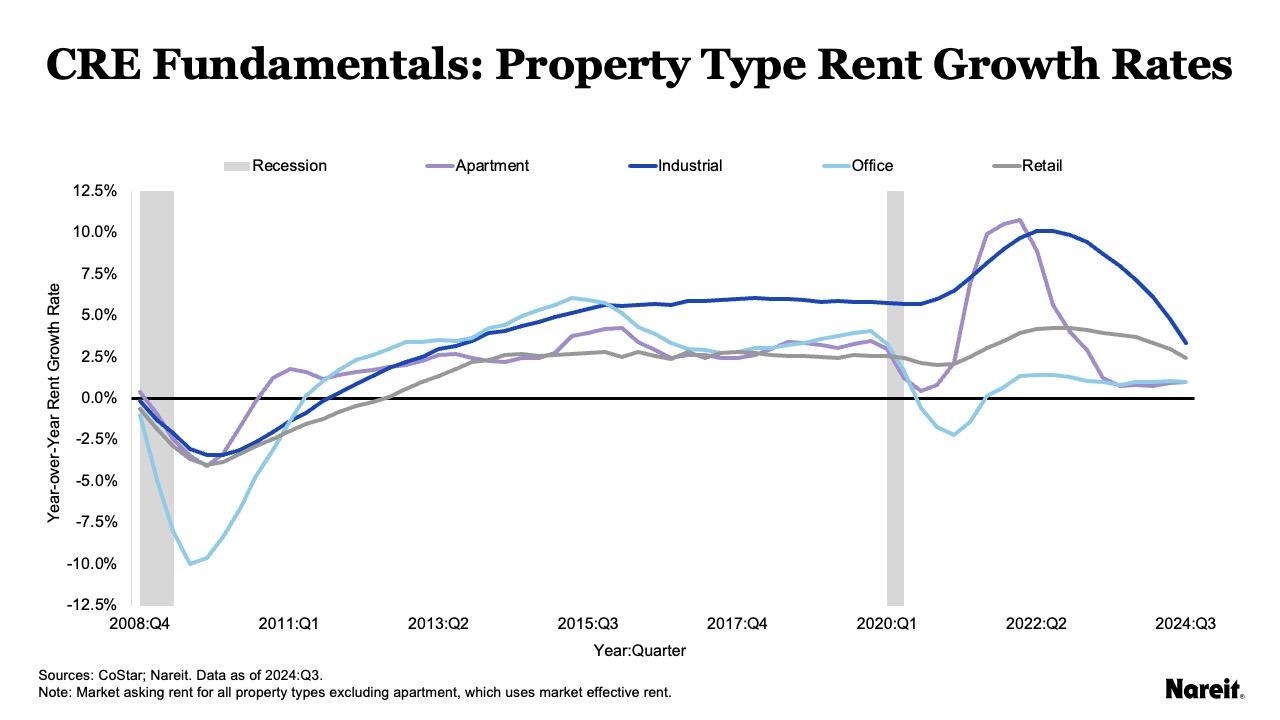

The chart above displays year-over-year rent growth rates for the four traditional property types, as well as U.S. recessions, from the fourth quarter of 2008 to the third quarter of 2024. Industrial and apartment rent growth rates have dropped off in the face of record amounts of new supply following record rent growth in the past few years. The retail sector saw more modest declines as its fundamentals have remained more fairly balanced. Reflecting a shifting and uncertain demand environment with the advent of more widespread remote work, along with continued supply, office has struggled to maintain positive asking rent gains.

Despite downward trajectories, industrial and retail asking rent growth rates have remained healthy. In the third quarter of 2024, the industrial and retail rent growth rates were 3.4% and 2.4%, respectively. After reaching its double-digit peak in early 2022, the apartment effective rent growth rate plunged, but it has stabilized at 1.0%. Even with its fundamental challenges, the office sector has maintained positive (but modest) asking rent gains for more than three years, posting recent growth of 1.0%.

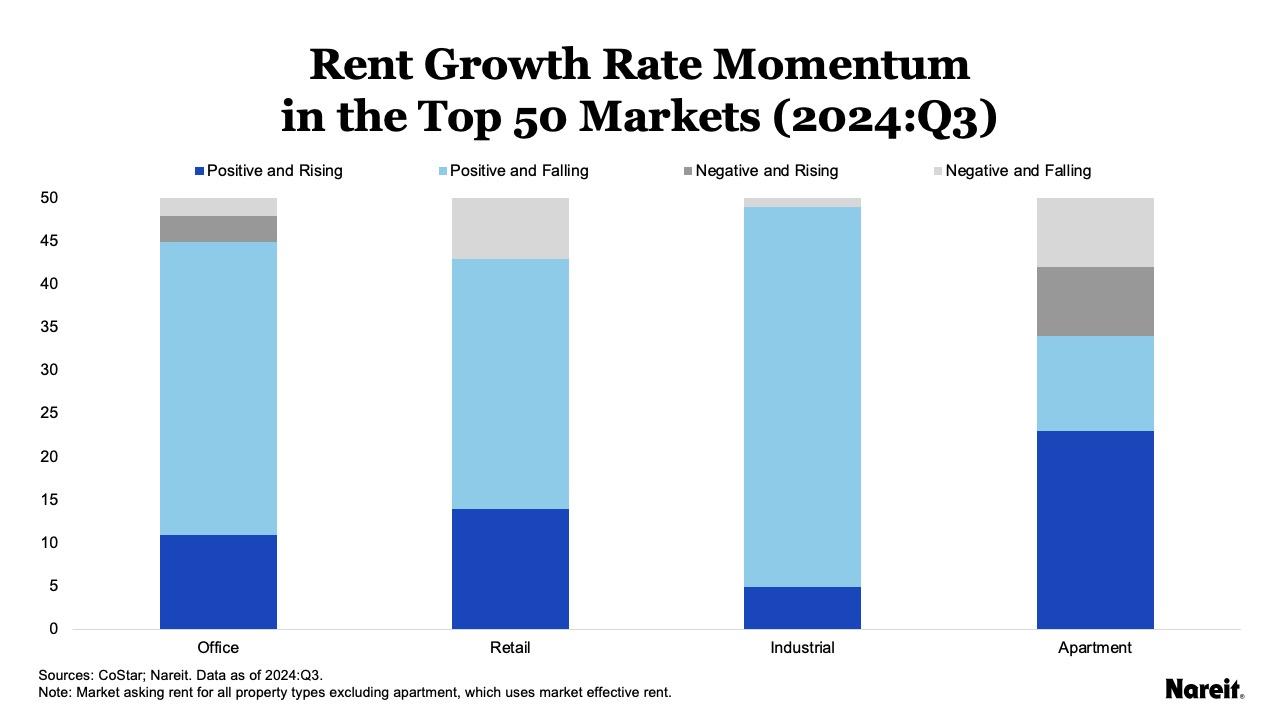

Tallying the number of the largest 50 markets within each property type (by positive and rising, positive and falling, negative and rising, and negative and falling, year-over-year rent growth rates by quarter) provides a gauge of sector strength. Movements across these categories also offer a sense of positive or negative momentum within a sector.

Using CoStar data, the chart above presents the number of markets that had positive and rising, positive and falling, negative and rising, or negative and falling, year-over-year rent growth rates for the largest 50 markets by property asset values for each of the four traditional property types in the third quarter of 2024.

Sector Focus: Industrial

In the fourth quarter of 2021, each of the largest 50 industrial markets had positive and rising year-over-year asking rent growth rates, averaging 8.9%. By the third quarter of 2024, only five markets had positive and rising rent growth rates. During that quarter, average growth rates for positive and rising (5), positive and falling (44), and negative and falling (1) industrial markets were 6.5%, 4.1%, and -3.6%, respectively. Although industrial rent gains have moderated, growth rates have generally remained healthy.

Sector Focus: Retail

The number of top retail markets with positive and rising year-over-year asking rent growth rates peaked at 46 in the third quarter of 2021; the average growth rate was 3.5%. The remaining four markets had positive and falling rates that averaged 2.6%. Since that time, the number of positive and rising rent growth rate markets has generally declined, but growth rate levels have broadly remained solid. In the third quarter of 2024, average growth rates for positive and rising (14), positive and falling (29), and negative and falling (7) retail markets were 4.2%, 3.3%, and -0.8%, respectively.

Sector Focus: Apartments

In the third quarter of 2021, all top 50 apartment markets had positive and rising year-over-year effective rent growth rates, averaging 11.4%. A year later, none of these markets had positive and rising rent growth rates. The apartment sector has been recovering since that time. In the third quarter of 2024, average growth rates for positive and rising (23), positive and falling (11), negative and rising (8), and negative and falling (8) apartment markets were 2.1%, 1.9%, -2.0%, and -1.8%, respectively.

Sector Focus: Office

The number of top office markets with positive and rising year-over-year asking rent growth rates reached a local maximum of 36 in the first quarter of 2022; the average growth rate was 3.6%. The tally of these markets has generally declined since that time and, interestingly, the count of negative rent growth rate markets has remained limited. In the third quarter of 2024, average growth rates for positive and rising (11), positive and falling (34), negative and rising (3), and negative and falling (2) office markets were 1.3%, 1.7%, -1.0%, and -0.7%, respectively.

CRE: Moderating, but Positive Rent Growth Gains

CoStar data generally highlight modest or moderating year-over-year rent growth rates across the four traditional property types. As of the third quarter of 2024, each sector faced different rent growth rate momentum conditions across its top 50 markets. Industrial and retail rent growth rates broadly appeared healthy despite negative momentum. The apartment sector has been recovering and gaining positive momentum. Office has faced negative momentum but has limited the number of its markets with negative asking rent growth rates. While these conditions will likely place pressure on future property operational performance into 2025, it is important to note that rent growth rates across each of the four traditional property types have generally remained positive.