Resources & Resilience

REITs are stewards of long-term investments in tangible assets and have a long history of owning and developing sustainable, resilient, and efficient real estate.

REITs Conserve Resources

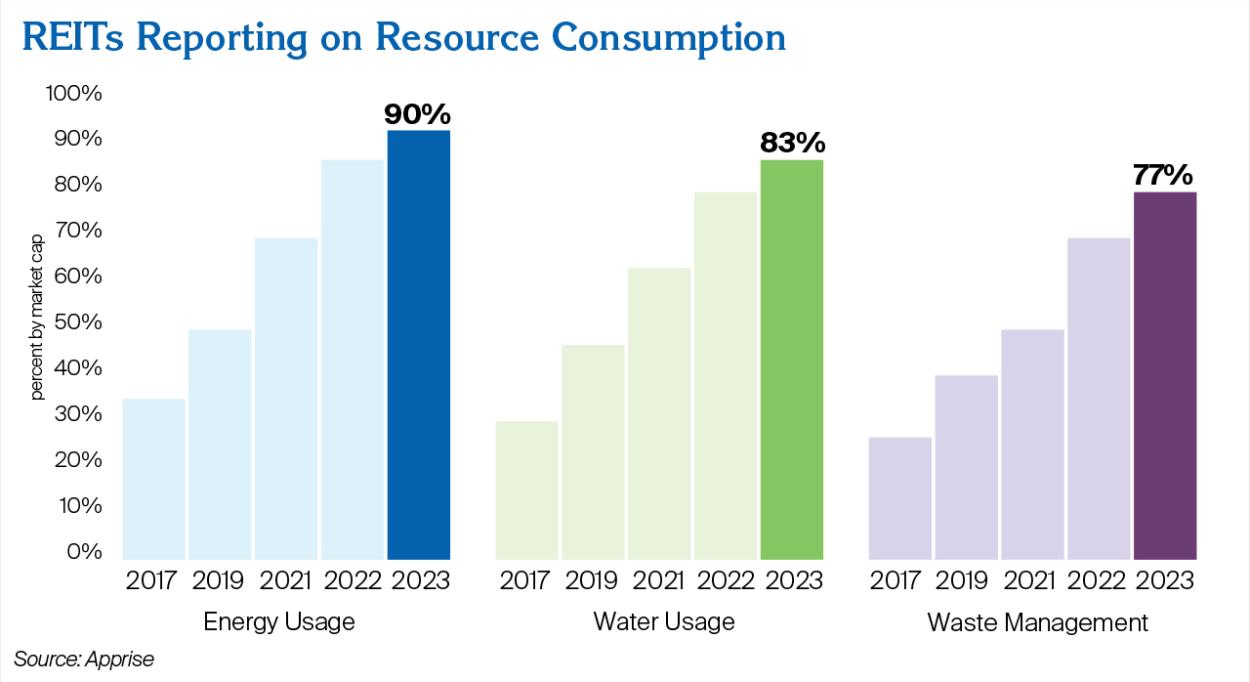

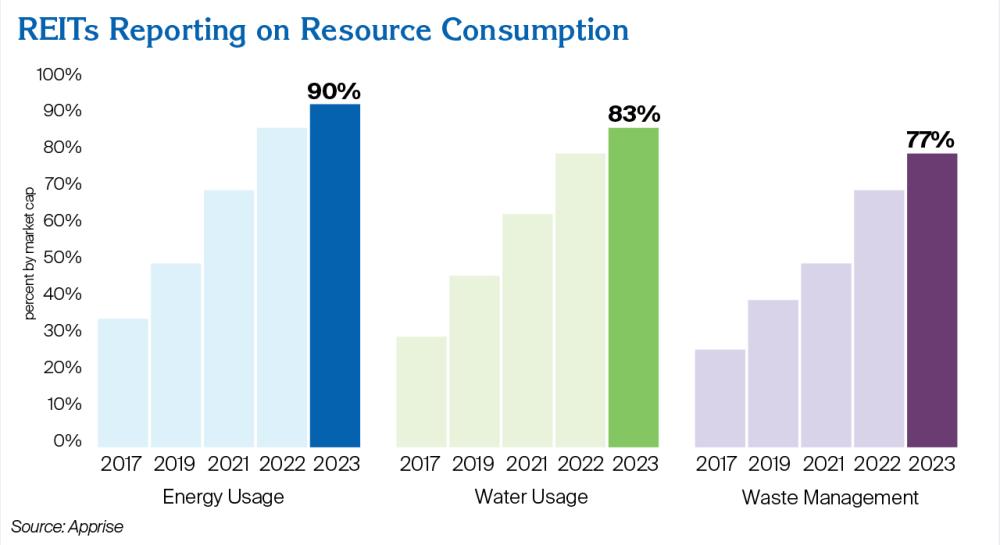

The number of REITs reporting on energy, water, and waste, and efforts to conserve resources continues to increase. A REIT’s sustainability performance reporting provides valuable data on the effectiveness of efforts to improve efficiency and reduce its environmental footprint, as well as the potential magnitude of risk related to increased environmental regulation. Many REITs are providing increased transparency about their goals and progress in managing environmental impact. By publicly reporting on specific targets to reduce consumption over time, REITs demonstrate accountability for delivering continuous improvements.

Related content:

Empire State Realty Trust Makes the Business Case for Decarbonization Strategy (Podcast)

Digital Realty Uses AI to Maximize Efficiencies

REITs Report on Emissions

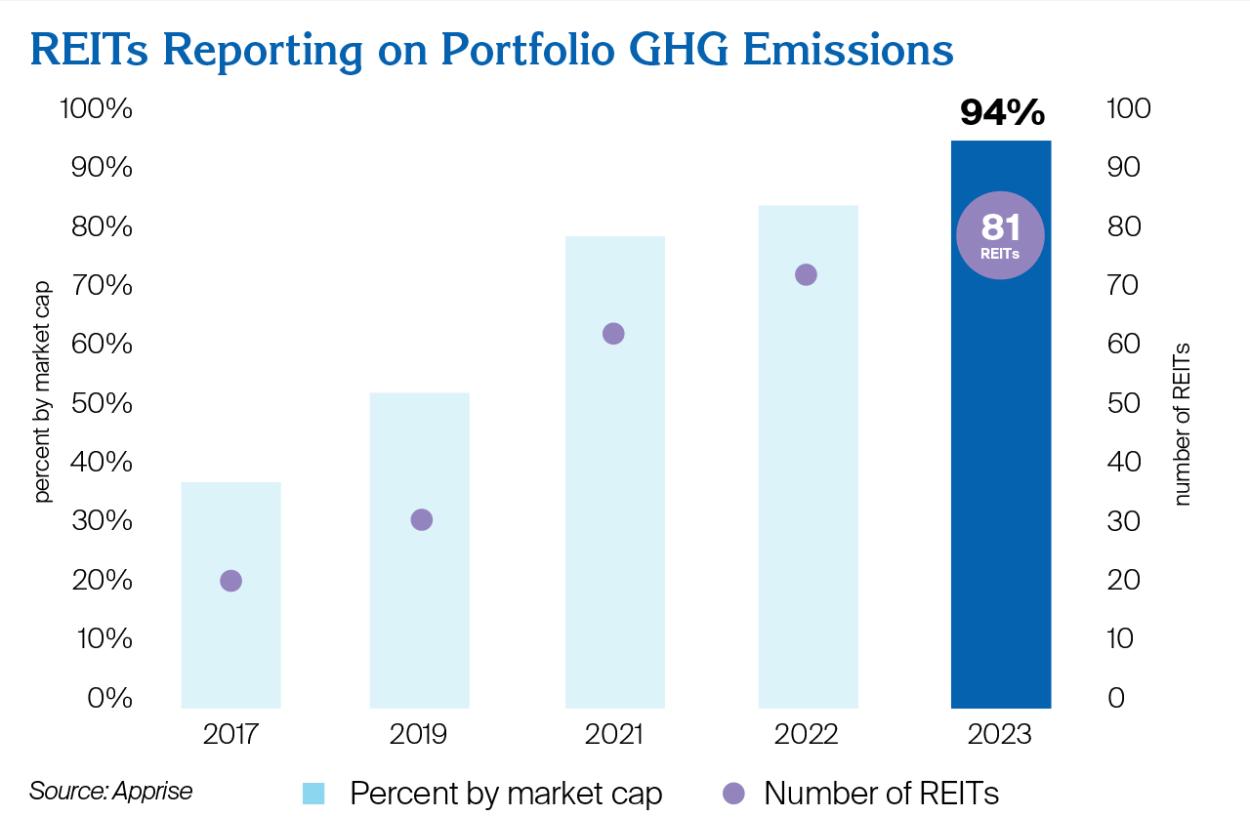

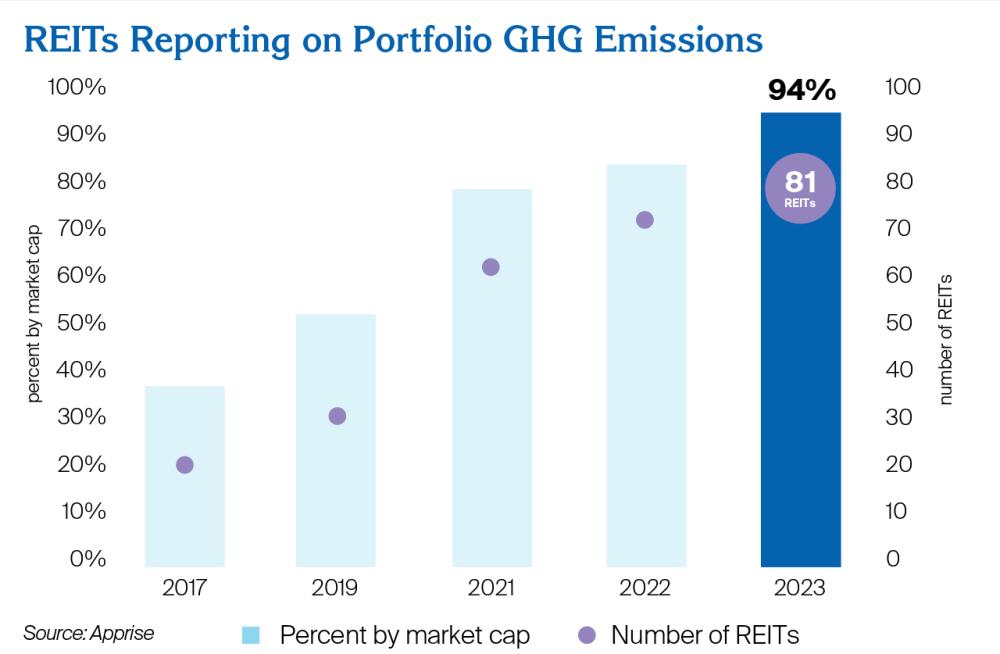

Many REITs report publicly on the carbon footprint of their operations, which may provide key stakeholders insight into their carbon risk and information on progress being made to achieve emission reduction goals. REITs are making progress on measuring emissions from “whole-building” operations, including landlord-controlled energy use and from tenant-managed operations. Most REITs report on upstream and downstream indirect emissions, which may require engagement with tenants and utilities to collect energy use data.

Related content:

BXP’s Ben Myers on Electrifying the Built Environment (Podcast)

REITs Manage Climate Risk

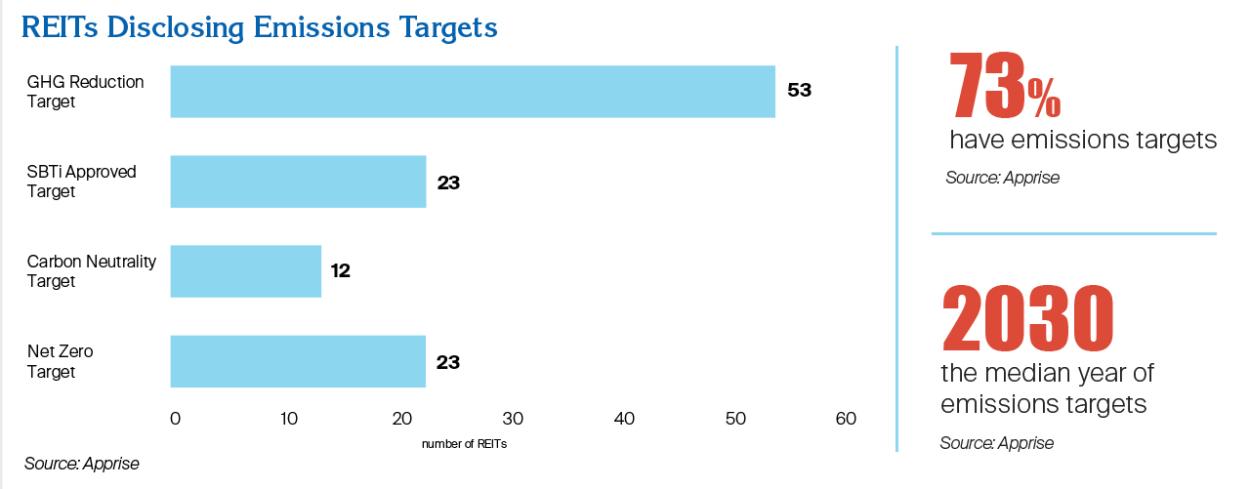

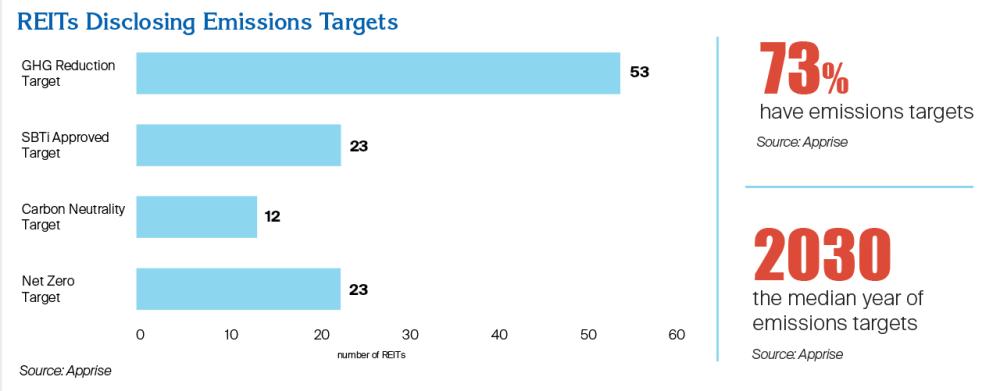

REITs actively participate in the global conversation about climate-related financial risk which includes both physical and low-carbon transition risk. REITs continue to formalize risk management processes and align investment strategies with decarbonization pathways. By aligning with climate targets and frameworks, where possible, REIT management, investors, and other interested stakeholders can better understand and manage transition-related risks.

Related content:

Weyerhaeuser Sees Long Term Value Creation from Voluntary Carbon Market Participation

REITs Utilize Clean Energy

REITs are implementing innovative ways to power, heat, and cool buildings with clean energy, including on-site energy generation or procurement from off-site sources. Because buildings rely on electricity supplied by the utility, while grid decarbonization is underway in many parts of the U.S., REITs are utilizing market-based solutions to shift to clean sources. Some market-based solutions available to REITs include power purchase agreements (PPAs), green tariffs, and purchases of energy attribute certificates, including renewable energy credits (RECs).

REITs Adapt to a Changing Climate

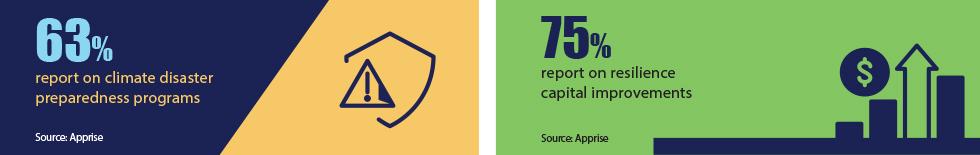

REITs are assessing climate risk to support informed decision-making and communicating with investors about how climate-related risks may impact investment performance.Information on the likelihood, frequency, and intensity of hazards facing building portfolios is helping REITs prepare for and report the financial impact of extreme weather events.

As REITs continue to further their understanding of climate-related risk, they are taking steps to improve the resilience of their portfolios by engaging with local stakeholders, including tenants, community members, local authorities, and first responders, to prepare for and mitigate the financial impact of severe weather events.

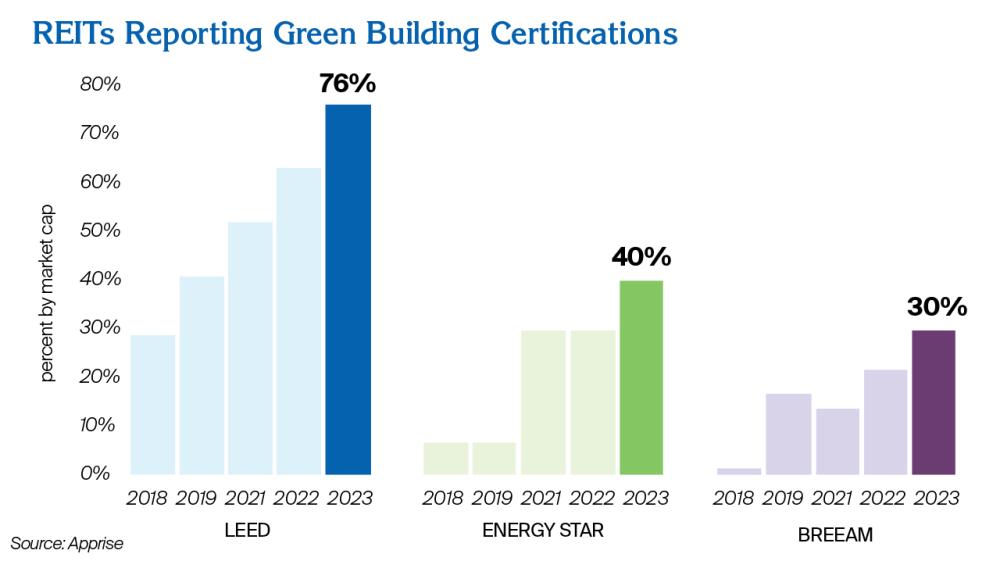

REITs Own Certified Sustainable Buildings

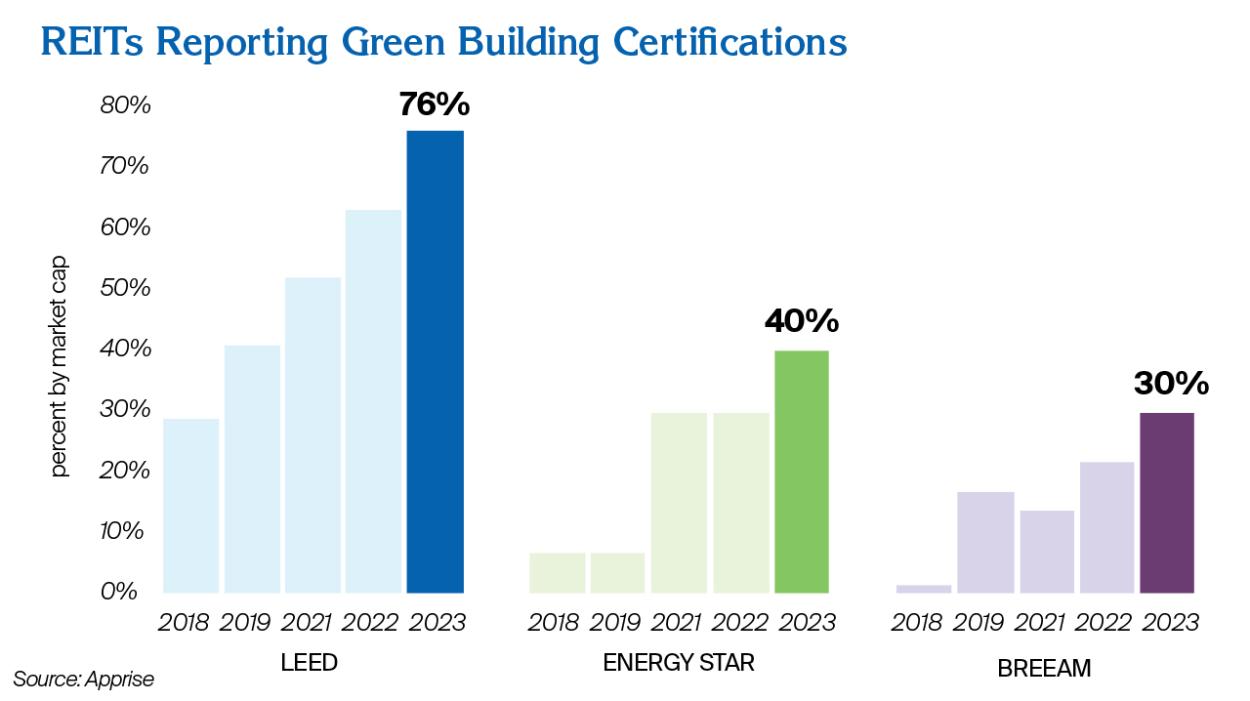

Green building certifications are becoming more accessible for REITs in all sectors. Organizations that offer green building rating systems are working in partnership with the real estate industry to create science-based solutions that raise the bar and promote the adoption of sustainability across the built environment. Certification systems like LEED and BREEAM focus on a building's design and operations across a variety of sustainability factors, while the U.S. Environmental Protection Agency ENERGY STAR certification recognizes the top-performing energy-efficient buildings.

Related content:

REITs Named as EPA 2024 ENERGY STAR Award Winners

Next Section: