WASHINGTON, D.C. (May 14, 2024) – REIT active management can consistently add net value to commercial real estate (CRE) portfolios, according to a new study by CEM Benchmarking, Inc. The study, commissioned by Nareit, spans over two decades and includes data from more than 350 U.S. institutional investors, primarily defined benefit (DB) pension funds.

The report—Market Efficiency and Value Added by Listed and Unlisted U.S. Institutional Investor Real Estate Portfolios—provides a comprehensive look at the use of actively managed REITs and private real estate in CRE portfolios and their relative performance, both in terms of absolute returns and in the return compared to their benchmark, or “net value added.” The report shows that actively managed REIT portfolios consistently outperform their benchmarks, creating value added, and they also outperform private real estate.

“Real estate is a valuable component of most institutional investment portfolios. Both actively managed REITs and private real estate outperform their respective benchmarks before accounting for fees. The ability of real estate investors to outperform their benchmark, or create alpha, distinguishes real estate from other asset classes, particularly large cap equities” said Nareit Executive Vice President of Research and Investor Outreach John Worth. “Importantly, the CEM study shows that after fees, REITs outperform their benchmarks—and private real estate—by a notable amount, making it clear that investors should consider using REITs as a key component of their real estate strategy.”

Active REIT Management Adds Alpha to CRE Portfolios

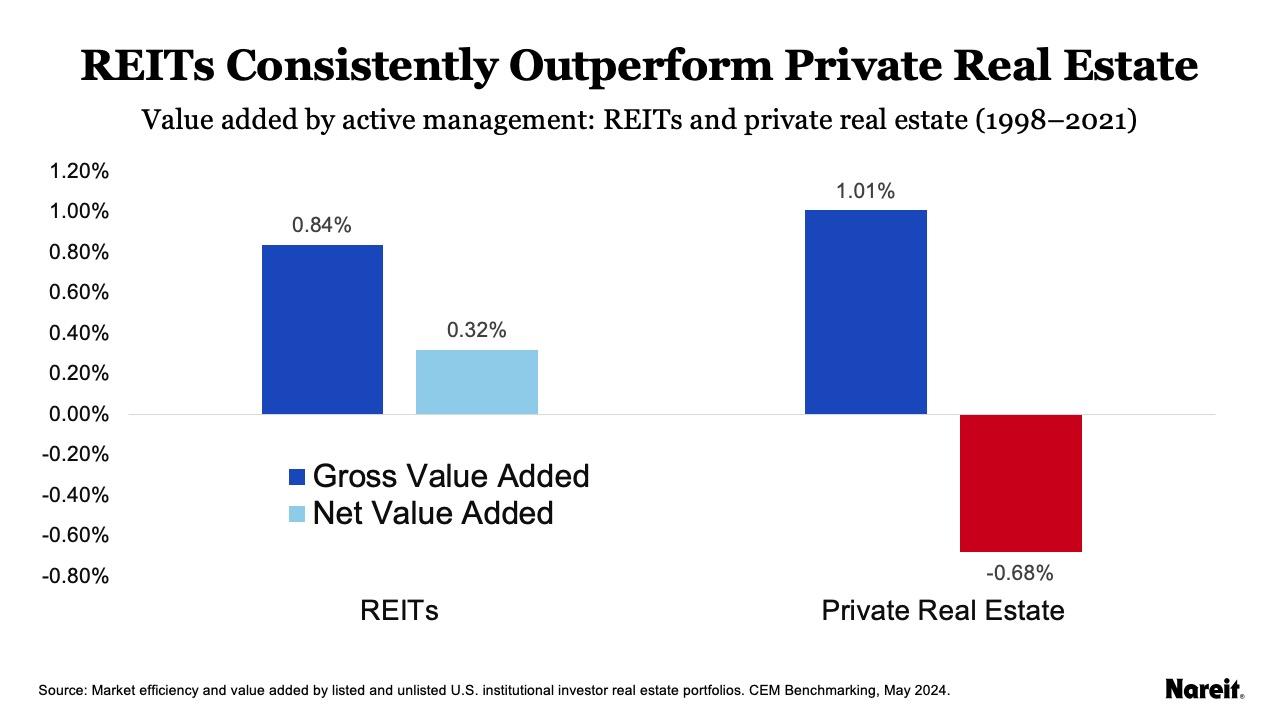

The study is anchored in a comprehensive data set, which shows that, after fees, REITs consistently outperform their benchmarks and private real estate. Actively managed REIT portfolios outperform their benchmark, generating a value added return of 0.32% while private real estate portfolios underperform their benchmark, generating a negative net value added return of -0.68%.

The chart above shows REIT and private real estate value added performance before and after fees. Before fees both REITs and private real estate outperform, creating value added compared to their benchmarks. Notably, after fees, REITs continue to outperform, generating net-value added returns. By contrast, private real estate underperforms because fees are greater than the value added from active management. The resulting net underperformance versus the benchmark is entirely due to fees.

REITs Add Value and Outperform Across Distribution

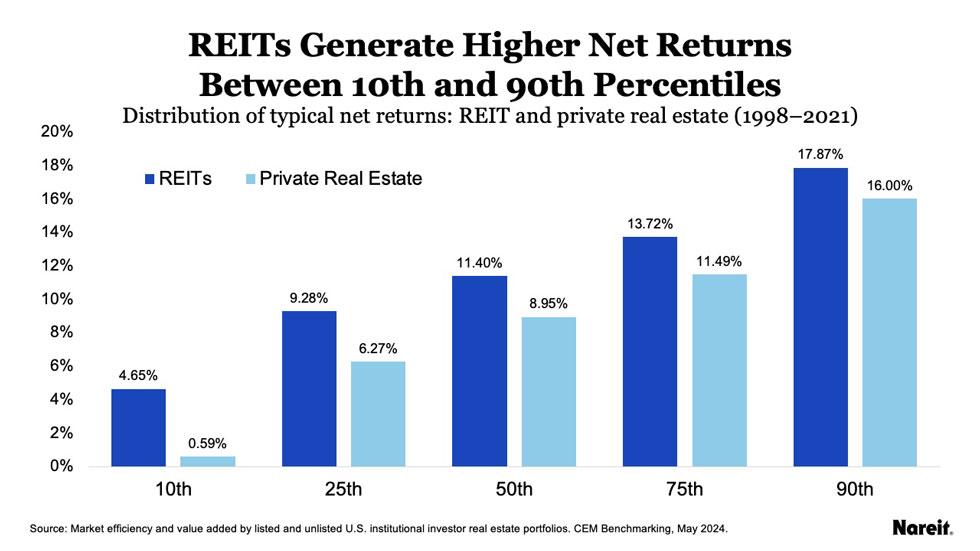

The CEM report also explores the distribution of returns in terms of net value added versus the benchmark. On a value added basis, the study shows that after fees, REITs outperform between the 10th and 90th percentiles of the distribution. At the extreme positive tail (above the 95th percentile) of the distribution, private real estate outperforms REITs; at the negative tail private real estate significantly underperforms REITs.

When looking at the data for a typical year on a total net returns basis, the report finds that before and after fees, REITs outperform private real estate across the distribution.

As the chart above shows, after fees, REITs outperform between the 10th and 90th percentiles of the typical returns distribution. In other words, at almost any percentile of REIT performance, REITs generate more alpha and higher net returns than at almost any percentile of private real estate performance.

“Investors who believe they can select top-quartile portfolios have always valued the potential to deliver outperformance in private real estate,” said Chris Flynn, CEM Benchmarking Head of Product Development. “Investors in active REITs have seen top-quartile portfolios deliver even greater outperformance than top-quartile private real estate portfolios, with the appealing feature that median active REIT portfolios have also outperformed investable benchmarks."