Mid-Year Report: Diversity of Global Real Estate Returns Offers Investment Opportunities

Publicly listed real estate is a core piece of a well-balanced investment portfolio, and it’s important to be aware of the differences in performance across global regions.

The FTSE EPRA Nareit Global Real Estate Index Series is made up of REITs and publicly listed real estate from the Americas, Asia/Pacific, and Europe, Middle East & Africa (EMEA). As of June 30, the index series includes 496 constituents in 39 countries and territories with a total equity market capitalization of more than $2.3 trillion, of which $1.3 trillion comes from the Americas, $655 billion from Asia/Pacific, and $335 billion from EMEA.

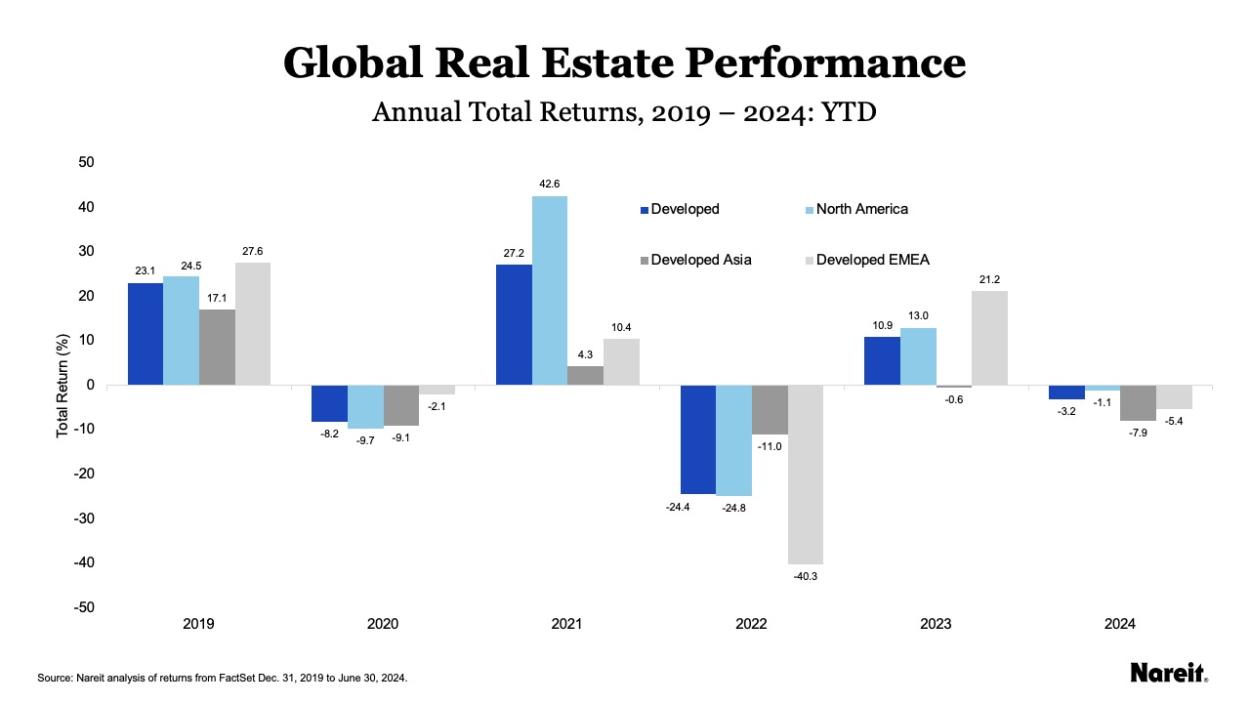

As of June 30, the FTSE EPRA Nareit Developed Extended Index was down 3.8% on a year-to-date basis, having rallied back from a 9.4% decline in mid-April as Treasury yields spiked.

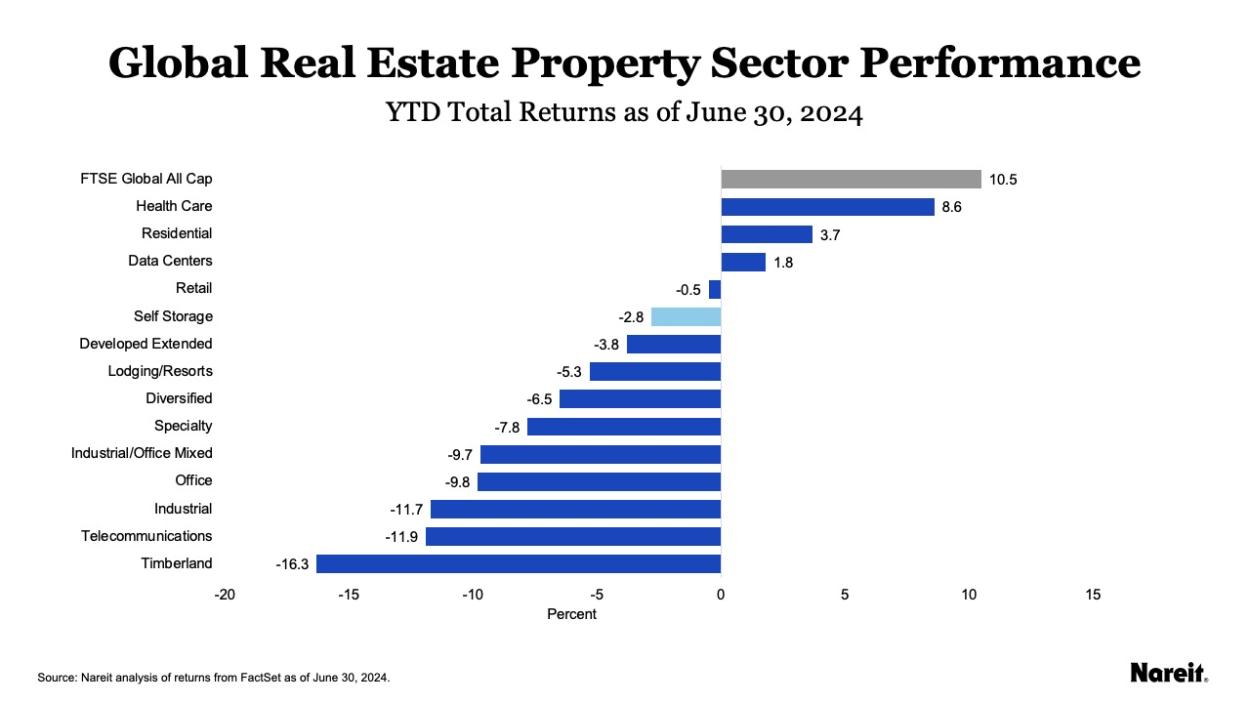

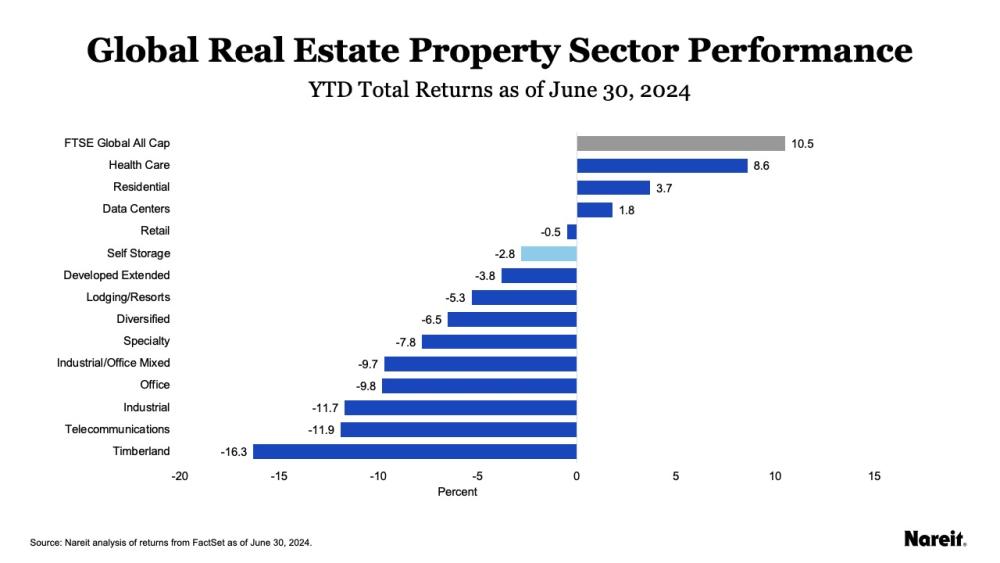

Health Care, Residential, and Data Centers Lead in 2024

Health care, residential, and data centers have outperformed in 2024. As reflected in the chart above, health care leads with a total return of 8.6%, followed by residential at 3.7%, and data centers at 1.8%.

Timberland, telecommunications, and industrial, which collectively represent roughly 30% of the index series, have declined 16.3%, 11.9%, and 11.7%, respectively.

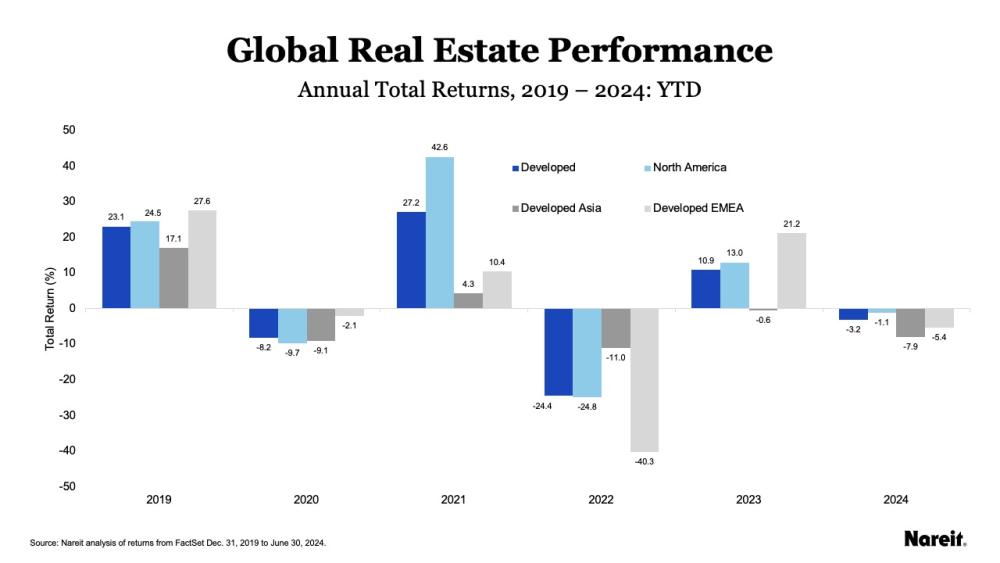

Regional Performance Leaders: EMEA, North America

An analysis of regional performance reveals where potential opportunities may lie for investors. As shown in the chart above, the Developed Index is down 3.2% in 2024, after rising 10.9% in 2023. A look at the year-to-date annual total returns on a regional basis show that:

- North America, which rose 13.0% in 2023, leads with a total return of -1.1% in 2024.

- Developed EMEA led in 2023 (21.2%) and has returned -5.4% in 2024.

- Developed Asia was the only negative sector in 2023 (-0.6%) and continues to lag in 2024 (-7.9%).

All of this serves to highlight that real estate performance is not monolithic. A well-balanced portfolio considers regional differences in performance.

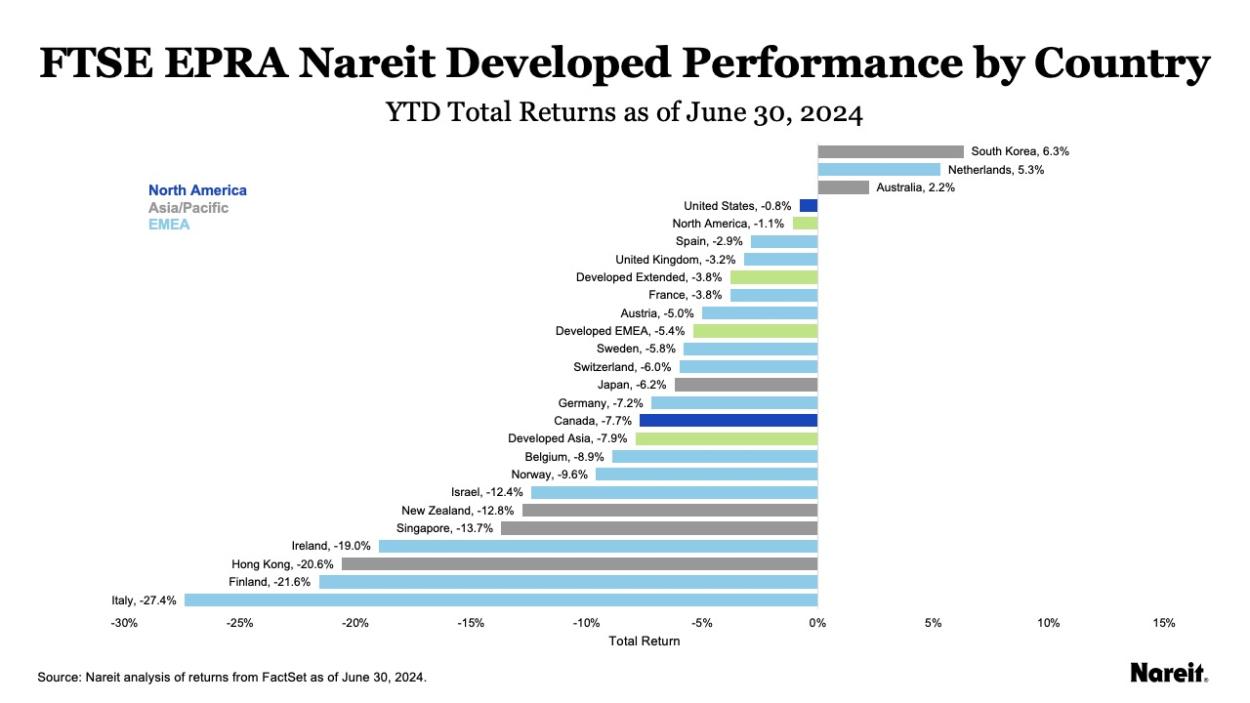

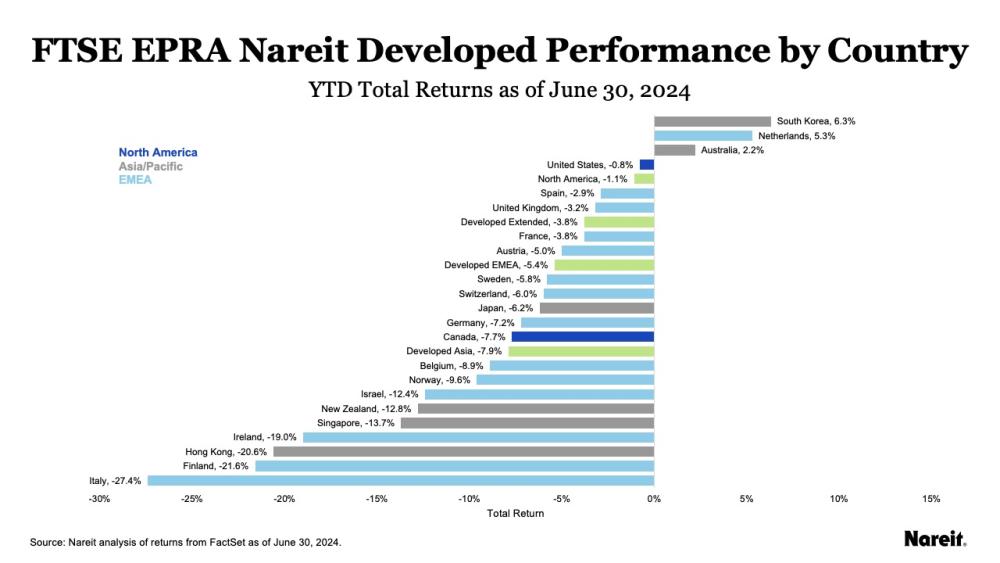

Country-Specific Opportunities

Drilling down to country-specific performance gives a more detailed look at the regional picture. The chart above reflects the year-to-date total return performance of the countries in the FTSE EPRA Nareit Developed series. Weighing 64.1% of the index on June 30, the United States pulls the index series back to the middle; but global opportunities can be found as South Korea leads with a total return of 6.3%, followed by the Netherlands at 5.3%, Australia at 2.2%, and the United States at -0.8%.

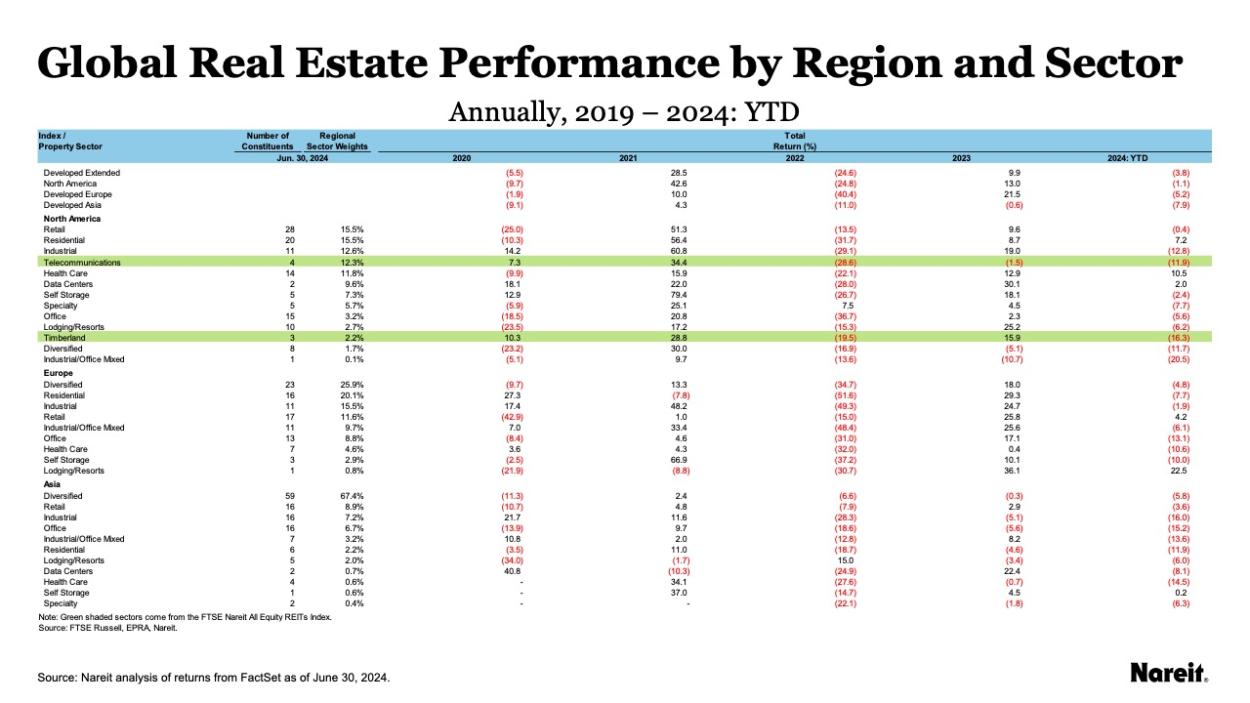

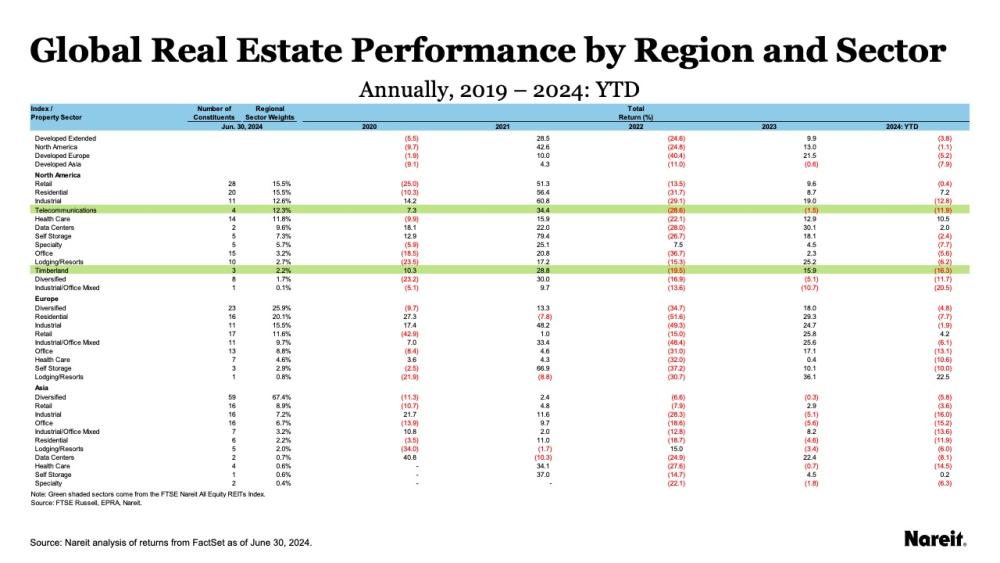

Lodging/Resorts, Retail Offer Relative Strength Across Regions

Combined regional and sector analysis rounds out Nareit’s analysis of differences in global performance. The table above shows global real estate performance by region and sector. On a regional basis, North America leads with a total return of -1.1%, followed by Developed Europe at -5.2%, and Developed Asia at -7.9%. Looking at the sector level, lodging/resorts and retail have offered relative strength across regions, while health care is the strongest performing sector in North America but has performed comparatively weakly in Europe and Asia. Further sector analysis shows that:

- Lodging/resorts has been one of the stronger performing sectors in Europe and Asia in 2024 with a total return of 22.5% in Europe, -6.0% in Asia, and -6.2% in North America, ranking first, fourth, and seventh regionally.

- Retail has performed comparatively well with a return of -0.5% globally, reflecting a total return of 4.2% in Europe, -0.4% in North America, and -3.6% in Asia.

- Industrial has performed well in Europe, but lagged in North America and Asia. The industrial sector is the third best performing sector in Europe, with a total return of -1.9%, while it has declined 12.8% in North America and 16.0% in Asia.

- Globally, the office sector continues to face headwinds with a year-to-date total return of -9.8%, and -27.6% since 2020. The sector has performed better in North America with a return of -5.6%, compared with -13.1% in Europe and -15.2% in Asia. In the latter two regions, the sector lags all others.

To read more of Nareit’s analysis, including the latest data and research about the global REIT marketplace, sign up for Nareit’s quarterly research newsletter and daily returns distributions.