Leadership & Governance

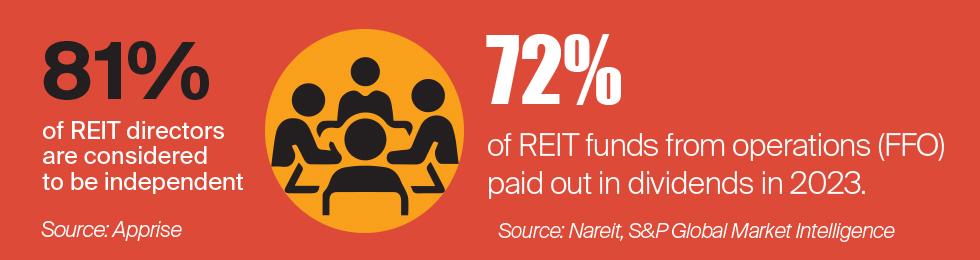

The REIT model provides inherent governance benefits, including alignment of management and shareholder financial incentives and oversight from an independent board that contribute diverse perspectives to REIT management teams.

REITs Demonstrate Accountability and Give Shareholders Control

Most publicly listed REITs are internally managed and have an independent board of directors that oversee risk and executive compensation, among other things. REITs are required to distribute 90% of taxable income, and most distribute at least 100%. By paying regular dividends that represent the majority of their income, REITs allow investors to decide where their money is best spent, which provides a level of control and accountability unique to REITs among publicly traded companies.

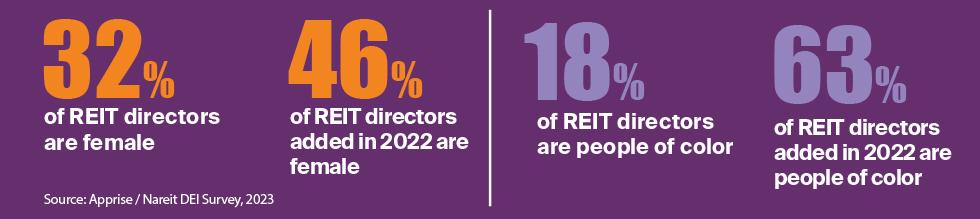

REIT Boards Contribute Diverse Perspectives

REITs are adding new directors from a variety of backgrounds who provide unique and valuable insight and direction to the management team. REITs report on the director’s experience, skill sets, and gender and ethnic diversity.

Related content:

REIT Boards Enriched by Contributions of Female Directors

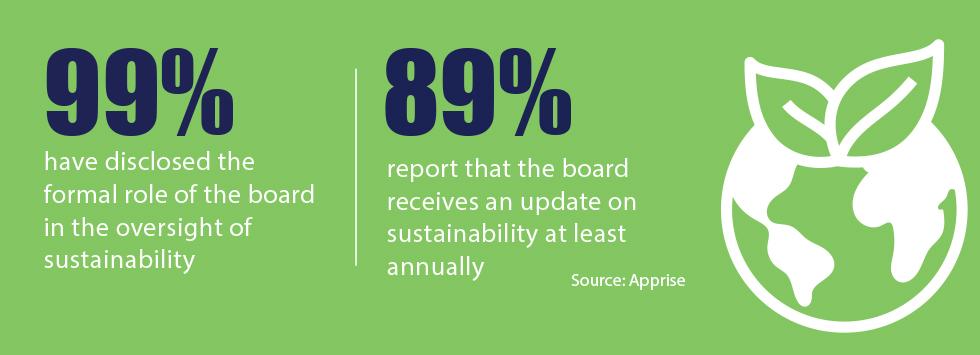

REIT Boards Oversee Sustainability

REIT management teams are formalizing board oversight of sustainability topics. Most REITs are proactively providing regular updates on how their real estate portfolios will contribute to and be affected by climate-related risks, environmental regulation, social issues, and workforce issues. REIT boards may also oversee progress toward achieving sustainability goals and targets.

REITs Set Sustainability Goals

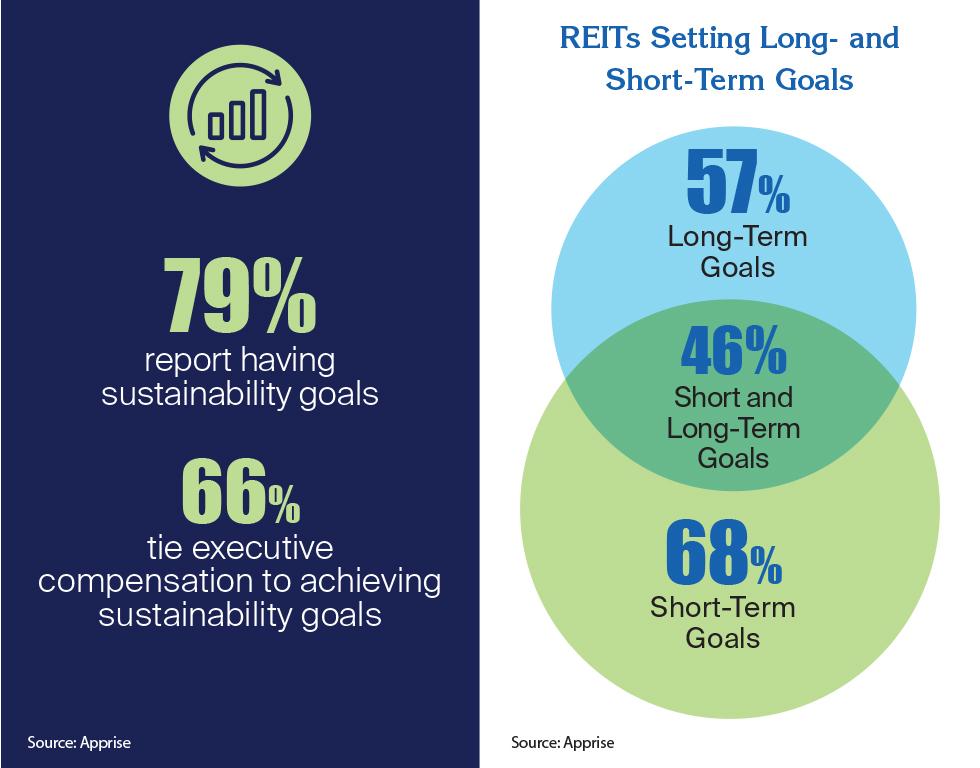

Many REITs are setting goals that align their approach to managing portfolio risk with global frameworks. By setting long-term goals, defined as 5 or more years, and short-term goals, defined as 4 or fewer years, REITs can create interim milestones that demonstrate progress toward long-term objectives for key stakeholders.

REIT transparency around executive compensation policies and incentive plans gives shareholders confidence that the management team’s incentives are aligned with shareholder interests. Some REITs have aligned management team incentives with the firm’s sustainability commitments, goals, and priorities.

Related content:

Essex Property Trust Sees Sustainable Practices Driving Sustainable Returns

Farmland Partners' Christine Garrison on Navigating the Evolving Role of General Counsel

Three REITs Named to List of 250 Best-Managed Companies

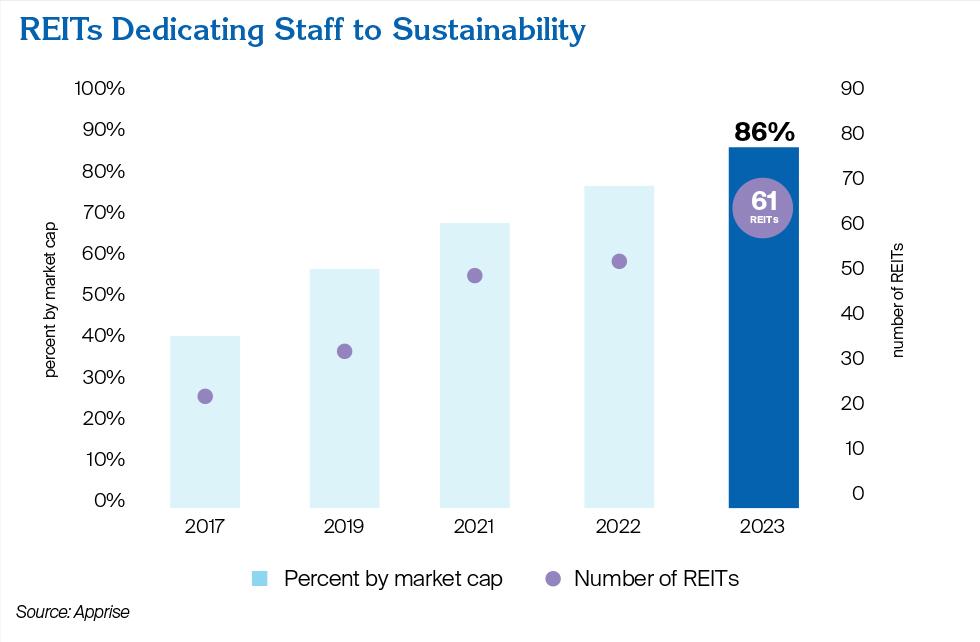

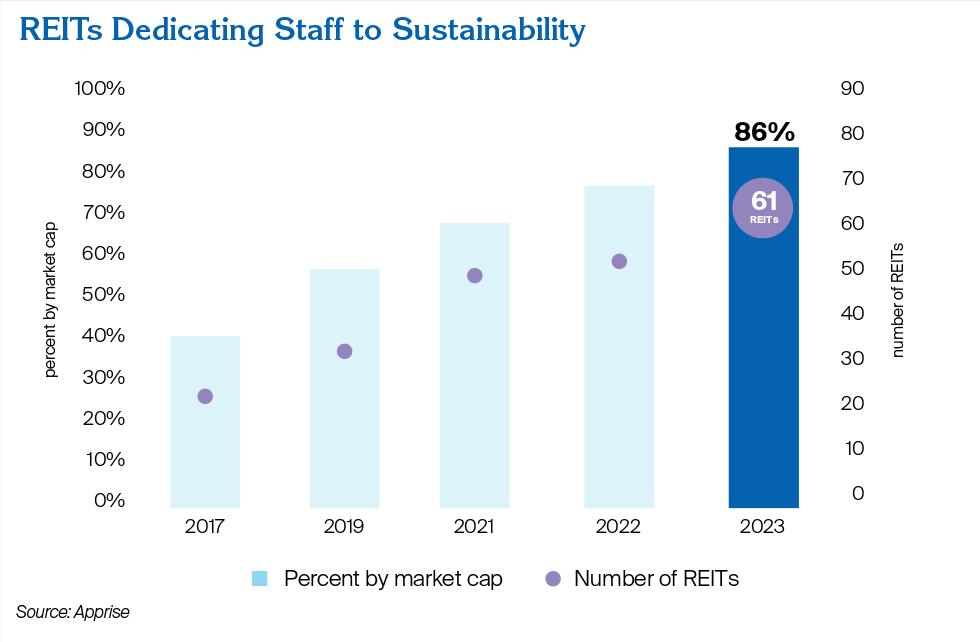

REITs Grow Sustainability Teams

More REITs now employ real estate sustainability professionals whose responsibilities may include sustainable investing and operating plans, as well as measuring and reporting on the results of sustainability measures. REIT sustainability teams are focused on implementing standard operating practices that embed sustainability data collection and governance throughout the business in order to comply with reporting requirements.

Related content:

Tanger’s Leslie Swanson on Strategically Integrating Sustainability

Sustainability for CRE in 2024 (Nareit webinar on demand)

Next Section: