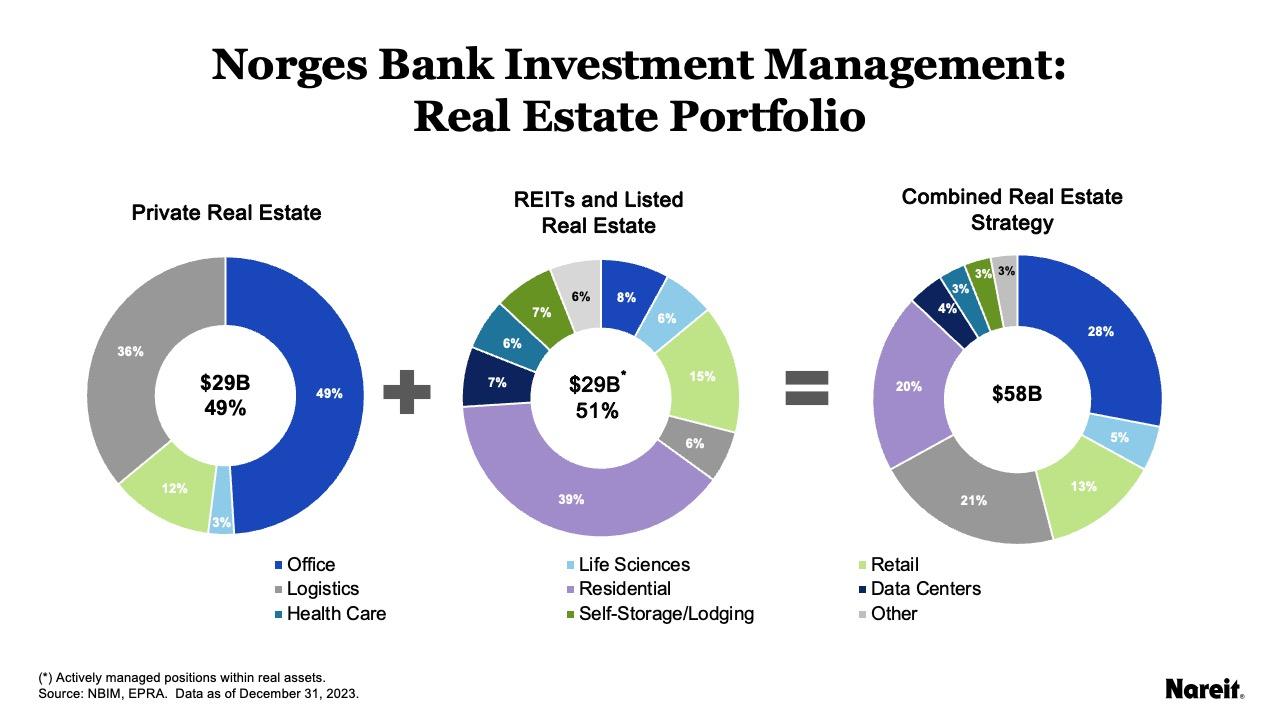

Norges Bank Investment Management (NBIM)

NBIM manages Norway’s Government Pension Fund Global and oversees $1.7 trillion in assets under management (AUM), including approximately $58 billion in real estate. It invests 50% in REITs and 50% in private real estate to enhance diversification, access new and emerging property sectors, and optimize cost management. REITs are critical to improving the fund’s sector diversification and its overall risk-return profile by giving the fund access to various sectors, including residential, data centers, health care, self-storage, and lodging—sectors that private funds may not be able to access as efficiently.

Read the NBIM case study

South Korea National Pension Service (NPS)

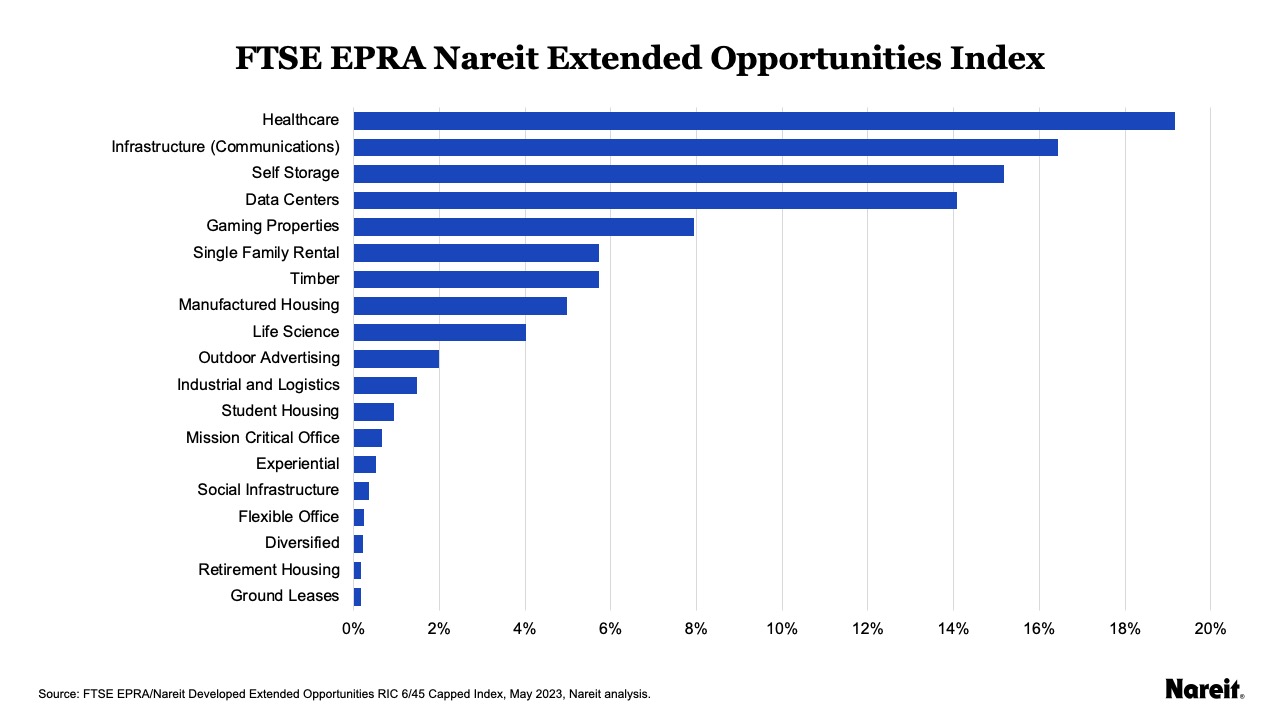

The South Korea NPS manages approximately $800 billion in assets. It collaborated with FTSE, Nareit, and the European Public Real Estate Association (EPRA) to create an index focused on a completion portfolio, and allocated $1 billion to a strategy benchmarked against that new index. The goal of the strategy is to increase diversification while enhancing risk-adjusted return. Health care leads the index, followed by infrastructure (cell towers and communications real estate), self-storage, and other modern economic and traditional sectors.

Read the NPS case study

PGIM/Australian Superannuation Fund

An Australian superannuation fund and PGIM used REITs to enhance sector and geographic diversification within the fund. The fund’s original portfolio focused on three traditional property sectors, all within Australia. By using REITs, PGIM expanded the portfolio’s exposure to new sectors and regions, including multifamily, health care, specialty housing, self-storage, and digital infrastructure within the United States, Canada, and Europe.

Read the PGIM case study

CenterSquare

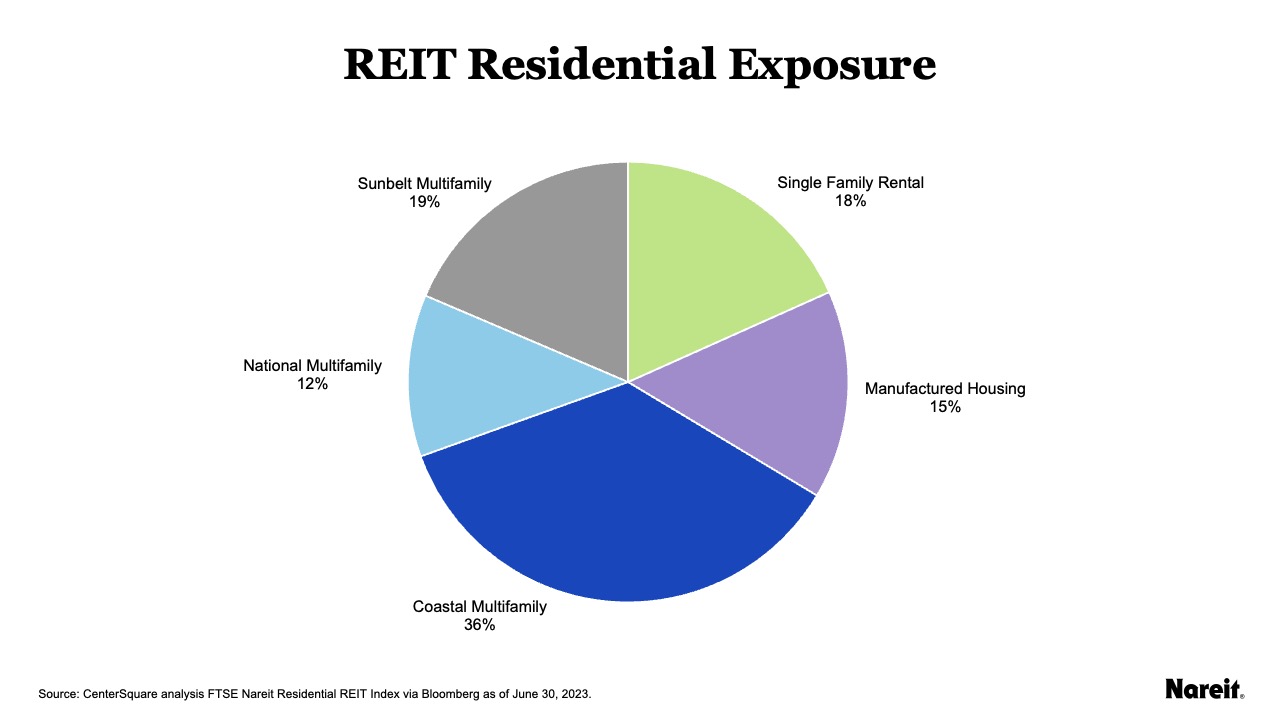

CenterSquare invested in REITs on behalf of an institutional client with more than $300 billion in assets. Using REITs enabled CenterSquare to achieve two goals: to capitalize on the dislocation between the public and private real estate valuations in 2022–2023 and to increase the client’s exposure to the residential sector. The client was under-allocated to residential, and REITs helped CenterSquare increase and diversify that allocation across residential subsectors.

Read the CenterSquare case study

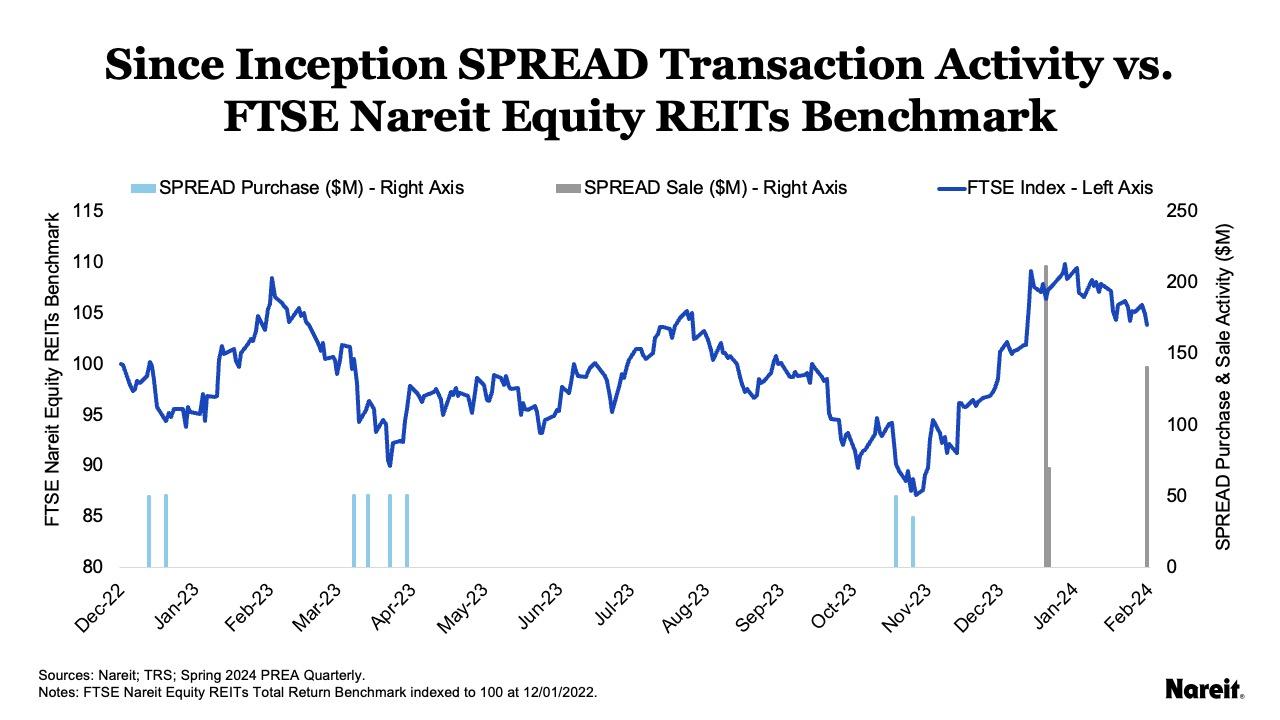

Teacher Retirement System (TRS) of Texas

The TRS of Texas manages $200 billion, 15% of which is allocated to its real estate portfolio. That portfolio historically invested mainly in private real estate and used REITs to tactically capitalize on the divergence between public and private real estates valuations in 2022–2023. The TRS invested $400 million into public REITs over a year. During that time, TRS achieved a 17.1% internal rate of return with $47 million in profit, significantly outperforming TRS’s ODCE private real estate benchmark, which would have otherwise yielded more than a 10% loss. Listen to the REIT Report podcast episode featuring Brendan Cooper and Jared Morris, directors at TRS.

Read the case study in PREA Quarterly

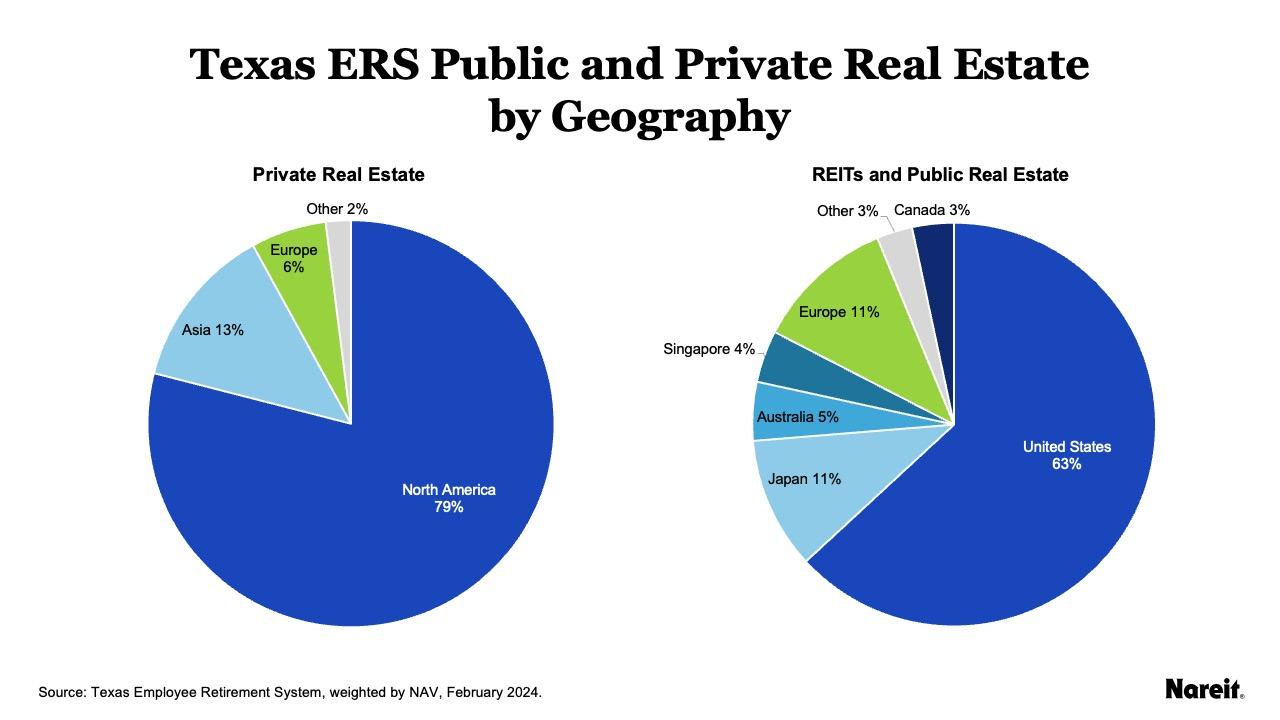

Employment Retirement System (ERS) of Texas

The ERS of Texas manages approximately $38.2 billion in AUM and allocates 12% of it to real estate. ERS use REITs to gain geographic and sector diversification and to take advantage of short-term tactical opportunities that private real estate can’t leverage. Global listed real estate, especially in Asia, is a key growth area for ERS. By using REITs in its public real estate portfolio, ERS is increasing its exposure to seven different regions, three of which are in Asia.

Read the ERS case study

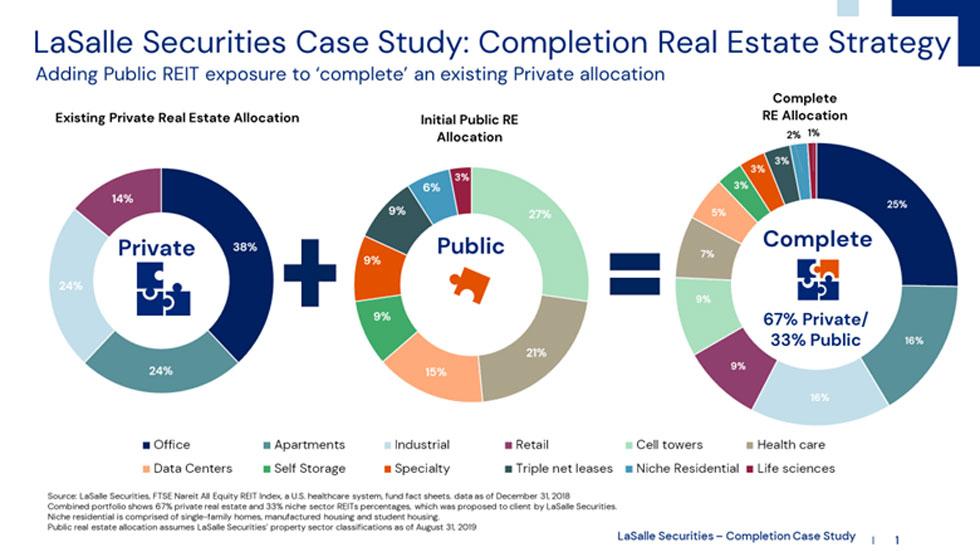

LaSalle Securities

LaSalle Securities invested in REITs on behalf of its client, a U.S. health care system with $4 billion to $5 billion in assets. The original real estate portfolio was mainly invested in private real estate in a few sectors. LaSalle and the client identified the gaps in the portfolio and created a custom universe of REITs to address those gaps and complete the client’s portfolio. The REIT sectors included telecommunications, health care, data centers, and more.

Read the LaSalle case study

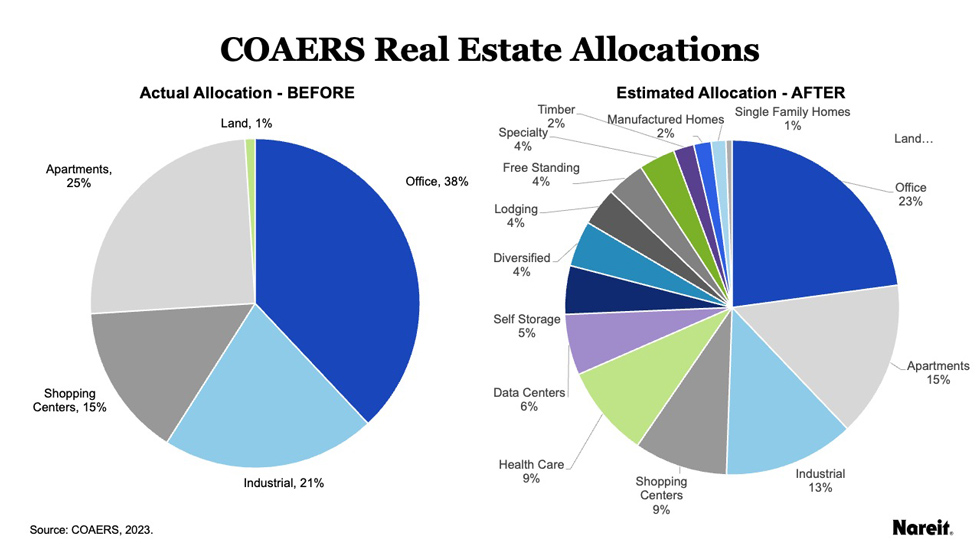

City of Austin Employees Retirement System (COAERS)

COAERS manages approximately $3.4 billion and historically only invested its real estate allocation in open-end private real estate funds focused on core sectors. The retirement system worked with FTSE and Nareit to create a custom index of REIT sectors to increase property diversification, lower costs, enhance liquidity, and achieve higher performance over time. The result: 6.7% cumulative outperformance, and 2.7% of excess returns on an annualized basis relative to the FTSE Nareit All Equity REITs Index. Listen to the REIT Report podcast episode featuring David Stafford, deputy chief investment officer at COAERS.

Read the COAERS case study